Monthly Market Outlook – April 2021

31st May, 2021

U.S.

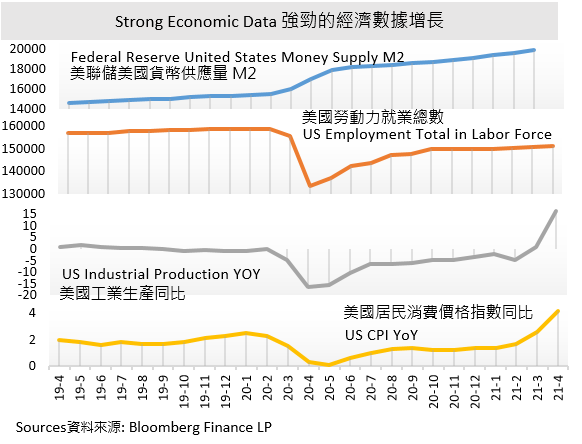

Starting from the second quarter of 2021, the US stock market remains strong. Investors shifted back to high-risk appetite, and market capital also reflowed to large growth stock and tech stock. The three major US stock indexes, Dow Jones Industrial Average (DJI), S& P 500 Index and Nasdaq-100 increased 2.71%, 5.24% and 5.88% in April respectively. Various data released in April showed the economic recovery was accelerating. Among them, Markit Manufacturing PMI raised up to 60.5 in April, while the CPI rose 4.2% from a year earlier, which 62% more than March and reached the highest level over past few years. In the employment aspect, non-farm payrolls (NFP) increased sharply to 916 thousand, which better than expected. The unemployment rate reduced to 6%, which was the lowest across a year.

Though investors worried Fed might increase interest rate early under the pressure of inflation, Fed reiterated its dovish stance to bring back investors ‘confidence. In late April, Fed reiterated to maintain the federal funds rate at 0%-0.25%, and USD 120 billion monthly debt purchase. The US 10-Years Treasury yield fell 11 basis points, which was the biggest drop since last July, stimulating a rebound in tech stocks.

However, investors need to pay attention to President Biden’s announcement of a series of tax plans in late April, which significantly increase corporate tax rates and propose canceling the corporate tax cut policies in Trump-era. It might have a serious negative impact on corporate profit or harm the US economy. If investors would like to make profit before raising tax, they might sell their holding and leave the market first. Selling orders are under pressure, and market cash flow might decline. There might be a certain degree of market correction in US stock in the short term.

China

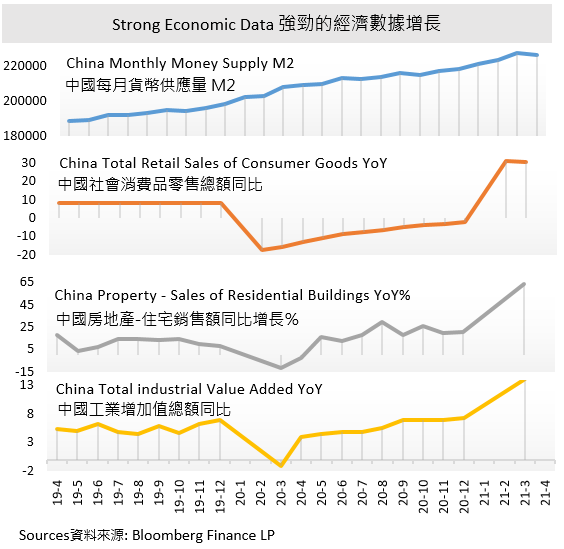

Monetary policies normalization is the main focus in the first half of 2021, which gradually removes additional market liquidity created at the pandemic. Starting from April, market money supply is obviously tightening. A- share stock market maintained a situation of shrinking volume due to the tightening of liquidity. The CSI 300 Index and SSE Composite Index increased slightly by 1.49% and 0.14% respectively. Since the Chinese government is targeting stable growth, change in monetary policies might not be drastic in the future.

China continues to tighten the regulation of monopolistic e-commence giants and internet firms. The market worried about the policies might expand from e-commerce platforms to other internet areas, which restricting company expansion and development. Under the policy's influence, investors are much cautious about the short-term development of leading internet technology companies. Due to the early sector correction, with the impact US treasury yield, tech sectors’ valuation has brought back to a more reasonable level. It is expected that there is little chance of a sharp fall in stock price.

It should be noted that the China-US relation and China-EU relation are deteriorating, which might affect foreign trade and add uncertainty to the future market.

