The optimistic attitude of investors

29th January, 2021

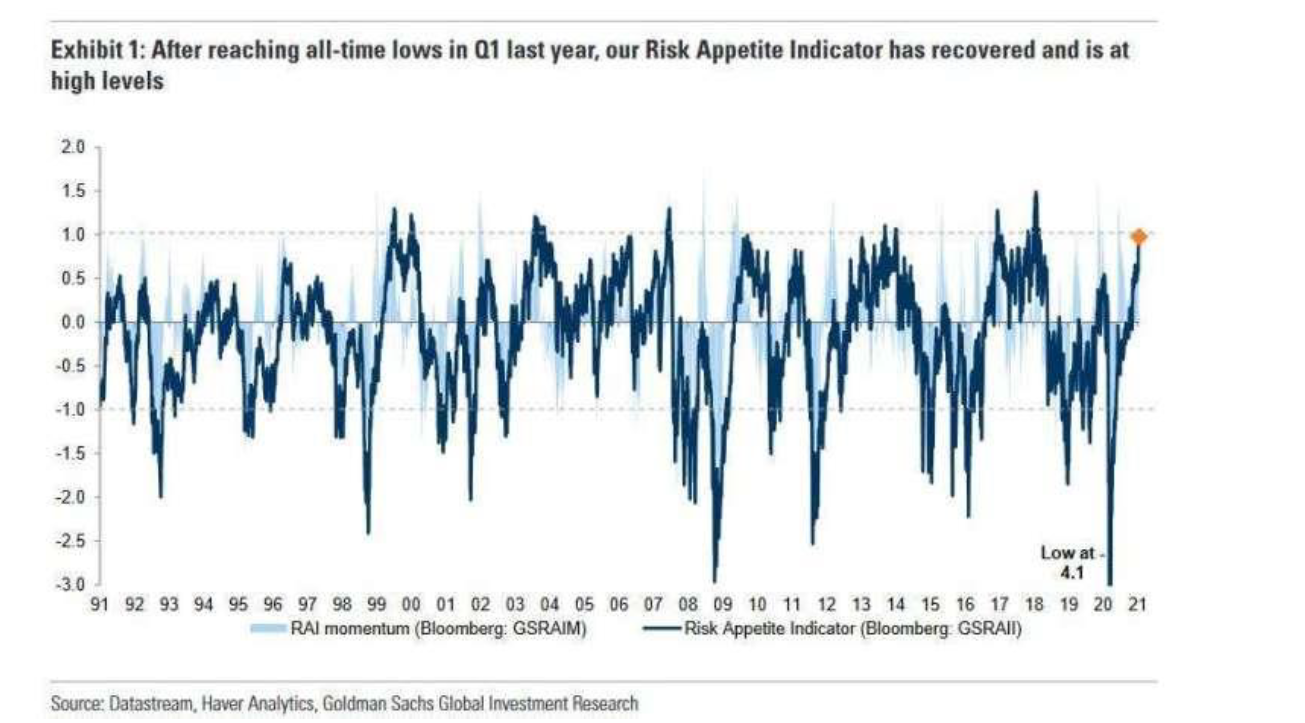

The number of seasonally adjusted initial claims increase to 970,000 and the fiscal deficit comes to the historical high in the United States. Despite the above unfavourable factors, investors seem to have no fear. The panic/excitement model shows the market sentiment reaches the new high which is higher than internet bubble. Investors are over-optimistic about the market. Moreover, the Risk Appetite index reaches the highest level since 2016 which means that the investors have great risk preference. Even the economic recession due to COVID-19, the investors are not risk-averse. The optimistic attitude may come from the vaccine.

Even several pharmaceutical companies released the vaccine, production and distribution require some time to finish it. Moreover, there was a virus variation in the COVID-19 which involves a higher infection rate. We expect the new normal will be continue in the first quarter of 2021. The work from home policy and online classes would be the same. As a result, people may buy more electronic devices to satisfy the need for working or learning. Therefore, companies related to electronic devices may outperform in the first quarter of 2021. Moreover, some countries, such as the UK, tightened the policy in order to prevent the virus. People may not be able to consume in physical shops. The demand for e-commerce remains high in the first quarter of 2021. The stocks of e-commerce may outperform in the first quarter of 2021.