Weak external demand urged a close call for BOJ rate cut

20th December, 2019

The authorities may be concerned by the recent weak manufacturing and consumer data in China. Industrial production grew by 4.7% YoY compared to the previous month’s reading of 5.8%, while retail sales grew 7.2% YoY, compared with a pace closer to 8.5% in the first half of 2019. Both industrial production and retail sales disappointed relative to expectations. China will likely grow below 6% yoy in 2020, the lowest since 1999, provoking concerns among market participants. This macro picture implies that policy should stay broadly accommodative across the key domains spanning monetary, FX, credit, fiscal, regulatory, and to a lesser extent, housing. However, a managed growth slowdown, on a standalone basis, is not always bearish for equities as history suggests that global equity markets, China included, tend to fare reasonably well during growth decelerations as long as realized growth is above or close to trend.

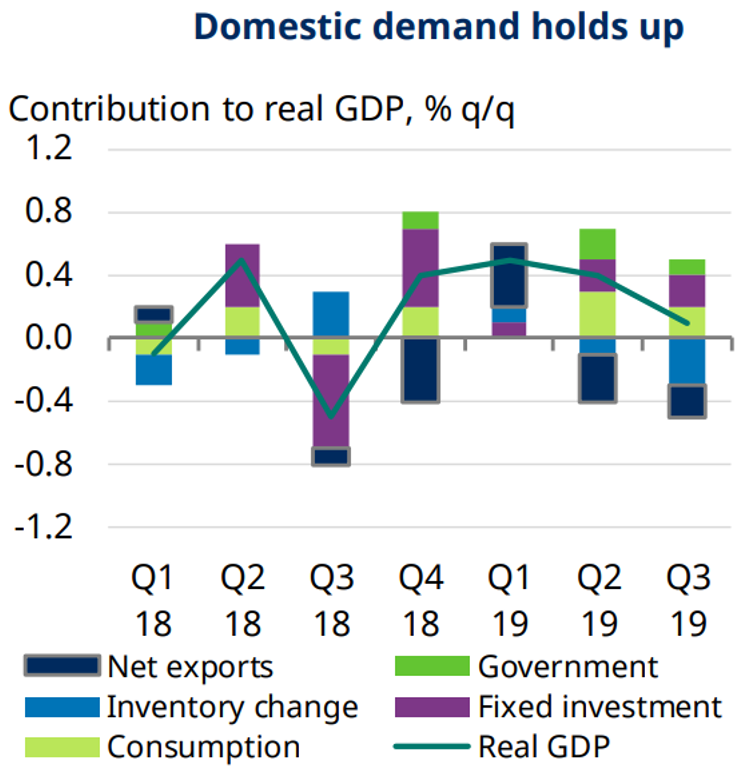

Japanese growth slowed to 0.1% QoQ in the third quarter, which was under expectations of 0.2%. Domestic demand slowed slightly but remained at healthy levels by Japanese standards. However inventory drag almost offset the primary drivers of domestic demand, consumption and capital expenditure, and net export were again a drag to the economy. At the October policy meeting, the BoJ tweaked its forward guidance to say rates would be kept “at present or lower levels” hinting at a future rate cut from the current -0.1%. We continue to monitor the outlook for global trade and prospect of yen appreciation – the two most important concerns of the BoJ. These concerns had faded somewhat, with signs of global growth stabilization point to a weaker yen and moderate trade war tension. The market had priced out expectations of a rate cut, driving government bonds yields higher this month.