As headwinds to growth and confidence gather, China was flexible in easing policy

17th January, 2019

The final month of 2018 was not friendly for equity markets, as investors were struggle again rising US central bank interest rates, a sharp slowdown in euro zone business confidence, weaker Chinese growth and rising geopolitical concerns. Such indigestible cocktail for investors put MSCI world index dropping 8.36% over the month. Although the Fed did lower its guidance from three to two rate hikes next year after the December meeting, volatility kept painful as this was less dovish than markets expectation. Oil price, on the other hand, plunged this quarter as rising supply caught up with demand. Fears were around the outlook for global growth and hence demand for oil had also weighed on the price. Oil producers were hurt from the oil price, while business investment in the energy sector would fall. However, volatility often came with opportunities, and when that time comes it is important to have some dry powder.

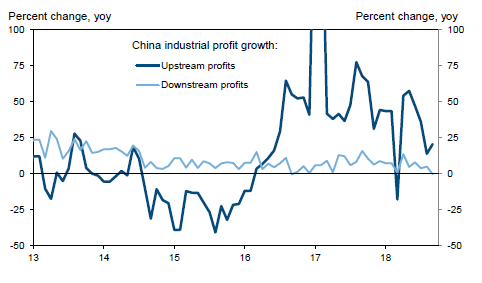

Although hopes for a positive dialog between China and US increased, China's economy faced its own domestic headwinds. Manufacturing experienced an even worse December than expected, with PMI falling to 49.7 rather 50.1 as expected. Profitability continued to diverge between mid-/downstream sectors and upstream sectors, with profit growth for the former (accounting for the majority of manufacturing investment) still weak, and it’s difficult to see strong reasons for firms to ramp up manufacturing investment in 2019. The government lower the GDP growth target at below 6.5%, while consumption continued to face headwinds including fading credit impulse and dampened consumer sentiment. Chinese equities dropped 20.3% in 2018, which was against the largely robust corporate earnings growth momentum. As such, valuations (at 11-12 TTM PE) are at cycle lows. As government showed some signals to try to improve private firms’ financing availability and more accommodative policies were expected to push growth, we kept cautiously optimistic for Chinese assets.