Monthly Market Outlook – Feb 2022

22nd March, 2022

U.S.

US stock market in February continue the weakness from the start of 2022 caused by the Russia’s invasion to Ukraine. On 24 February, Russia started the invasion on Ukraine with the aim of demilitarization and neutralization of Ukraine. The crisis was putting global markets in reverse, Nasdaq index opened at 14346 and reached the lowest point at 13037. It was then rebounded continuously and ended at 13751 downed by near 5% in February.

The geopolitical uncertainty caused by the Russia – Ukraine crises had greatly lowered the chance of a 50bp hike in March. Yet, a steady hiking by 25bp is still expected to be continued due to the inflation risk has created an urgent situation where signals for the wage-price dynamic was observed.

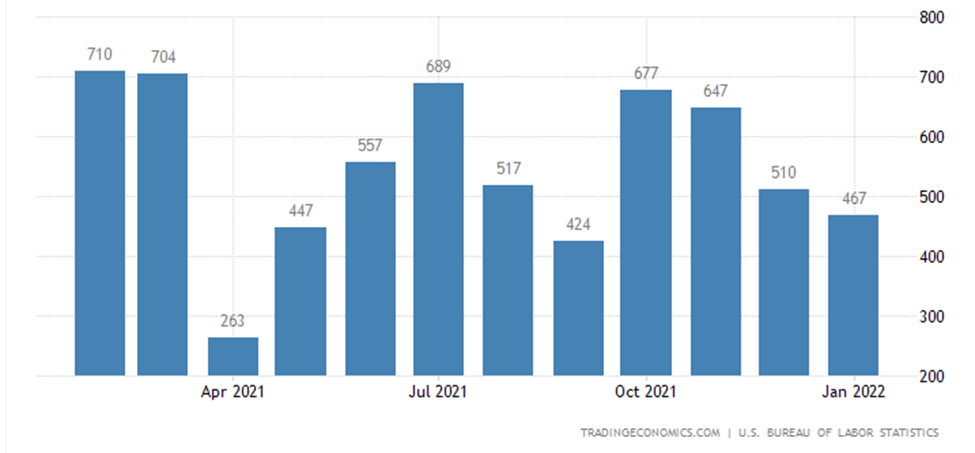

The US economy added 467K payrolls in January of 2022, beat the average forecasts of 150K. It was a big surprise as the omicron coronavirus variant left many Americans out of work due to illness or family care during the month. While in February, the consensus of the payrolls is 400K, well above the previous expectation of 150K in January. It is worth looking into the upcoming payrolls data and see whether it will beat the estimate again.

United States Non-Farm Payrolls

Japan

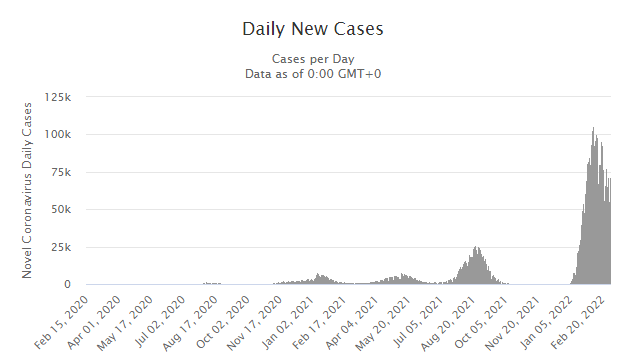

After reaching the Covid pivot in early February with over 100,000 daily new cases, the data declined continuously to the 60,000 level. The ease of pandemic has brought Japan to loosen strict border controls that were criticized by businesses and educators. In mid-February, Japan announced that they will raise the number of people allowed to enter Japan to 5,000 a day, from 3,500, starting from March. In additionally, they will also permit the entrance of foreigners such as international students, but yet for the tourists at the moment. While mandatory quarantine will also be downed from seven days to three days with conditions applies. This decision will be benefits to economic recovery and it poses positive effect to the Japan economic environment with a projected GDP growth of 3.4% in 2022.

China

China tech giant have been performed poorly in the past year, caused by the increasing regulatory requirements in the China markets. But now it might be the dawn of the bearish market trend as China’s technology giants from Tencent to Alibaba and ByteDance are turning into metaverse, a market that could be worth $8 trillion in the future. The buzzword “Metaverse”, could be referred as an all-in-one virtual world that people will be living, gaming and social in. It might be a catalyst for the technology giants as virtual reality, gaming and social media are deemed to be some early applications in the metaverse, which may greatly boost the revenue of those giants.

