The Market Rotation is Further to Run

27th April, 2021

Up till the first quarter from 2021, maturing economic recovery is observed due to loosening monetary policies, and diverse economic stimulus. Strong job position growth and economic reopening facilitate this adjustment. For instance, the unemployment rate in the US was 6% in Mar 2021 and reached its lowest level over the year. The US CPI rose 0.6% in March from the previous month and 2.6% from a year ago to reach its highest record over the last two years. They are all the clearest indicators to foresee business recovery and inflation.

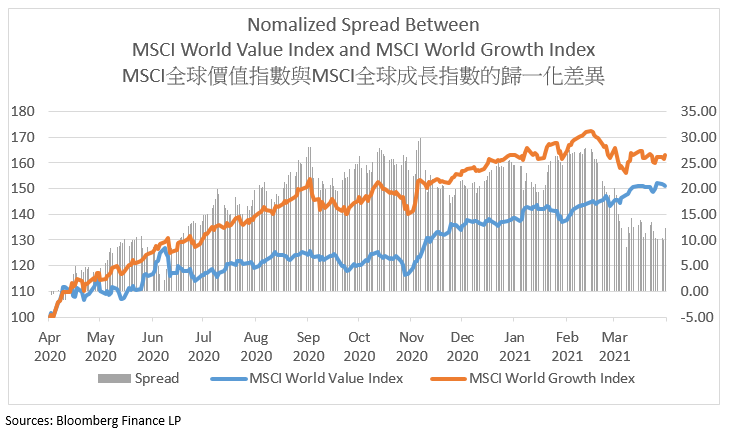

The economic recovery brings another expectation that investment might shift to the next stage of an economic cycle, market rotation as a result. MSCI World Growth index and MSCI World Value index can be used as references. The former is the technology-heavy index, while the latter focuses more on financial and industrial sectors. The Value index got outperformance and reached a gross return of 9.76% YTD, while the Growth index almost remained unchanged and only got 0.29% over the last three months. One of the major factors was the rise in US Treasury yield. Banks could boost their profitability by the rise in interest rates. On contrary, it pushed the stock price of technology sectors downwards and made it less valuable.

It is commonly believed that the long-term US Treasury yield closes to peak and tightening the monetary policies is unlikely to take place before 2023. Though this catalyst is improbable to reduce the gap further between the two indexes, the Growth index might not outperform than Value index in the following quarter. The rationale behind, although the gross return of Value index was well-performed than Growth index in the first quarter, Value sectors was still cheaper than Growth sectors.

Because of the attractive relative valuation, market capital tends to Value sectors. Together with the widespread usage of vaccination, economic reopening over the first quarter has continued. The material and industrial production resumed and under shortage due to excess demand. The White House announced the implementation of a more than two trillions USD infrastructure plan in late March, which might be another catalyst to support the sustained growth in material and industrial sectors.

Take the graph below as reference, the spread between value index and growth index get much smaller starting from mid-Feb when the US 10-year Treasury yield increased. If there is no other facilitator to stimulate technology sectors, it is difficult for it to reach the level the same as those during the pandemic. At the same time, value sectors and cyclical areas get a room for growth. The market rotation might not occur completely in the following quarter, but its gap might tend to narrower.