Monthly Market Outlook – July 2021

23rd August, 2021

China

The China markets started to lose their growth steam under the post-Covid economic recovery in Q2 2021, given the CSI 300 Index and SSE Index accumulatively dropped 7.68% and 2.18% from year-to-date till July. To pick up its momentum, the People‘s Bank of China cut the reserve requirement ratio for all banks by 50bps in early July and expected to release around 1 trillion yuan in long-term liquidity. Despite this positive stimulus, the stock markets did not take many reactions to it.It seems investors are cautious and pay more attention to short-term worries than long-term development.

On 23rd July, the Chinese government announced the latest guidance on banning profit-oriented K9 academic tutoring by alleviating students’ burden. The market reacted greatly after the announcement. Not only tutoring sectors, but also tech, medical, and property management sectors which related to monopoly, data security, and people’s livelihood dropped dramatically, some stocks in tutoring sectors even cut half of their share price in one trading day. A board-based selling, foreign capital in particular, not only reflects the worries behind the policy but also the fears of other restricted regulations might come soon in other sectors.

Besides, DIDI, a China Concept stock, was listed on the New York Stock Exchange, ignore the suggestion of China’s cybersecurity watchdog on the delay of its IPO. Due to the worries of network security, China launched the removal of the Didi app from local app stores. It is an unprecedented penalty and Didi is at risk of even harsher sanctions than other tech giants’ penalties before. Because of the worries of data leakage into foreign hands, the overseas offering and listing regulation is expected to amend and after that, all Variable Interest Entity (VIE) structure companies, given that more than half of the Chinese stock listed in New York Stock Exchange and Nasdaq are in use of the VIE structure currently, need to get approval from the China Securities Regulatory Commission before listing overseas, including Hong Kong and the United States.

The storm of rectification set off by Chinese regulatory authorities has spread more and more, from tech sectors to tutoring sectors, from local stocks to overseas stocks. In July, CSI 300 Index, SSE Index, and Hang Seng Index dramatically dropped 7.90%, 5.40%, and 9.94% respectively. According to market estimate, the market value of Chinese Concept stock ADRs listed in the U.S. lost more than US$400 billion in July. After a catastrophic July, the market has still not reaching the bottom yet. It turns difficult for a bull case shortly, unless it entails some conditions. First and foremost, some signs are emerging for the end of the internet regulation cycle, couple with the outstanding performance announcement from giant companies and economic data in the following times. The US-China relation also plays an important role in it.

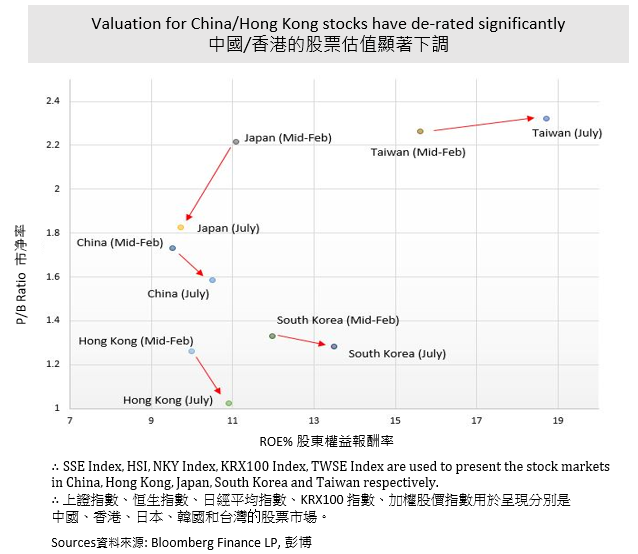

Though the Chinese officers reiterate the regulatory campaign, aiming to strike a balance between social fairness and growth, and for healthy long-term development, the performance of regulatory-center stocks, including ADRs and internet sectors remain weak. Throughout the regulatory wave, the price to book value (P/B) ratio of the SSE Index and HSI obviously declined from mid-Feb to the end of July, showing its stock valuation was cut due to the potential change of its business model. Under regulatory uncertainty, investors should avoid the above-mentioned stocks. In contrast, some industries aligned with the national strategic growth blueprint, including cybersecurity, chips, and green energy, might be a shelter under market instability.

