Currency was important for UK trade, but so were other factors

20th August, 2019

Financial markets paused for breath in July after an exceptionally strong start to the year, with most asset classes delivering muted returns. Investors were forced to wait until the last day of July for the main event, when the Fed reduced US interest rates by 0.25%. The immediate market reaction implied that some investors had been hoping for more stimulus, and they were therefore disappointed by Fed chair Jerome Powell’s suggestion that the move in interest rates did not signal the start of a “lengthy cutting cycle”. In fact, a slowing, not stalling, economy with moderate domestic inflation does not currently warrant more aggressive action. The US earnings season is now in full swing, and US corporates look set to deliver low single-digit earnings growth for the second quarter. Approximately three-quarters of companies have beaten analyst earnings estimates so far, although this was largely driven by share buybacks and, in part, reflects a lower hurdle after analysts had grown more pessimistic. The S&P 500 reached new all-time highs during July, closing 1.4% up over the month and more than 20% up year to date.

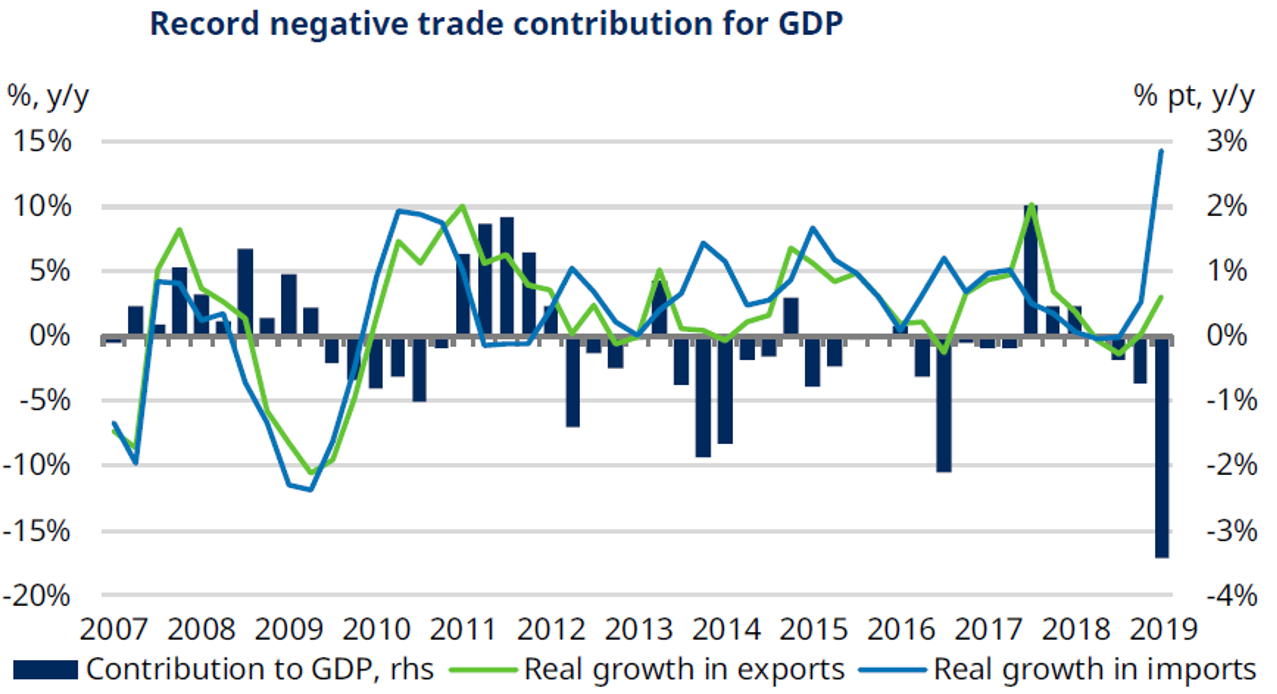

Sterling was once again under pressure with GBP fell 6.7% against USD for the past three months, and a further depreciation was expected if the UK leave the EU without a deal. The British industry was supposed to be rejuvenated by the falling sterling, as faster growth in exports would boost the economy, along with job creation and wages. However, the trade data even worse, as the latest figures showing net trade reducing GDP growth by 3.4 percentage points compared to a year earlier in the first quarter of 2019. These could be explained by many large multinationals had kept their prices unchanged despite sterling's depreciation and became more profitable. This is great for investors, but less so for the economy in real terms, as without the increase in exports, part of the expected benefit from the currency depreciation is lost. In addition, poor productivity growth and competitiveness of the labor market dragged export volume.