Strong return for European equities in 2019, but lower potential in 2020 is under expectation

6th January, 2020

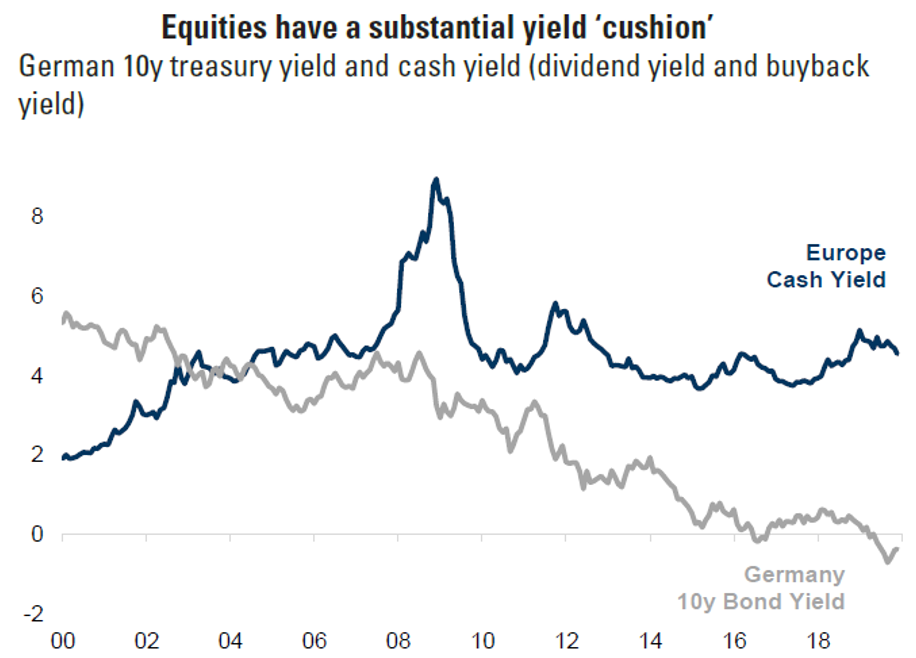

The European stock market (SXXP) generated a total return of 23.16% in 2019, the best year since 2009. This was the best performance relative to the US since 2015, the year the ECB started QE. It was important to emphasize that part of the strong return in 2019 is a function of the low starting point and powerful rapid recovery at the beginning of the year. In contrast to encouraging equities performance, the European economy had struggled through 2019 as a result of weakness in the manufacturing cycle in particular. Investors were broadly expecting return potential for European equities in 2020 is lower than in 2019 and a low EPS growth. However, there were still large supports for the markets in the coming 2020. The gap between equities yield and long term bond yield was substantial, while equites yield was above 4% but bond yield was staying at the negative territory. Dividend yield and buyback yield had formed a large proportion of the European stock return in recent years. The combination of more share repurchases and fewer rights issues from the banks indicated equity supply was slightly shrinking.