U.S.

The three U.S. major indexes in the stock market outperformed other major indexes in the world despite their growth slowdown. In July, the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite Index slightly increased 1.25%, 2.27%, and 1.16% respectively. On 29th July, the Commerce Department estimated that the GDP accelerated at 6.5% annualized rate in the second quarter, well below the market expectation of 8.5%. Meanwhile, the inflation indicator PCE rose 3.5% YoY in June, which was the biggest move over the past 20 years. The high prices of consumer goods made a great impact on daily life. Inflation continues to rise, might lead to stagnant consumer demand. It is difficult to achieve a strong economic rebound as expected by the market, then the global economy might eventually recover at a very slow rate. It might trigger some policies implementation to maintain healthy inflation growth.

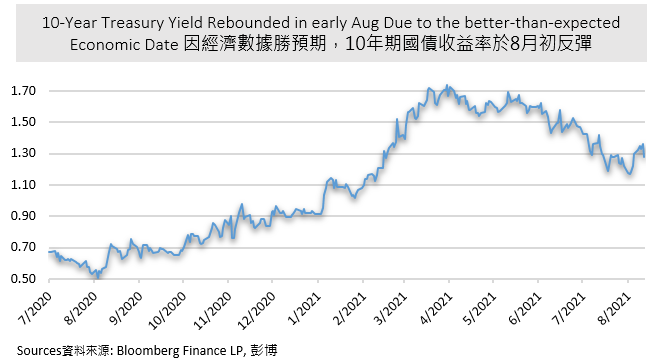

With the announcement by the Labor Department on the first week of August, 943,000 nonfarm payrolls were added in July and the unemployment rate fell to 5.4%. Both of them performed better than the market expected. Treasury yield shoot higher with the inflation worry, recorded 6.41% increase to 1.30% in single trading day. Though the yield showed a downtrend in July, it rose rapidly in August. During the first two weeks of August, the highest and lower spread of 10-year Treasury yield reaching 15.63%. The market expected the 10-year yield would rise to 1.8% by the year-end. Some aggressive approaches from ibanks were even predicted to 2% in December 2021. Rising in yield is seen as a sign of economic optimism, and high yield is beneficial to a bank’s profit margin. Value stocks might be boosted.

The meeting held by Fed in late August or in September might provide more guidance and schedule for the withdrawal of its $120 billion monthly government bond purchase program. Once the schedule is confirmed, it might stimulate yield to boost even higher. Since growth stocks are quite sensitive to the yield hike, investors should pay attention to its risk.

Japan

In July, the stock market saw a 5.24% and 2.19% decline in the Nikkei 225 Index and TOPIX Index respectively due to the widespread delta variant and uncertainty of the economic future. The reported new coronavirus cases continued to break the highest daily count, given the new cases recorded in the first week of August were nearly double the record set a week before. The Japanese government announced in late July that a state of emergency throughout Tokyo was extended to surrounding prefectures. The fragile Japanese economic recovery might be postponed again.

