An unprecedented policy responded for an unprecedented shock

10th April, 2020

While it was already clear that we were in the later stages of the economic cycle, nobody could have predicted at the start of this year that large parts of the global economy would be brought to an abrupt halt by the COVID-19 pandemic. Unfortunately, the debate had now moved on from whether or not there will be a recession this year, to how deep and long it will be. Equities fell sharply with the worst returns coming in March, reflecting this new reality. Over the month, The S&P500 fell 12.5% over the month and the MSCI World Index declined by 13.5%. As central banks cut interest rates and restarted QE, government bonds rose in price. However, corporate bond declined drifted by concerns about the effect of the shutdowns on corporate profits, and riskier, junk-rated corporate bonds had fallen by more than investment grade rated companies.

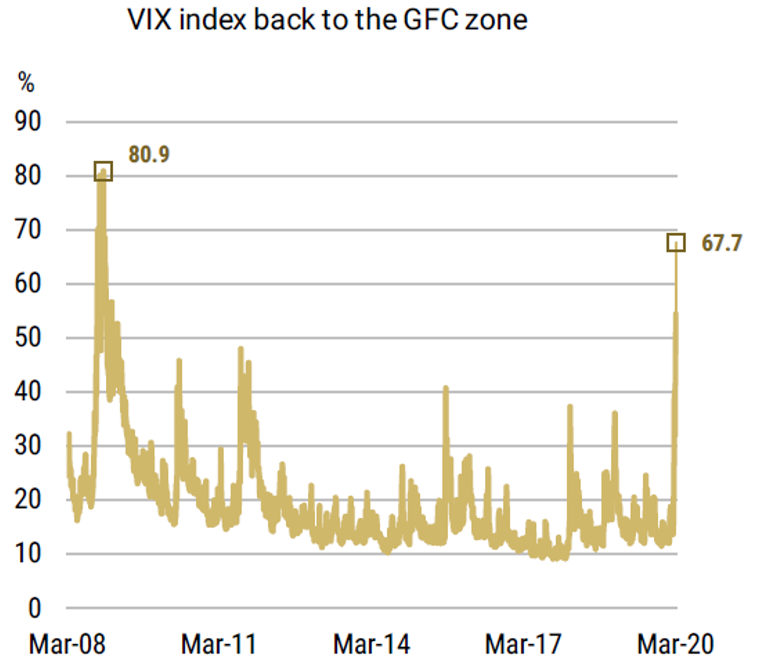

xtreme levels of volatility in rates and equity markets have put pressure on the Fed. A substantial fiscal stimulus package was agreed, worth about 10% of GDP, which will include some grants to small businesses. The central bank had cutting rates to their lower bound and restarting and expanding asset purchase programs. The Fed also provided government backing to investment grade companies, which should ensure that large investment grade companies don’t fail in near term. Investment grade corporate bonds rose in price after the announcement, but some large companies may require grants or bailouts rather than just credit to survive this shock in the longer term. The depth and duration of this recession will therefore depend on the extent to which governments fill in the gaps in their current fiscal responses, comforted by the support of the central banks, to ensure that unemployment is prevented from spiraling higher and bankruptcies of otherwise sound businesses are prevented.