When Tech Stocks Stop the Downtrend?

31st March, 2021

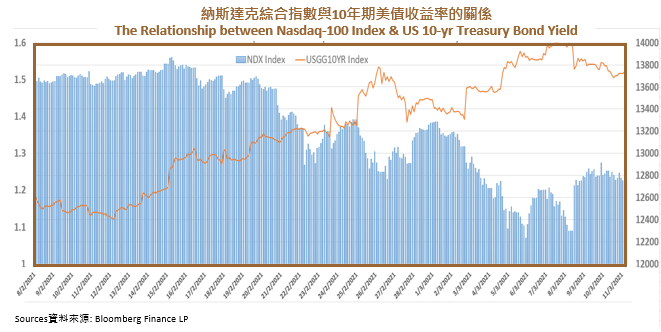

Starting from Mid-Feb 2021, the stock price in the Tech sector kept falling. Nasdaq-100, the tech-heavy benchmark, recorded an over 1000 points drop. It could be attributed to the surge of the US Treasury yield. Under a large-scale economic stimulus package, together with the prevalent usage of vaccine, Covid-19 was foreseeable to be controlled, thus, the public was optimistic towards the accelerating speed of US economic recovery, and expected the asset market return rate and inflation rate to rise. The market demand for safe-haven assets declined, investors switched out their assets from treasury bonds, which made its price plunged while yield surged. In late February, the US 10-Year Treasury yield recorded the highest over a year, to 1.5%, affecting the re-allocation of assets in the market.

The asset market is very sensitive towards yield, especially the Tech sector. In general, their price movement is negatively correlated with the yield volatility. Starting from Nov 2020, US Treasury yield retained low, the technical bull market followed which pushed the Nasdaq-100 up to 13800 points. Later, Nasdaq-100 recorded a significant dropped at around 7% when treasury yield surged within a half month.

The fundamental side of Tech Stocks is not bad, as they are one of the well-performed sectors in the last half-year. In the market, the valuation method for Tech stock is limited as they are facing unstable cash flow, not profitable in the early stage, and not able to calculate intangible asset and potential value in the future correctly, therefore, some traditional valuation method is not suitable for Tech stocks. Foreign investment institutions mainly take risk-free rate and the dividend growth rate as a reference to take forward-looking estimation. They can be considered as hedging relationships. The market would expect risk free rate and inflation rate to increase followed by a yield surge, if the dividend growth rate keeps stable or the risk-free rate is increasing faster than the dividend growth rate, its valuation might be pressed downward.

Nowadays, the US 10-year Treasury yield reaches the level the same as those before Covid-19. However, when comparing with the current economic situation, unemployment rate, the consumer confidence index, etc., there is still a large gap between the two periods. When the actual economy cannot support high treasury yield, or new factors to push the yield rate moving up, phased adjustment may occur in the short run. On the other side, considering the existing huge amount of US debt, plus the government needs to issue large-scale national debt in order to provide financial support to its economic stimulus package. It is believed that the “main buyer” Federal Reserve Board (Fed) would try to maintain the Treasury bonds at a higher price and lower yield, and they might not allow the yield rate to increase sharply.