The global need for a COVID-19 cure improved sentiment toward the health care industry

20th August, 2020

US GDP fell by an annualized 32.9% for the second quarter, which confirmed to be the largest economic decline since the Second World War. As the stimulus packages launched, investors have been more focused on the recovery in some of the economic data since April. Consumer incomes had so far been protected by support measures from the US government, which provided USD 1,200 stimulus checks as well as a USD 600-per-week boost to unemployment benefits. US retail sales had rebounded by 27% since their bottom in April and were just 1% below their peak in January of this year. In the midst of the US second-quarter earnings season, over 55% of the companies reported that earnings was a little stronger than market expectation of 45% yoy decline. Over the month, S&P 500 rallied 5.6%.

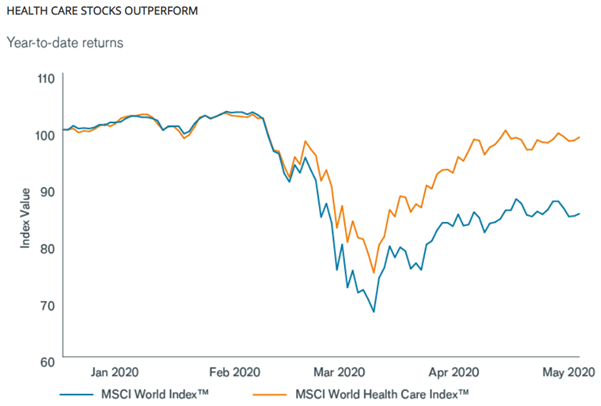

The health care sector had been playing a leading role during the COVID-19 pandemic. While equities globally collapsed, the sector outperformed most other areas of the market. The intense focus on finding a COVID-19 cure helped accelerate growth trends in health care and, long term, potentially improves sentiment toward the sector. The intense effort to address COVID-19 could also improve public perception of the biopharma industry, which in recent years had drawn scrutiny because of rising drug prices and out-of-pocket costs. Several innovative small-cap biotech firms had built partnership with large biopharmaceuticals as they seek to develop COVID-19 treatments. For example, German firm BioNTech is working with Chinese pharmaceutical Fosun Pharma and U.S. pharma company Pfizer to develop a mRNA-based vaccine. Collaboration is also rising.