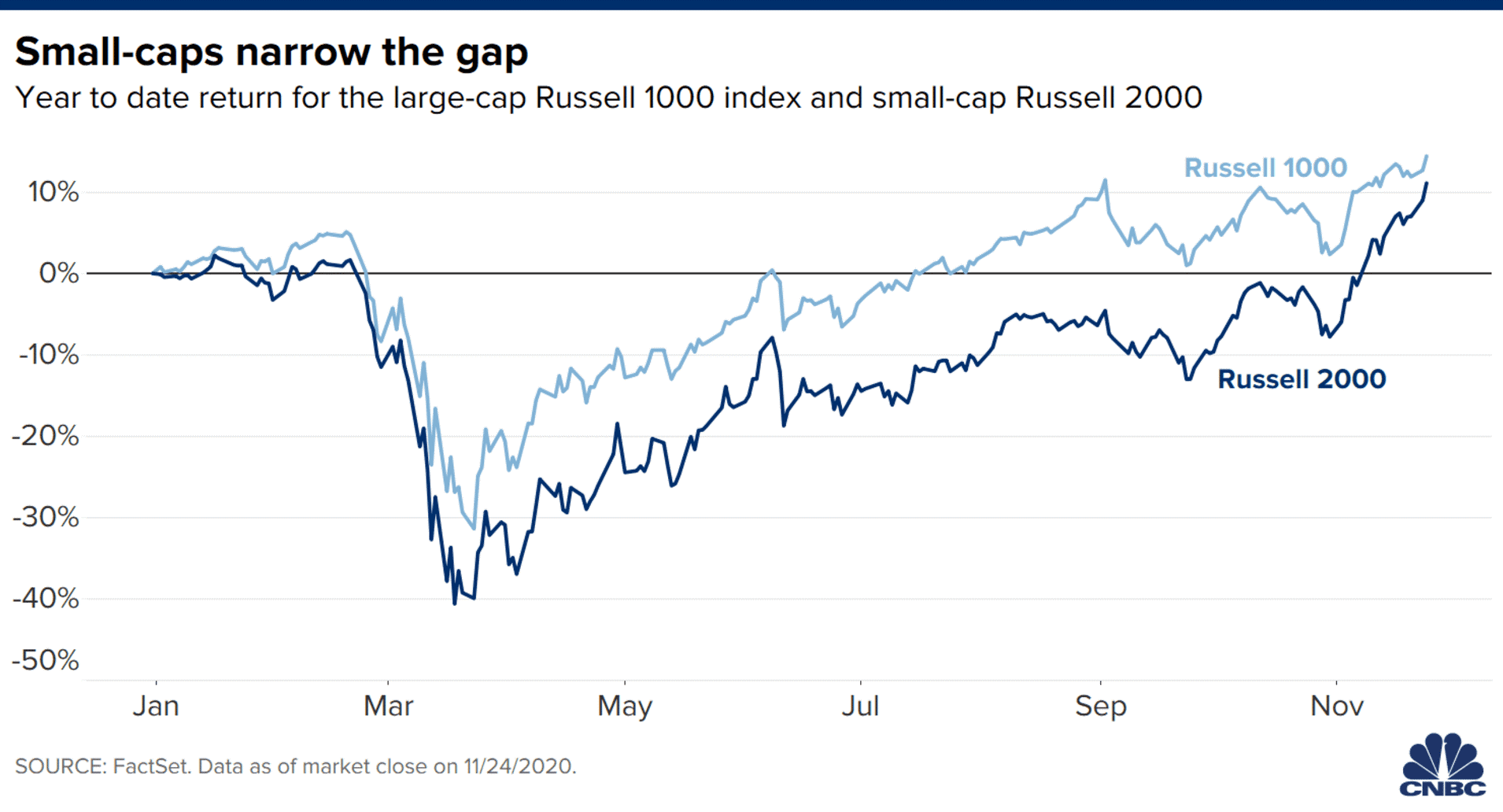

Small cap stocks narrow the return gap

14th December, 2020

There were several COVID-19 vaccines breakthrough announced over the month. It is believed the launching of effective vaccines will bring an end to the long-lasting pandemic and everything can finally back to the normal. Even though it is still too early to tell the time of official launching of the vaccine, the expectation of returning normal already ignited the market’s sentiment. On top of that, the US presidential election result despite initially having controversies in the beginning, the result was gradually accepted by the whole society. The process of presidential transitioning had begun, the enormous uncertainty was finally removed. These favorable factors definitely excited the market in this month. Over the month MSCI world index surged 12.66%, Dow Jones Industrial Average increased 11.84%.

Since the pandemic began, small cap stocks had keep underperforming than large cap stocks. Small cap stocks may not yet have developed stable revenue stream so they maybe more vulnerable to negative macro-economic factors and easier to have sharp revenue plunge. Thus investors seek small cap stocks risker than large cap peers, treating small cap stocks as cyclical shares. The impact of pandemic put larger pressure on small cap stocks than large cap stock. However the situation has been changed recently, the market expects the economy can return to normal with vaccines as mentioned above. Small cap stocks price began to rally and outperforming large cap stocks recently, narrowing the year-to-date return gap compare to large cap stocks. Over the month, the large-cap Russell 1000 index increased 11.6%, the small-cap Russel 2000 index surged 18.29%.