Japan

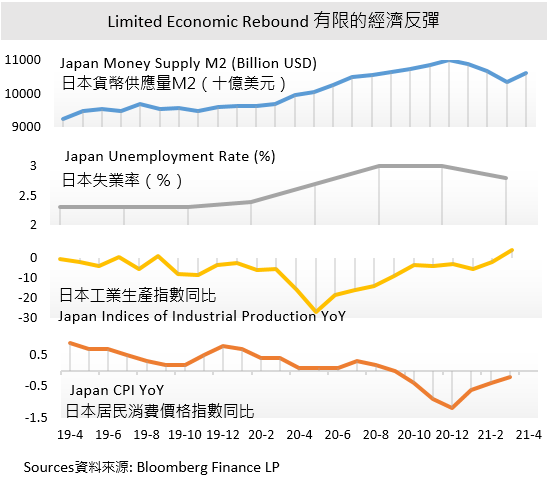

Japan’s economy performed weakly in April, coupled with the re-outbreak of the epidemic, made the domestic economy lag behind other developed countries. In April, the Nikkei 225 and TOPIX index fell 1.25% and 2.85% respectively. Other economic data showed mediocre performance. The seasonally adjusted unemployment rate dropped 2.6% in March, a decrease of 0.3% from February, and CPI in Tokyo area fell 0.2% year-on-year in April.

Because of strong overseas demand, car production in particular, the government issued industrial output data, which recorded a surprise increase of 2.2% in March from the previous month. However, it might not alleviate the worries of the resurgence of infection. Japan announced the state of emergency in economic hub Tokyo and Osaka in the same month, it might put downward pressure on short-term industrial output.

In late April, after the financial meeting, the Bank of Japan announced that it would maintain various financial policies unchanged and raised its GDP forecast to 4% this year, which in line with market expectations. Affected by the weak economy, the central bank pointed out that it was difficult to reach its 2% inflation target by 2023. In other words, the Bank of Japan might maintain its monetary easing policies for a longer period. However, the pandemic instability might encourage capital inflow to Yen, which is considered as a safe-haven currency. In the short run, Yen might face little change to depreciate.

Emerging Asian Markets

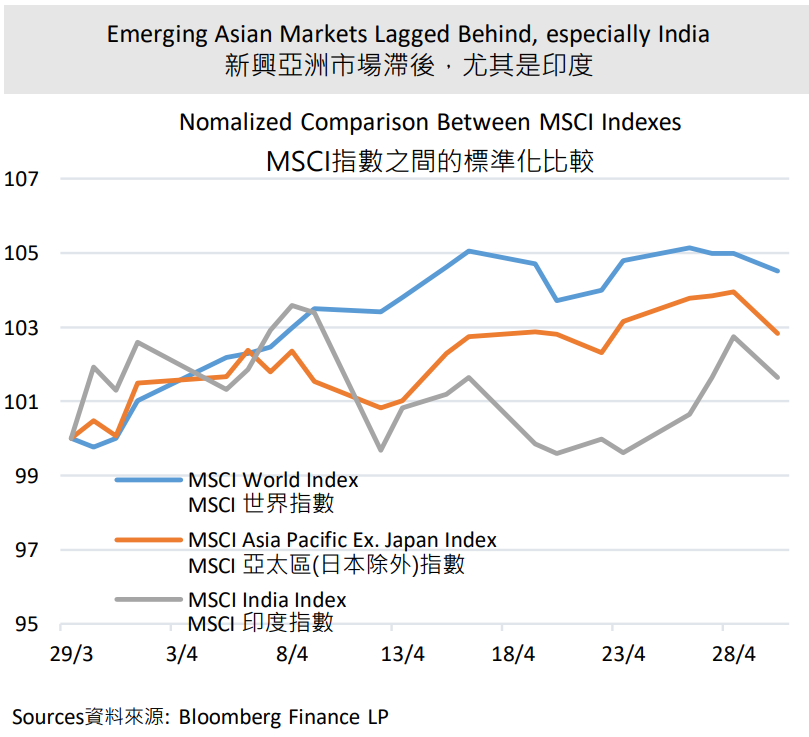

Under the re-outbreak of the epidemic, emerging Asian markets have experienced oversold, and their overall economic performance was unsatisfactory. MSCI Asia Pacific (ex. Japan) edged up by approximately 2.83% in April, lagging behind the 4.70% of the MSCI World Index. According to market data, as of 21st April, global investors divested more than USD 1.3 billion equity funds from emerging markets, excluding China, and international investment institutes sold more than USD 1.1 billion India stocks. If the infection continued to worsen, it would intensify capital outflow from India. Its financial market instability might be retained in a certain period of time.

