EM Inflationary pressure was coming from food and energy with transitory shocks

7th February, 2020

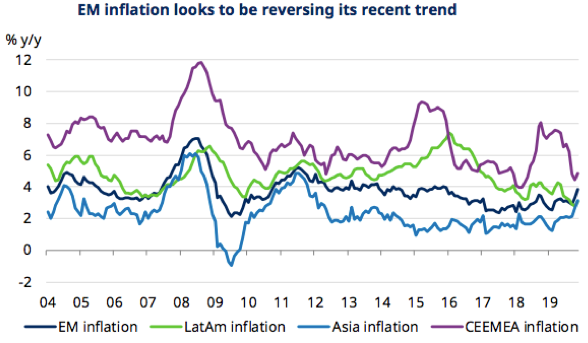

One of the key EM stories of the past two years was the decline in inflation, almost to developed market level. The lower inflation opened up policy space for EM central banks and helped generate strong returns for EM fixed income assets. Recently, however, this trend had come under threat. This was mainly because food and energy prices have increased. In the case of energy, oil jumped sharply as tensions between the US and Iran rose. Global food prices, meanwhile, were under pressure thanks to a confluence of disruptive events in a number of countries. Bad weather had affected a number of harvests and swine flu has decimated pig herds, particularly in Asia. Overall, the risks to the inflation outlook were modest. Core inflation-inflation with volatile components like food and energy removed-was still on a declining trend. As the drivers of non-core inflation were temporary, it allowed EM central banks to maintain an accommodative stance.