Monthly Market Outlook – Aug 2021

27th September, 2021

U.S.

August was a positive month for the U.S. market. S&P 500 Index and Dow Jones Industrial Average Index took stable return in 2.9% and 1.2% increase in August. But its stock market started to show a sign of correction in the early Sep.There are two major pieces of information that the market concern most recently. First, the July FOMC meeting minutes and the Jackson Hole Economic Symposium are often good opportunities to re-examine their attitude towards tightening the monetary policies. It shows that central banks are likely to prepare tapering by the end of 2021. We expect Fed would adopt a moderate pace for tapering. For instance, it might take 8 months to clear its USD 120 billion monthly purchase by reducing USD 15 billion bond-buying each month. The tapering might have a limited impact on stock markets. Apart from the moderate tapering schedule, its financial conditions remain loose. Since the first interest rate hikes might be implemented by 1H 2023, there is a large gap between the end of tapering and the first interest rate adjustment.

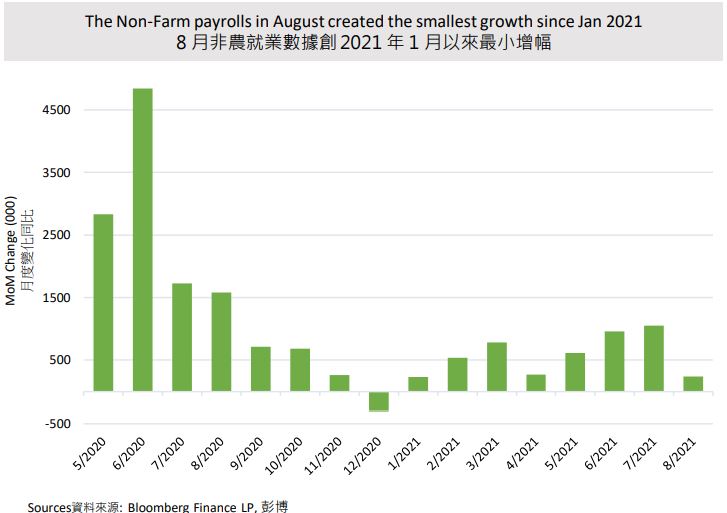

Second, the Non-Farm Payroll was announced on 3 Sep and recorded an addition of 235,000 jobs in August, far below the market expectation of 750,000. The surprising data removed the urgency of tapering in Sep, but might not affect its timetable by 2021. The sharp drop in employment was attributed to some temporary causes, such as the slowing down recovery of entertainment and hotel sectors due to delta variant. Despite the short-term bullish towards the stock market, the worse-than-expected employment data has a minor impact on Fed’s decision. Tightening monetary policies are mainly based on inflation and the employment rate. There is still a long gap for an interest rate hike in 2023, and one single piece of data is not representative enough for the latest economic situation. Also, in terms of the approaching tapering, employment data in Sep and Oct would be relatively critical. Under vaccination rollout or the delta variant is under control, the non-farm payroll might get a stronger increase to prove the achievement of substantial further progress.

The reduction of temporary employment data did not undergo fundamental changes for economic recovery. Inflation remains strong and U.S. producer prices got unprecedented increased by 8.3% YoY in August. Coupled with the full expire of the extended unemployment benefits in Sep, the employment is expected to surge by the end of this year. The latest CPI announced on 10 Sep met the market expectation and reached 5.3% YoY, but the core CPI was worse-than-expected. Both the inflation and the employment data are expected to meet the target for tapering this year. The next FOMC on 22 Sep might validate the schedule of tapering.

Europe

European equities enjoyed a stable run in August given CAC 40 Index, FTSE 100 Index, and DAX 30 Index increased by 1.02%, 1.24%, and 1.87% respectively. It might attribute to strong investor confidence based on robust earnings growth among companies.

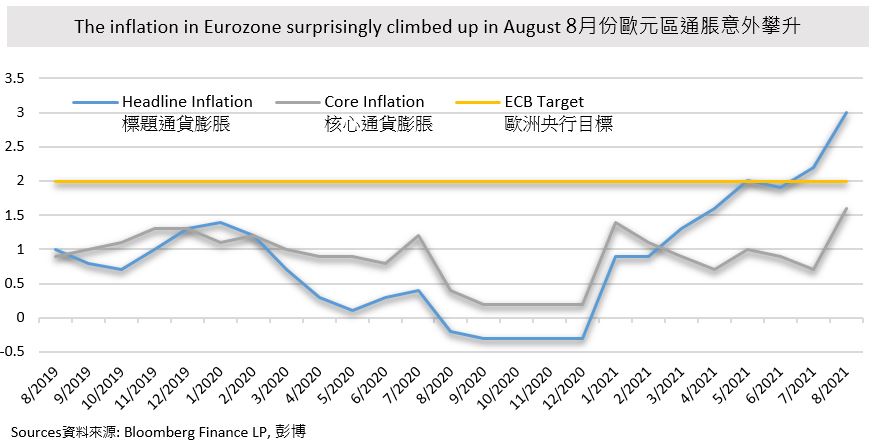

Inflation in the Euro area climbed upward surprisingly in August. The core inflation was rising 1.6% YoY, which was the larger growth since mid-2012. Meanwhile, the headline inflation, which included energy and food, reached 3% YoY in the same month. Both of them performed better than the market expected. It might attribute to summer sales boosted, in France and Italy in particular, coupled with the cost of goods rose, and reversal of the German VAT cut also drove high price and high demand, leading to higher inflation in August. Though the inflation rate got surprisingly overshoot, ECB remained its weak medium-term outlook, which inflation is difficult to meet their 2% target in 1Q 2022. A relatively dovish attitude on monetary policies is foreseeable. However, Eurozone is recovering at an accelerated pace. ECB expects that the economic output would exceed the level before the Covid-19 outbreak by the end of this year. Under the ECB meeting in early Sep, the progress of its Pandemic Emergency Purchase Programme (PEPP) with a total scale of 1.85 trillion Euro would stay, but the debt buying pace would be moderately slower down.

