The Culprit that drove the correction

14th February, 2018

Global equities sank into correction territory after January's euphoria

The global equity market continued their ascent in January, led by emerging Asia and the US, amid a rosy global growth picture. Over the month, developed market and emerging market equities delivered decent returns of 3.8% and 6.8% respectively. However, as strong macro-economic data such as wage growth and employment data came out in late January, there was a growing confidence among central banks and market participants that the ongoing recovery might bring inflation towards targets sooner than expected. Most government bond prices slumped, notably US Treasuries, and the resultant yield spike triggered an abrupt correction among global equities in early February, with the MSCI All Country World Index losing 9.02% in the two weeks ended on 9-Feb, 2018. The CBOE VIX index once surged to 50.2, a level not seen in more than two years, under elevated uncertainty and short covering.

The dollar weakens despite the pickup of yield differential

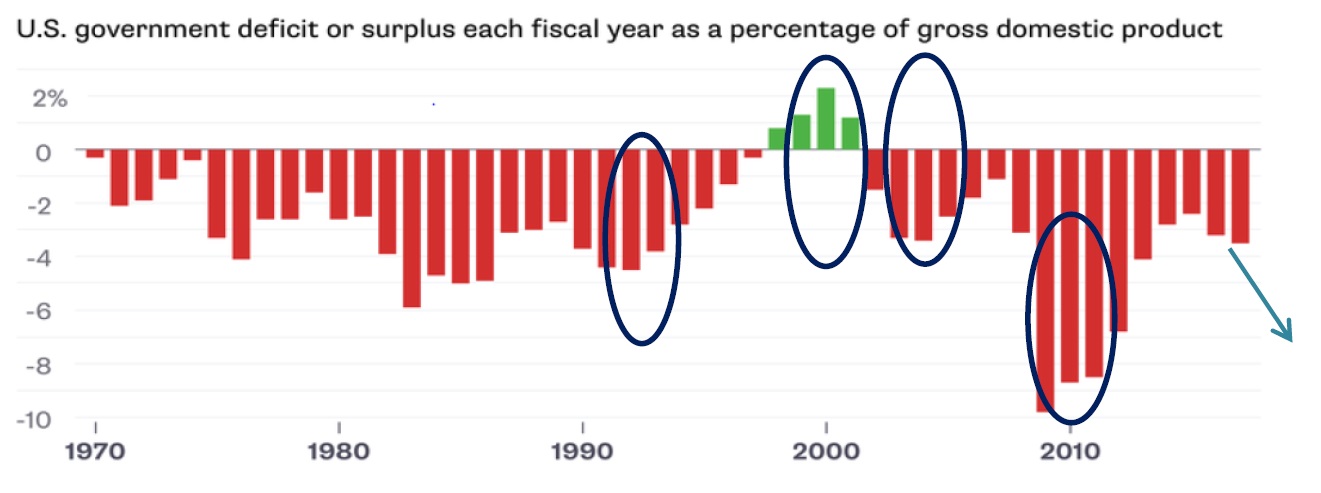

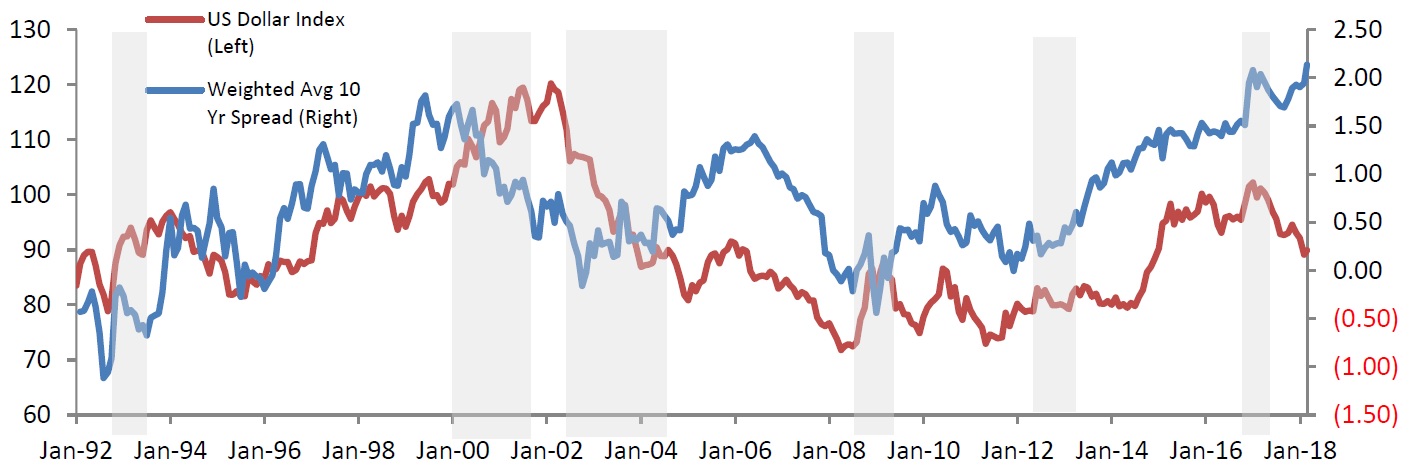

Along with the recent correction of global equities, another notable market move was the weakening of the US dollar even though the yield differentials between the US and major economies have no longer been narrowing since last August. The divergence of yield spread and dollar strength is relatively uncommon, and happens only in about 25% of the time in the past 26 years when budget deficits or the credibility of the US government are taken into account by investors. From 2000 to 2001 the dollar strengthened despite a falling spread amid a rare US budget surplus, and then weakened drastically from 2002 to 2004 when the US government significantly increased expenditure on national defense. The spending plans unveiled by Donald Trump, along with the tax cut package passed last year, are expected to send the budget deficit sharply higher to nearly USD 1 trillion in 2019. It is likely the market is now pricing in this shift in fiscal policy stance. We cannot be sure how long this divergence would last, but we believe the dollar and the yield differential will be in sync again when other major central banks, namely ECB and BoJ, enter further into their tightening cycle, which will in turn squeeze the yield spread and give pressure to the dollar.

Investors’ sentiment dampened, but too early to conclude the bull market is over