EM monetary policy space in EM is ample thanks partly to pre-emptive hiking last year

19th July, 2019

Confronted by weaker PMI, still low inflation and geographic politics, the Fed and the ECB indicated that the cavalry is coming in the form of further monetary stimulus. Investor sentiment was greatly encouraged over the month. Risk assets, such as equities and credit, rallied along with traditional safe haven assets, such as developed market government bonds and gold, while current market pricing had reflected expectations that central bank stimulus will keep the economic expansion going. On the other hand, the G20 meeting resulted in the US and China agreeing to keep talking about trade, with no escalation in tariffs but also no significant signs of progress in addressing the key sticking points in the negotiations. While the lack of further escalation avoided the worst case scenario for now, the ongoing uncertainty and potential for a further breakdown in negotiations could continue to weigh on business sentiment.

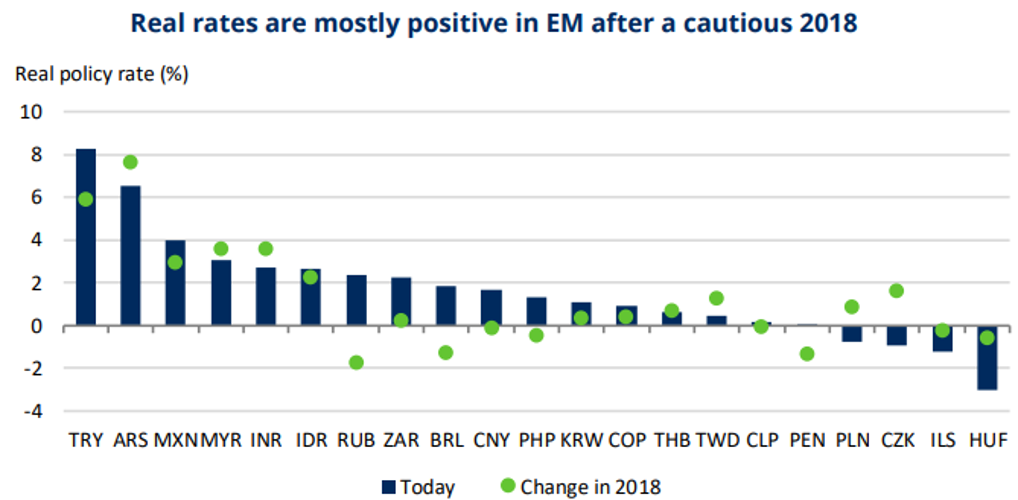

Happily for emerging markets, monetary policy was one area where convergence with their developed market (DM) counterparts was still some way off. DM central banks face serious challenges in responding to any future downturn, with rates in some cases already in negative territory, so QE was increasingly viewed as weapons of first resort. In EM, However, nominal rates were universally in positive territory and in most cases so were real rates. Furthermore, existing monetary conditions were not obviously already inflationary. Should the economy require support, there was nothing here to prevent central banks from acting. Central banks across the emerging world were in this position in many cases because they took a very cautious stance in 2018. Against the backdrop of a hawkish Federal Reserve (Fed), which seemed set to continue hiking through 2019, many EM central banks oversaw a tightening of monetary conditions. Given the dovish turn from the Fed, this caution now looks excessive, providing greater comfort to central bankers who may want to ease in the face of softer global demand. Over the month, MSCI EM Index gained 5.7%.