Monthly Market Outlook – Aug2022

26th September, 2022

U.S.

The inflation in the US eased, with the Consumer Price index falling from 9.1% in June to 8.5% in July, which was better than expected. The main reason for the fall is the price decrease in raw materials, food and especially oil, with its price reaching six-month lows in mid-August. Similarly, the Producer Price Index also dropped from 11.3% in June to 9.8% in July, reflecting the downward trend in prices and easing inflation, benefiting consumption.

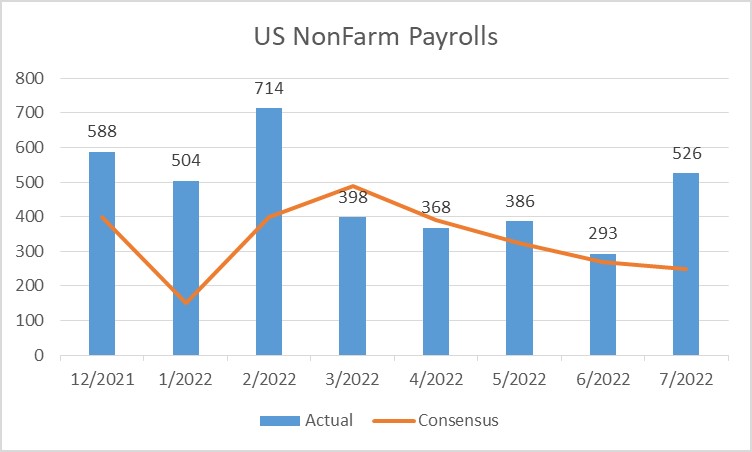

On the other hand, US employment data was surprisingly strong, with the nonfarm payrolls increased by 526k in July compared to the market consensus of 250k. And the equities declined after Fed Chair Powell’s hawkish speech on 26 Aug. S&P500 and NASDAQ indexes dropped more than 8% and 10% respectively of August’s highest point.

US Non-Farm Payroll

Japan

Due to a recovery in consumer spending, Japan’s GDP expanded for the third consecutive quarter in 2Q22, recording a 2.2% annualized expansion, exceeding pre-pandemic levels. After lifting quasi-emergency measures against COVID-19 in March, spending in service industries increased by 1.1% and is expected to increase further as tourism increases.

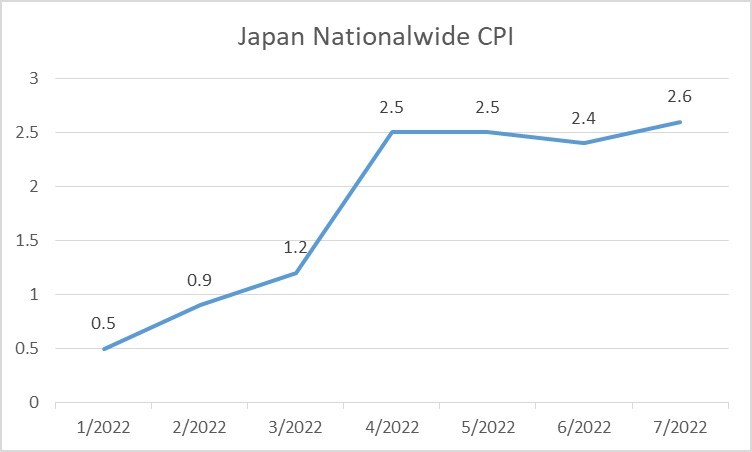

Japan’s CPI in July remained unchanged at a 2.4% year-on-year increase, with the decrease in oil prices offset by the rise in mobile phones and food prices. Nevertheless, the core CPI exceeded the central bank’s 2% target for the fourth consecutive month. Together with the rise in the annual inflation rate from 2.4% in June to 2.6% in July, consumer prices and inflation in Japan remains high.

Japan Nationalwide CPI

China

China’s trade weakened in August as anti-virus measures, inflation, and high energy prices weighed on global and Chinese consumer demand. Exports grew 7% over a year ago to USD314.9 billion in August, down from July’s 18%, and imports rose 0.2% to USD235.5 billion, slowed down from the 2.3% in July. In addition, consumer prices rose 2.5% which was slower than expected, while producer prices hit 18 month low, reflecting an economy plagued by weak domestic demand.

China’s State Council, Chaired by Premier Li Keqiang, outlined a 19-point policy package worth 1 trillion yuan to support the economy on 24 August, which included another 300 billion yuan that state policy banks can invest in infrastructure projects. Although the government stepped up its economic stimulus, the CSI300 index still fell more than 2% in August.

China Export and Import Trade

UK

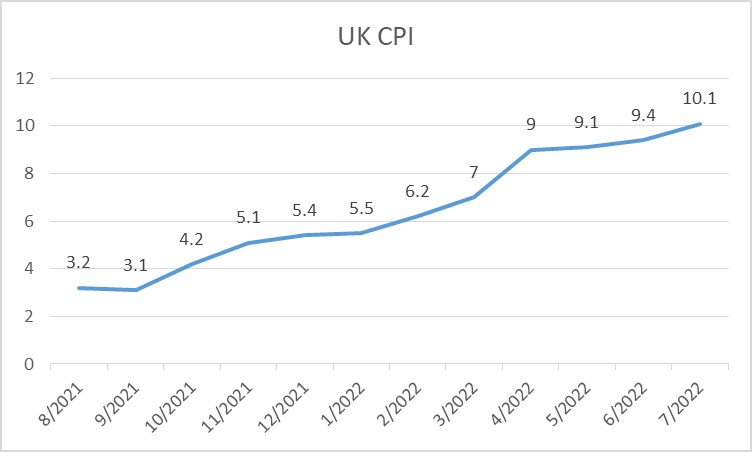

The CPI in July accelerated to 10.1% in July from 9.4% in June, recording the highest inflation rate in 40 years. The largest movement in the CPI in July came from food and fuel costs. With the Bank of England’s prediction of a 13% inflation rate in October, it is likely for inflation to stay high throughout the year. With a shrinking economy reflected by a -0.1% GDP, it is also likely for the UK to enter into a recession. In the recession fear, FTSE 100 index was down by 2% in August.

UK CPI