Federal Reserve keeps rates near zero, US presidential election raised uncertainty

19th October, 2020

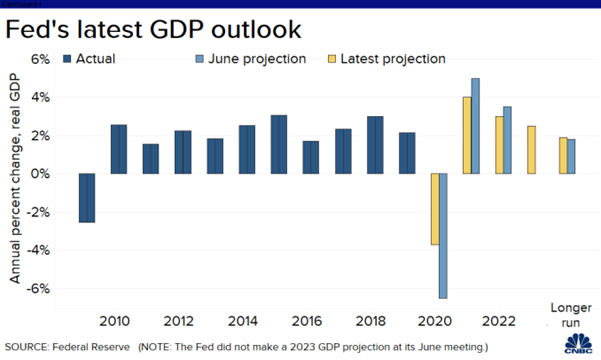

Federal Reserve decided to remain interest rate at 0% to 0.25% and expected the near zero interest rate will be kept until at least 2023, as the inflation rate was lower than their target 2% for a long period of time. The Fed also adjusted their GDP outlook, while they raised 2020’s GDP outlook to -3.7%, they turned down the the GDP outlook of 2021 and 2022 to 4% and 3% respectively. US presidential election will soon to be held on November and uncertainty to the market was raised, potential impacts could be happen towards certain sectors. Over the month, S&P 500 dropped 3.92%, NASDAQ index dropped 5.16%.

China’s economy is steadily recovering, industrial firm profits continued to surge for 19% in August, following July’s 19.6% increase, increased for four consecutive months. The National Bureau of Statistics believed that the recovery of production and demand, falling costs and fees for companies are drivers of the rise. Yet, the first eight month cumulative growth of profit is still down 4.4% from last year. On the other hand, Yoshihide Suga was elected as Japan’s prime minister to replace Shinzo Abe. Suga had worked with Abe for a long period of time. People were expecting Suga to continue Abe’s policy including “Abeconomics”: aggressive monetary policy, fiscal stimulus and structural reform etc which are designed to boost Japan’s economy. Over the month, Nikkei 225 index slightly raised 0.2%, Japanese Yen spot slightly dropped 0.41%.