ECB tool kit was nearing its limits

22nd November, 2019

Risk assets generally outperformed traditional safe havens in October, with financial markets welcoming signs of an easing in geopolitical tensions. Emerging market returned 4.2% compared to 2.6% from developed markets, and the S&P 500 gained a further 2.2% and made new all-time highs at the end of the month. However, data out of the US continued to suggest that the US economy was losing momentum. Consumer confidence fell 0.4 points to 125.9 in October, while the pace of job growth had also been slowing—on average, 160k jobs have been added each month this year, compared to 220k per month in 2018. The US earnings season for the third quarter of the year was well underway, with companies so far doing better than expected. Earnings per share and sales were growing at 1% and 4% year on year (y/y), respectively on the S&P 500. However, US companies continued to give lower guidance for next year’s earnings, with the trade dispute an ongoing theme.

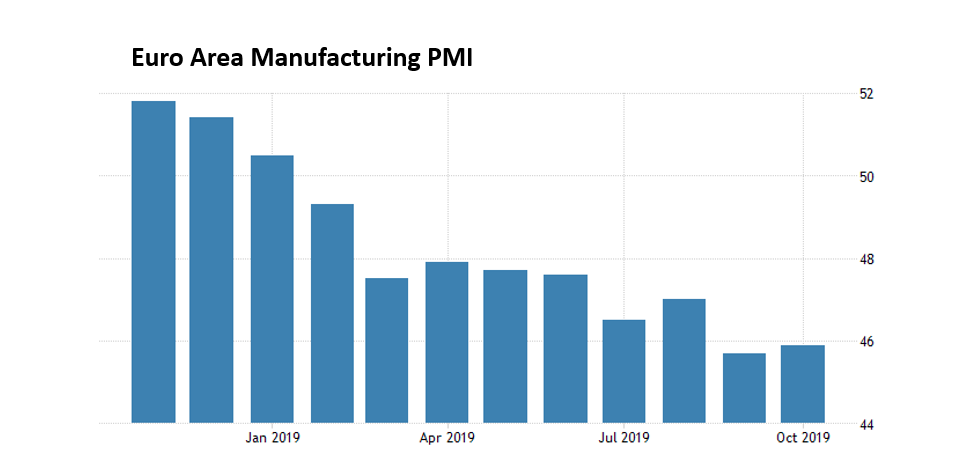

The Eurozone’s economy looks fragile—PMIs for October remained at 45.9 in manufacturing and rose slightly for services to 52.2, to give an only slightly expansionary composite reading of 50.6. The labor market and consumer were also feeling the effects of the slowdown. October’s European Central Bank (ECB) meeting marked Mario Draghi’s final press conference as president. Christine Lagarde, former head of the International Monetary Fund, now took the reins. Lagarde inherited an ECB tool kit that is nearing its limits, with interest rates at -0.5% and quantitative easing of EUR 20 billion per month in place until the inflation target was close to being achieved. With a seemingly depleted monetary toolkit, the challenge will be whether or not Lagarde can convince governments to loosen the fiscal purse strings to stimulate the economy.