Liquidity and Inflation

26th February, 2021

The fiscal stimulus proposed by Joe Biden involves US1.9tn package tops up the USD0.9tn agreed in December, but the combined USD2.8tn is not much bigger than the USD2.5tn of 2020 which has expired for the most part. As a result, the investors doubt whether the government will maintain the current extent of expansionary policy. If investors expect the government to reduce fiscal expansion, the market might tend to be cautious.

Some may expect Joe Biden could reduce the conflicts between the US and China, enhancing the trade relationship. Recent signs show it might not be the case. Joe Biden expressed his first policy speech. He mentioned he would fight against China’s economic evils, human rights, intellectual property rights and global governance with the Democratic Alliance. Despite the above conflicts, there are still room for cooperation with China if it is in United States' interest. The US and China are the two largest economies of the world. The tension between them could bring some uncertainties to the market. Even if the vaccine can effectively beat the virus; COVID-19 has led to severe economic damage, such as high unemployment rate, high fiscal deficits, and a high number of retailers closing up. Investors should expect higher volatility in short-term.

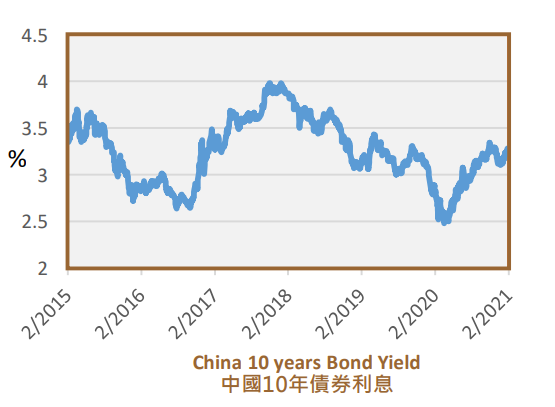

While in the east, Chinese treasury bonds issued by the central government and policy-bank bonds with shorter durations bonds(five years or below) may have greater defensive power against temporary bull-steepening windows in 2021, which could happen due to tapering bond supply amid fiscal stimulus dial-back and a rosy macro backdrop. If dynamics after the 2008-09 global financial crisis are a precedent, the bond bear market since May 2020 may not be over yet. Commercial banks in China, the main holders of these bonds, may still purchase them for coupons, given their hold-to-maturity strategies and tolerance of marked-to-market swings. Global investors could buy more too, with China likely to open up further and FTSE Russell set to include China bonds in its index from October 2021.

Less Chinese treasury-bond issuance may suppress yields of shorter duration ends, while further pickup in macro-financing demand may anchor the 10-year yield close to the 3% technical support, with a 2021 range of 2.9-3.4%. Short-duration bonds with a maturity of five years or below may have better defensive power against curve steepening, we believe. That would promote inflation and we have already seen some signs of picking up of commodities prices in recent months, including most energy and agricultural products, together with various kinds of industrial and precious metals.