Since the emerging markets are the major provider for labor-intensive manufacturing, thus the global industrial chain is suffered. Apart from the industrial aspect, oil demand is also under pressure. India, the world’s third-largest oil consumption country, was under a new wave of the pandemic. Some of their economic activities were suspended, making the oil demand sharply decreased. Oil inventory accumulated in the past two years might fail to be consumed on schedule, while oil production is gradually resumed, thus the oil price might face further downward pressure in the coming few months.

Europe

There are differences in epidemic control and vaccination penetration among Europe, its performance is not as good as the US market. The three major indexes in Europe, DAX 30 Index, CAC 40 Index and FTSE 100 Index increased 0.85%, 3.33% and 3.82% in April respectively. The recently announced PMI of the manufacturing and service industries in April hit a recent high. Although the economy rebounded in Europe, its GDP in the first quarter fell by 0.6% quarter-on-quarter, which was lagged when comparing with other regions.

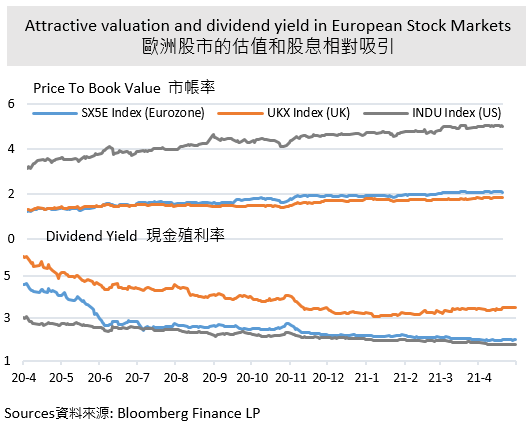

In recent months, investors have taken advantage of the economic recovery and gradually adjusted their investment portfolios. Market capital tends to flow into the US or other emerging markets, and relatively few injection into the European markets. Compared with the MSCI World Index, the European stock market has advantages in terms of valuation and dividends. In the medium and long term, it would help attract capital to flow into the local market. Due to the unstable pandemic, the pace of conducting the “Pandemic Emergency Purchase Programme” is expected to be faster in Q2 than before, thus support the market through liquidity injection.

What is worth mentioning is the performance of the British economy. As its vaccination rate is ahead of other regions, the infection rate and death rate have been greatly reduced. Economic activities are gradually resumed. The IMF predicted that the British economy would grow by 5.3%, and some investment banks even predict 7.1% growth, which might outperform the US market.

Bond Markets

In April, the Global bond market stopped falling and rebounded. Under economic recovery, investors prefer risky investment. In the same month, total investment inflow into the emerging market was USD 45.5 billion, and the bond market accounts for USD 31.2 billion. Among them, high-risk emerging market bonds, high-yield bonds and convertible bonds are in high demand. Some government bonds and investment-grade bonds with low yield are not welcomed by investors. Together with the weakening US dollar, bond performance in the US dollar is even less satisfactory. For instance, US diversified bond funds and global bond-US hedge fund only recorded 0.14% and 0.15% return respectively.

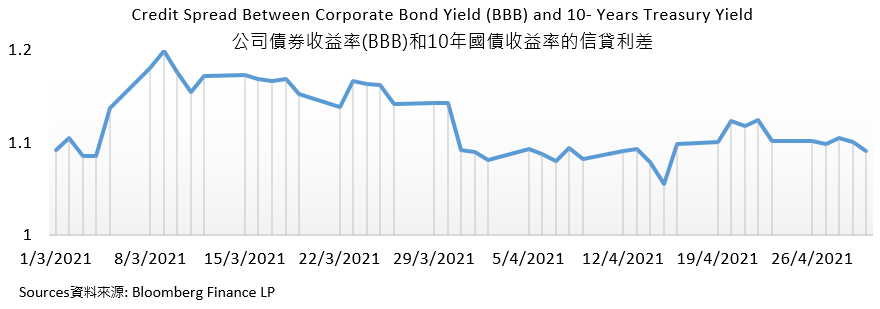

Supported by the fiscal and monetary policies, credit spread is tightening. At current level, when treasury yield increase, corporate bond yield might not inversely react under gradual clarity economic recovery. There is little room for credit spread to further tighten. Investors should pay attention that lower corporate bond yield might result in longer duration, plus more exposure in default risk.

The Chinese fixed income market is eye-catching in April. The capital outflow from serious Pandemic infection region might pour into RMB fixed income, which is less reactive to global conditions. External stimulus, such as normalizing monetary policies by tightening market liquidity could increase real rates, thus promotes the attractiveness of local currency, thus local currency bonds relative to other developed countries. Due to the high demand of RMB, the offshore RMB to USD exchange rate hit 6.46 on 29th April, the highest value since mid-March.