Undoubtedly, the decision from ECB would negatively affect the market sentiment. It caused the temperate correction on European equities. Despite this, the European markets are still expected to be outperformed this year due to the support of loosen monetary policies, and greater rebound for its GDP and EPS.

China

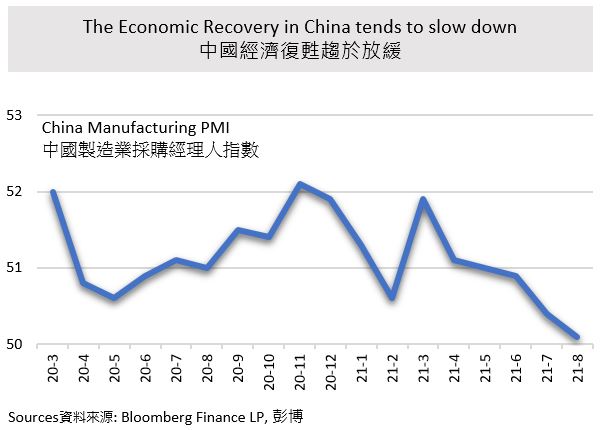

China’s economy continued its slow momentum but tended to be stable in August. Hang Seng Index slightly dropped by 0.32%. The China manufacturing PMI has consecutively dropped in three months and reached 50.1 in August. Meanwhile, the China services PMI fell below 50 to 46.7 since May 2020. To some extent, it reflects more cautious consumer sentiment, thus, the market expects the central bank might keep or even more dovish to support the market by providing additional liquidity to small and medium companies. On the other hand, China equity, especially e-commerce platforms are still under regulatory reset and extending from tech sectors to healthcare and casino industries. The former focuses pilot reform on the pricing of medical services, while the latter involves more stringent gambling terms and daily operation management.

In mid-August, China announced a concept of “common prosperity”. It aims at rebalancing the economy towards labor, tackling social inequality with distribution, and enhancing social welfare, etc. In the eyes of business or investment, enhancing the treatment of workers means increasing the cost of business. It might let companies re-assess their business models and strategies and might cause postponement of business expansion in the short term. Under this idea, consumer goods and services might the major beneficiary and optimistic sectors for long-term investment. However, top luxury goods and related industries might bring adverse effects in the short run and its future development depends on policy direction.

Japan

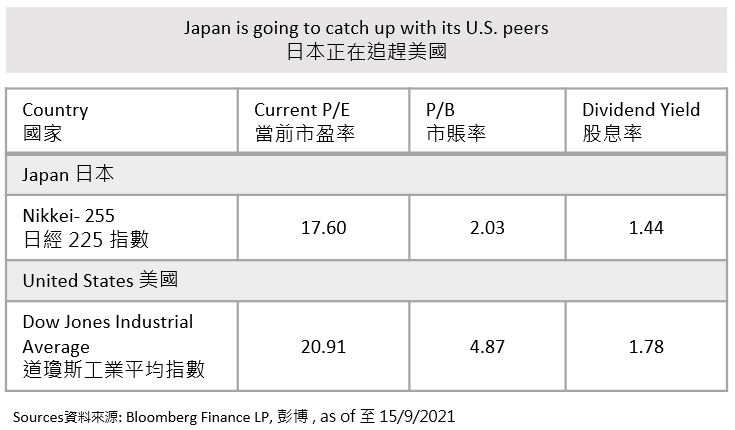

After the previous challenging month, Japanese equities rebounded in August. Nikkei 225 Index and TOPIX Index climbed up 2.95% and 3.14% respectively. Both of them were the second largest monthly growth this year. Despite of the extension the timeline and coverage of the state of emergency and the poor pandemic control, the Cabinet Office consumer confidence index in August slightly declined by 0.8% to 36.7, while the retail sales exceeded market expectation by increased 2.4% yoy. The dovish attitude towards monetary policies support Japanese equity market. Meanwhile, the strength of its U.S. peers might drive local sentiment and the stocks market up.

On the early September, the Prime Minister Suga announced to step down. The market expects the new president would lead Japan out of the pandemic and improve the economy. Nikkei 225 Index responded by rally for the first two weeks in Sep, and reached 5 months high. The change of Japan’s political leadership also considers as an opportunity to catch up with their U.S. counterparty. Though the local vaccine rollout is slower than the U.S., the vaccination rate has skyrocketed and tended to meet the government’s target for finishing all inoculation who are willing by Nov this year. The optimistic sentiment for catching the U.S. peers earlier than expected made its equity market outperformed than most of the economy in Aug and the early Sep.