Too early to conclude the bull market is over

21st February, 2018

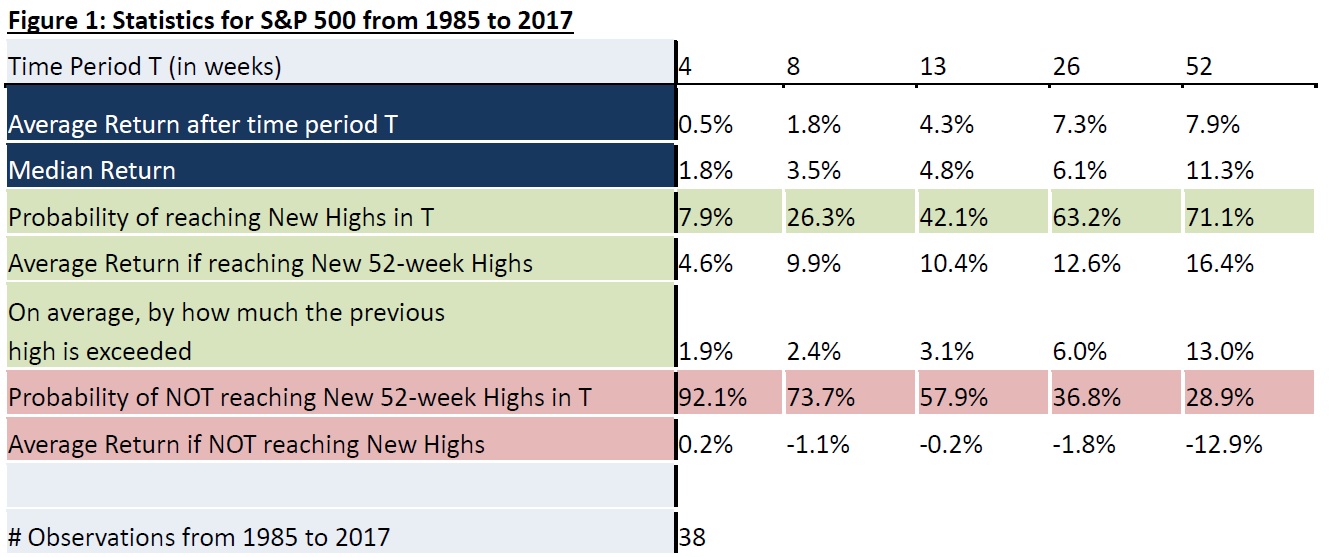

The global market rout in early February sparked concerns among investors over whether the “old” bull market that last for nearly eight years is about to end. These worries are reasonable given the generally stretched valuations among equities and the yield uptrend of government bond as a lower-risk alternative. However, historically speaking, while an abrupt correction could dampen investors’ sentiment in the short term, it does not necessarily indicate the advent of a bear market. Upon revisiting the weeks of significant correction in S&P 500’s bull markets over the past 30 years, the index is very unlikely to reach new highs within the first two months after a weekly drawdown over 3.5%, and even if it does, the degree by which the previous 52-week highs can be exceeded is relatively limited. However, as the forward looking period lengthens, the picture is more optimistic, with an increasing expected return and likelihood of reaching new highs.

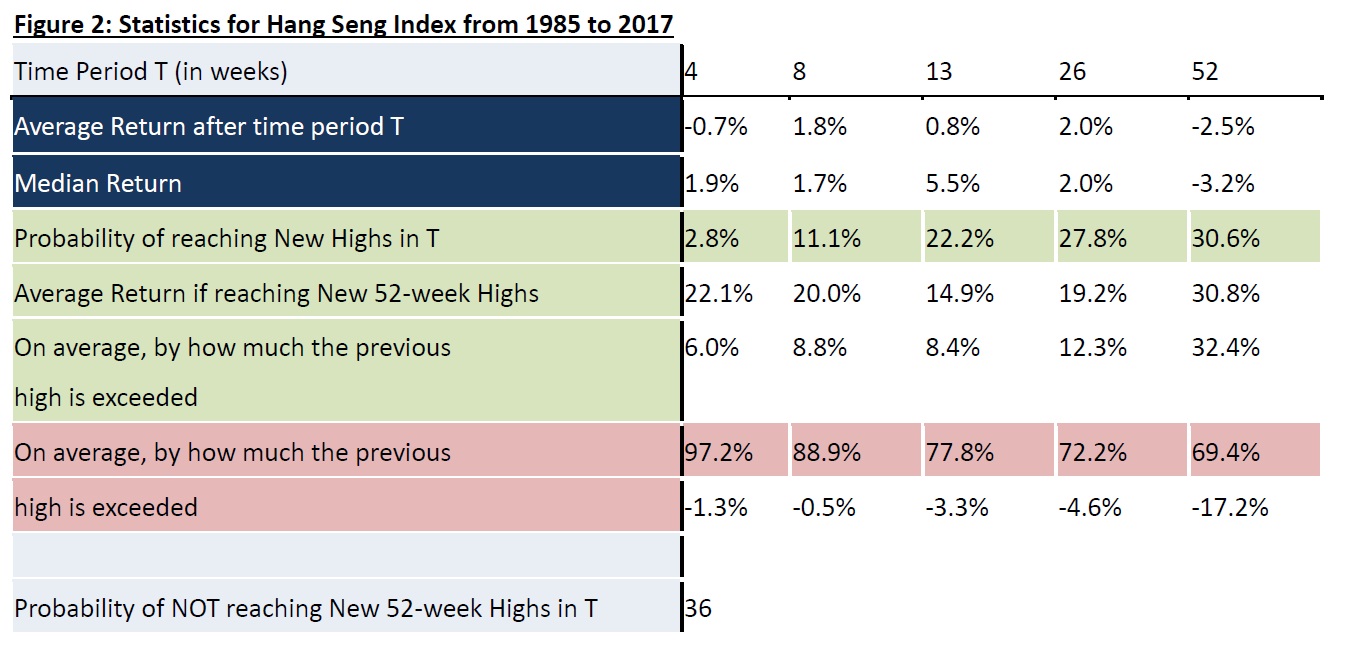

Similar patterns could be observed for Hong Kong’s equity benchmark Hang Seng Index, except for the generally lower probability of exceeding previous highs and greater divergence of expected returns.

In terms of fundamentals, macro-economic data indicated that the synchronized global growth remain robust, and corporate earnings growth are decent across various regional markets, particularly in the US and Asia. With the expansionary fiscal policies in the US, recession risk shall not be imminent this year. With a solid economic backdrop, we believe global equity markets will be able to challenge higher levels in 2018, even though the unconditional odds are not entirely favorable in selected markets.