Activities were threaten in China and supply chains were also being disrupted

6th March, 2020

In February, trade was replaced by the coronavirus as the main focus for the markets. Near-tern negative effects fear on Global growth, together with the expectation of further monetary support, sent core government bond yields lower throughout the month. The US 10-year Treasury yield stood at a new all-time low of 1.1%, 2.1% points below the recent peak in October 2018 by the end of the month. Developed market equites fell sharply, with the S&P 500 ending the month down 8.2%. From a regional perspective, emerging market equities outperformed developed markets, despite the fact that most COVID-19 infections are currently in Asia, as investors factored in declining rates of new infection in China compared with increasing infections outside China. Macro data in the US proved a mixed bag for investors in February. Low mortgage rates continue to fuel activity in the housing market, but Job openings declined by 5.4% month on month and were down 14% y/y.

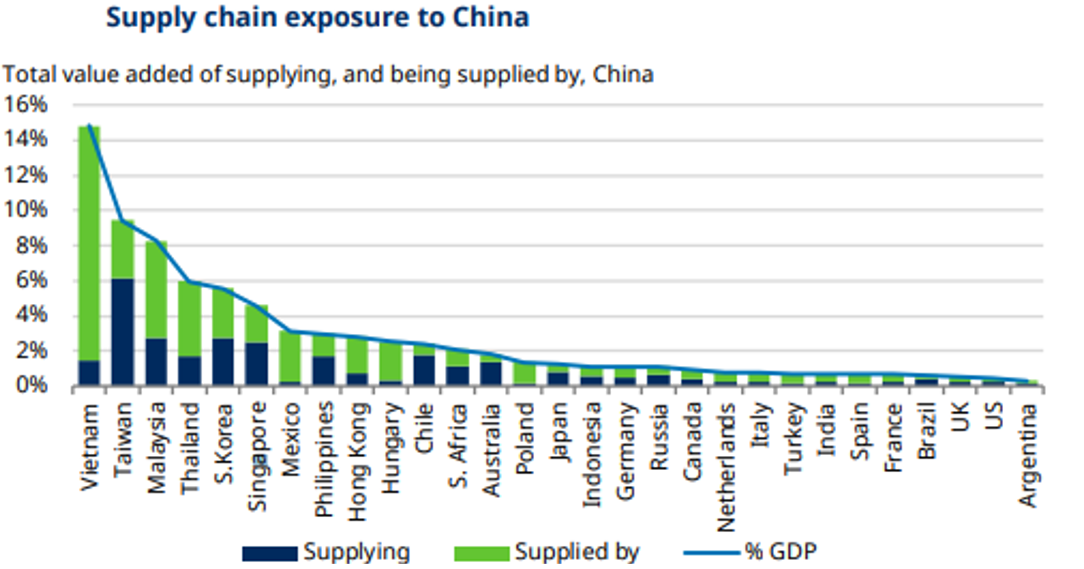

The virus outbreak represents a large shock to the Chinese economy. Significant restrictions on travel and production were implemented by authorities in order to reduce the spread of infection. In February, coal consumption was depressed for most of the month and didn’t show the typical rebound that usually follows Chinese New Year. Although Policymakers have responded with several supportive measures, hopes of quick and sharp recovery in Q2 could be premature given the slow recovery in production and the uncertainty around the extent to which the virus will continue to spread globally. From a regional perspective, South East Asia was most vulnerable given its close ties with the China supply chain. Vietnam was the most exposed, with just over 14% of GDP involved in either supplying, or receiving supplies from China. On this metric, the next five countries were all Asian and nine of the top 10 were from the emerging markets.