Eurozone labor market looked strong, while ECB once again delayed raising rate

17th April, 2019

The first quarter had brought with a new wave of optimism, with equities and credit rallying strongly across the world. Much of the rally this year was built on market expectations that the Fed now won’t raise interest rates again in the next two years—in fact, the next move expected from the Fed by the bond market is now a cut, with 10-year Treasury yields down to 2.4%.The sharp fall in the US stock market late last year was probably also a factor in deterring the US administration from further increasing tariffs on China over the quarter. Two of the major risks were largely reduced, pushing MSCI World Index gained 11.9% over the first quarter of 2019. There were reasons for optimism, but also some caution. The weakness in the global economy was most stark in the manufacturing and export sectors. Eurozone industrial production was down 2.5% since its peak in December 2017 and Korean and Taiwanese exports both declined about 8% (y/y) in March.

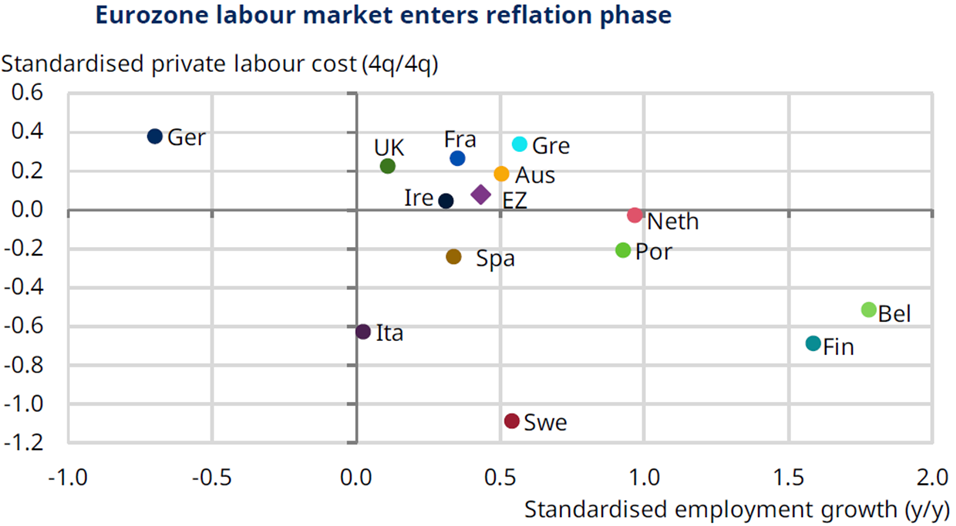

Though the slowdown in Eurozone GDP growth was disappointing for investors, 2018 marked the fourth consecutive year of above trend growth (~1.2%). Almost all of the major member states reported above average employment growth, which the Eurozone as a whole could enjoy for some time. As for monetary policy, the European Central Bank's (ECB) language was gradually softening to acknowledge the increased downside risks to the growth outlook. Previously, it had suggested that interest rate remained on hold through the summer of 2019, but the guidance on 7 March was changed to rate remaining at their present levels at least through the end of 2019. As a result, the dovish change in ECB guidance was not altogether unexpected, as leading indicators of activity were very weak in recent months and weakness in external demand may be feeding into the domestic economy. Hence, we keep cautiously optimistic on Euro Asset.