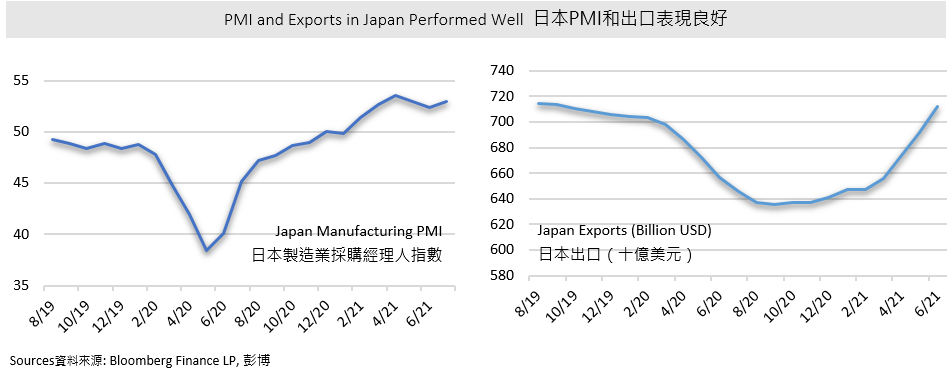

On the other hand, the continued weaker yen, despite a positive increase in the exchange rate to USD at 1.27% in July, beneficial to manufacturing industries and export. The Japan Manufacturing PMI rose to 53, better performed than 52.4 in June. The upward trend of the PMI shows the improvement of manufacturing industries, associated with export rose, and recorded 11.06% increase from the beginning of 2021, almost reaching the level of pre-pandemic period.

IMF cut Japan’s growth forecast to 2.8% in 2021, 0.5% lower than its forecast in April this year. However, it raised the Japanese growth outlook by 0.5% to 3% in 2022 due to a stronger rebound in the second half of 2021, supported by further vaccination campaigns. It should note that there was no major economic impact from holding the Tokyo Olympics, coupled with the extent state of emergency, the power of consumption remained weak, thus, face further downside risk of the economy in the near term.

Europe

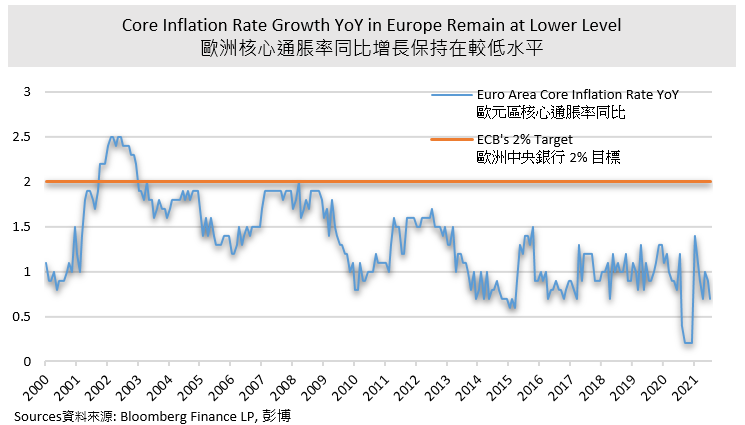

In July, the stock market was resilient despite the impact of the Delta variant in Europe. CAC 40 Index and DAX 30 Index slightly increased 1.61% and 0.09% respectively, which was positive growth in consecutive six months. The core inflation rate in the Euro zone remained low during the decade and the latest record was 0.7% increase YoY this month. In late July, the European Central Bank (ECB) pledged to keep interest rates low for even longer, and not likely to hike rates for at least two years. It aims at helping sluggish inflation back to its target of 2%, given the last time Euro Zone met its 2% target was 2008. Therefore, it is expected that ECB is not likely to change its tightening policy unless to see higher core inflation.

Europe is catching up with the recovery rate. The latest PMI at 62.8 in Euro Area showed a growth momentum towards the US, with its PMI at 63.4 in July. Up till the first week of August, nearly 90% of S&P 500 companies reported their Q2 results, and 87% of them beat expectations for profits and sales, while 90 % of MSCI European companies have reported earnings, and more than half of them beat expectations. The European earning session in Q2 was outstanding and steadily moved towards those in U.S. Both EPS in MSCI Europe Value Index and Growth Index increased in three consecutive months in Q2 and recorded 9.56 and 7.45 in July respectively. The financial performance of European companies is highly in line with the regional economic restart, and the European market is expected to return to its pre-pandemic situation by the end of 2022.