Domestic growth was improved in Japan, while the BOJ had entered the currency war

19th September, 2019

August was a volatile month for financial markets, with the VIX averaging 19, compared to 13 in July. The announcement of new tariffs by US on the remaining approximately USD 300 billion of Chinese imports triggered retaliatory measures from China, which announced three weeks later that it would also increases tariffs on roughly USD 75 billion of US imports. Profit-taking in global equity markets in August was triggered by the renewed escalation of trade tensions and the growing economic consequences. US equities market dropped 1.8% but outperformed their emerging market (EM) peers as the MSCI EM Index dropped by 5.1%. The manufacturing part of the economy remains the weak spot as shown by the drop in the August flash US Manufacturing purchasing managers’ index (PMI) to 49.9, its lowest reading since September 2009. The risk of an economic downturn increasingly dominated investment headlines.

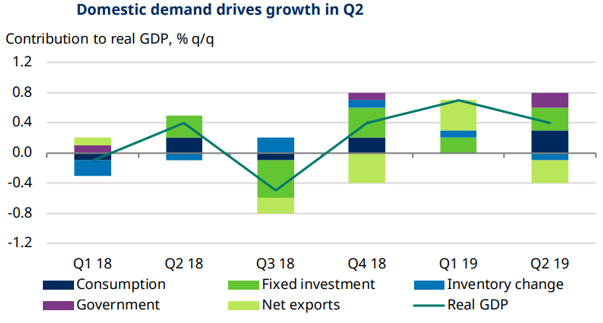

Japanese growth slowed to 0.4% qoq in the second quarter but beat expectations of a more pronounced slowdown to 0.1% q/q. The major drivers of domestic demand – household consumption and private nonresidential investment (capex) both picked up. On the external side, net exports were a drag to growth, reflecting both an improvement in domestic demand and a weak external environment. Stronger domestic demand was encouraging at a time when investors continue to question the ability of the Japanese economy to withstand the upcoming hike in VAT. In July, the BOJ signaled readiness to expand stimulus “without” hesitation if downside risks to inflation were to rise. Such ready-to-act stance was aimed at stopping the yen from appreciating against a backdrop of heightened expectations for easing from both Fed and ECB. In other words, the BoJ had officially entered the currency wars. After all, inflation well below target was nothing new to the BoJ and its growth projections actually remained fairly healthy by Japanese standards.