No-deal Brexit risk remained high

18th February, 2019

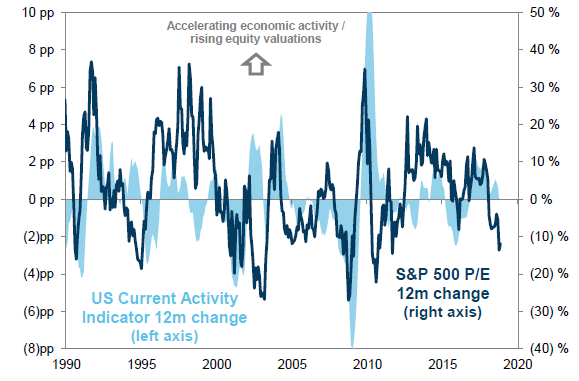

Over the month, the S&P 500 Index rebounded quickly after a heavy sell off and gained by 7.87% thanks to strong Q4 earning result. US equities remained competitive due to solid earnings driven by stable domestic economy. S&P 500 index valuation was elevated relative to history with PE reaching 60 percentile since 1976, but below the recent January 2018 high. Stretched equity valuation had been supported by historically relatively low interest rates and extremely high profitability, as margins stood at 13.5% and return on equity equaled 16.6%, both recorded highs since 1990. However, the normalization of monetary policy by the Fed was likely to put a squeeze on corporate margins and profitability, and historically, decelerating economic and earnings growth has been associated with contracting equity valuations. Although EPS growth was expected to reach 3.7% and 10.7% respectively in the next two years under consensus, we kept monitoring earnings revisions in case for any deterioration which would push US equities becoming expensive relative to other market.

Parliament voted against the ratification of the UK’s Withdrawal Agreement with the European Union in January. Since the Brexit vote, UK GDP growth had underperformed that of advanced economies, while consumer prices had risen by more than elsewhere. Weaker Sterling, the main source of the UK’s inflation overshoot, anticipated a weaker supply side. Thus far, the economy had adjusted quite smoothly to that shock. GDP growth had been bumpy through 2018 hitting 0.6 in Q3 owing to idiosyncratic factors including weather, while low unemployment rate kept falling to 4% was expected to continue. However, the risk of a no-deal Brexit was probably as high as it had ever been and in such situation, the UK could be leaving the EU without a transition period, and was likely to face significant trade tariffs in accordance with WTO rules, along with full customs checks, and a number of other important memberships/associations with EU institutions lapsing. The need for a general election or a second referendum to break the deadlock in parliament seemed more apparent than ever. Over the month, FTSE 100 gained by 3.58%, compared to the lackluster monthly return of 7.68% for the MSCI World Index.