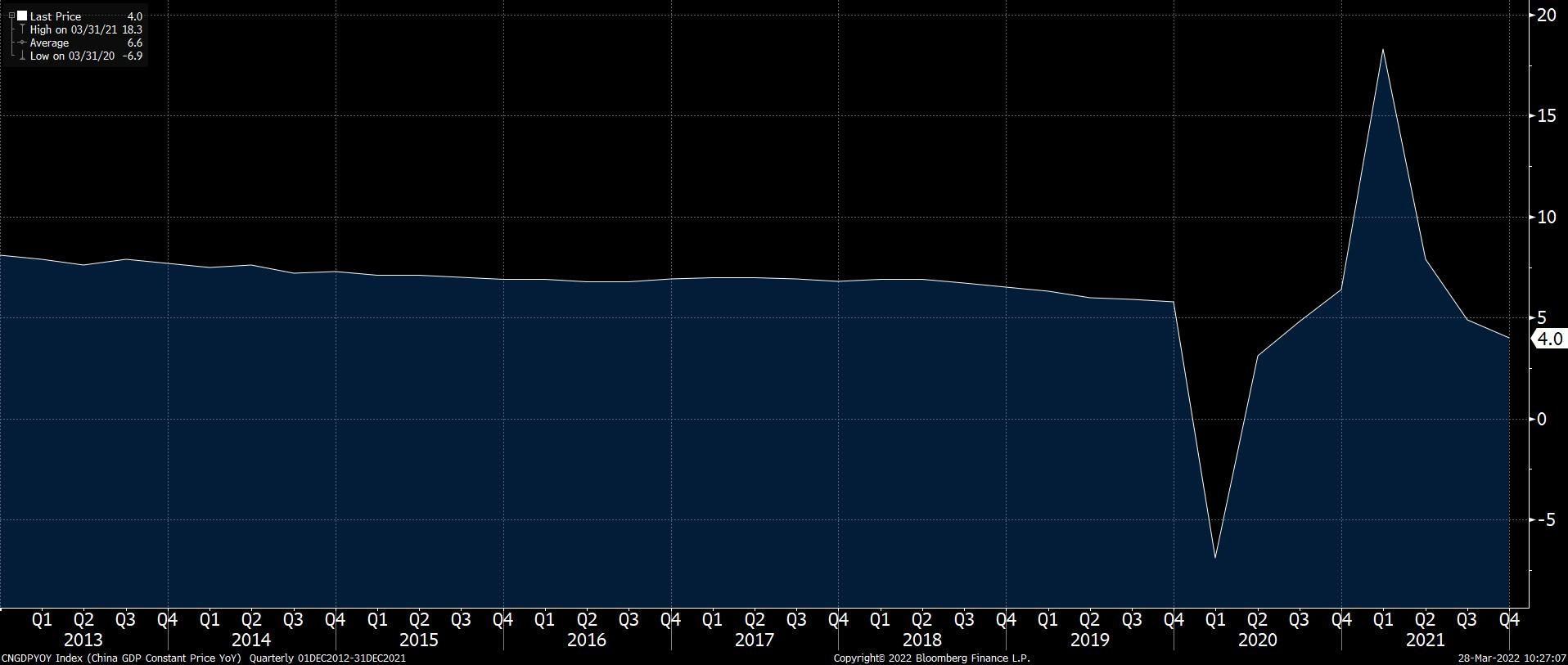

The world interest in the Chinese stocks market have been rising along the net capital inflow starting from Q4 2021. Various of investment banks, including Credit Suisse and Goldman Sachs have upgraded China to “Overweight” in their research reports as Monetary policy is being eased in China. It is expected that the new priority of Chinese leader in 2022 is to defend 5% growth and various measure in aiding business will be taken place as to stimulating the economic growth.

China GDP growth rate

Russia

The Russia – Ukraine tension had reached a maximum point when the world watched Russia to invade their neighbor Ukraine. The devastating attack was launched with the purpose of demilitarization and neutralization of Ukraine referred to Russia’s President Vladimir Putin. This action had brought to the globe’s attention and serval sanction from countries in different continents, have imposed on Russia as opposed to Russia’s action, including cutting off key Russian banks from the SWIFT financial messaging system and effectively freezing Russia’s central bank and sovereign wealth funds’ assets and banning dealings with the Russian financial institutions.

After the sanctions were announced, both RTS index and Ruble had plummeted for over 30% in the past month. While specific financial institutions that were targeted by the sanction such as Sberbank, the largest bank in Russia, had notched an 85% fall in one day, it had already dropped 99% of its value year to date.

In respond to the sanctions, Russia has more than doubled its interest rate to 20% from 9.5%, aiming to offset the increased risk of ruble depreciation and inflation.

Russia Interest Rate