Stock prices climbed with US data remained stable

15th March, 2019

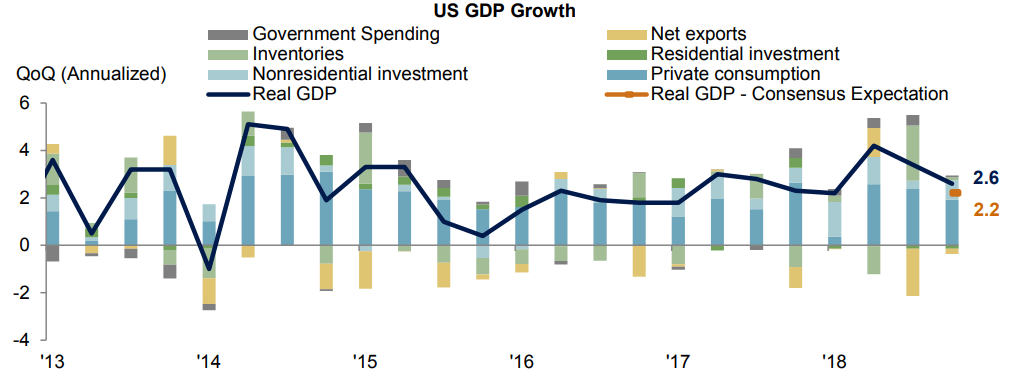

Equities maintained strong momentum across regions in February as a combination of constructive US-China trade talks, a considerably more dovish stance from the US Federal Reserve and the implementation of Chinese stimulus measures buoyed Investor sentiment. Economic growth in the US remained on firm footing with the delayed release of final quarter GDP recorded at a still above-trend 2.6% qoq. Although the partial shutdown of government depressed both household and corporate sentiment in January, economy saw some signs of a bounce back with the latest US PMI improved to 55.8 which pointed to an ongoing robust growth rate of 2%. The minutes of the January Federal Open Market Committee expanded on the Fed’s decision to maintain a larger balance sheet and therefore to end the process of quantitative tightening by the end of the year. The 10-year treasury yield barely moved staying at around 2.7% over the past two months, when both equity and oil prices bounced at 25% and 11% respectively.

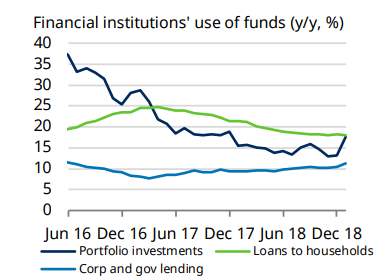

Chinese policymakers were implementing a mix of fiscal and monetary measures to support growth. Total social financing—a key measure of lending—hit record highs in January and the increment of local government bond issuance raised fund that would be directed at new infrastructure spending. The January credit data might turn out to simply bring forward activity from later in the year. On the other hand, much of the new lending by banks had been directed outside of the real economy, with the largest acceleration and contribution to the overall increase, coming from portfolio investments, rather than household or corporate lending. The central bank would continue to ease, but with currency stability now on the table in trade talks with the US the scope for a weaker renminbi (the corollary of monetary easing) is much less. A temporary turn around in growth within the next two quarters was under market expectation and equities market’s performance was encouraging with CSI 300 index had rebounded strongly at 21.9% since 2019.