Monthly Market Outlook – Oct 2021

22nd November, 2021

U.S.

In late Oct, the Fed announced that its bond purchases to be scaled back by USD 15 billion per month starting from Nov 2021. This implies that the tapering would be completed by June 2022. It is the major step for the U.S. to remove a significant shield for the economy provided during Covid-19. The schedule and scale meet the market expectation. The FOMC maintained the target rate for its benchmark policy rate at 0 to 0.25%. Fed continued to emphasize their belief of current high inflation was “expected to be transitory” and the consumer price pressure would ease for stronger employment and economic growth shortly.

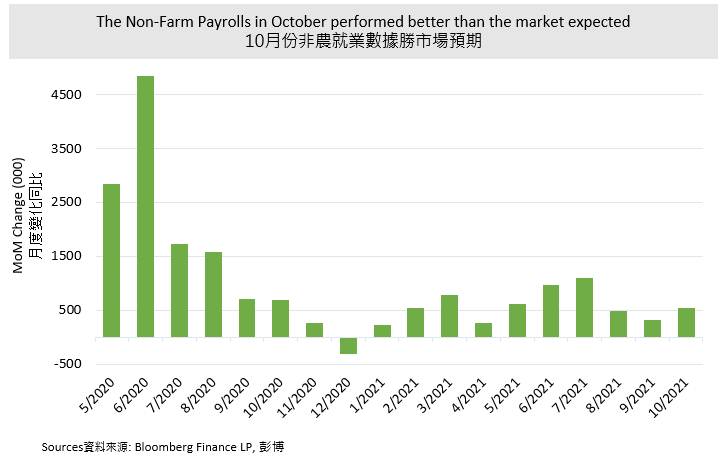

Another significant figure for Fed to raise interest rate is the non-farm payroll. Its latest record in Oct was announced in the first week of Nov. There was a better-than-expected 531,000 job creation, which offers evidence that economic activities were retained their momentum. Meanwhile, tapering and strong employment might provide a signal of the virus impact fading out.

The five U.S. tech giants FAAMG have issued their Q3 financial report in 2021. Among them, Alphabet, the parent company of Google and Microsoft beat the market expectation, while Facebook, Apple, Amazon showed significant growth slow down due to declining in advertisement revenue, chips shortage, and global supply chain constraints, and rising transportation cost respectively. Though their performance in Q3 differed, their upward trend did not be hindered. Following the name changed by Facebook to Meta in late Oct, which refocuses on virtual reality, Metaverse concept-related stock was favored by investors. Together with the stimulus of no signals for early interest rate hike from the Fed, tech-heavy Nasdaq continued to break the record high.

Starting from 8 Nov 2021, the U.S. start to resume its border to non-essential international travelers among 33 countries with fully vaccinated against Covid-19, including from China and most European countries. This measure would drive demand for U.S. flights and hotels. The reopening is also likely to drive up travel-related sectors, such as airways, hotels, booking platforms start to show growth momentum. According to Reuters, the sale bookings has soared by 450% shortly after the announcement. The Market expects that the U.S. retail sales could be promoted for the upcoming Christmas Shopping season. Therefore, the market sentiment is motivated and support the stock market. However, investors should not ignore the risk of the spread of the pandemic virus due to the influx of tourists.

Japan

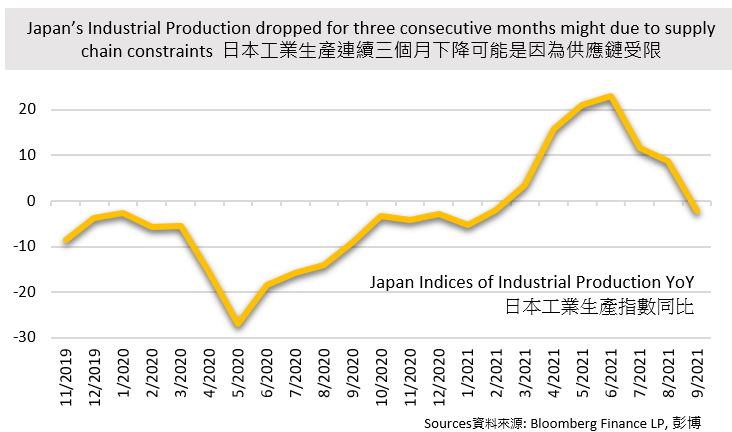

The Bank of Japan (BoJ) announced to keep its interest rate and asset-buying plans unchanged while lowering its growth forecast which would expand 3.4% from 3.8% in the current fiscal year ending Mar 2022. The market expect that BoJ might continue its loosing monetary policy until 2Q 2023. The decline on economic forecast is attributed to the setbacks from the Covid surge in summer and supply chain constraints that weighted on export and production. The Japan Industrial Production recorded -2.3% YoY in Sep, which got first negative level since March this year. Japan, as an automobile industry, the shortage of chips and insufficient supply of materials from Asia significantly affect the production. Following the vaccination rollout among Asian emerging markets, the shortages of components might be released. On the other side, there were economic data that performed better than the previous record, such as the manufacturing PMI, CPI, and unemployment rate, and recorded 53.2 in Oct, 0.2 YoY, and 2.8% in Sep respectively.

Investors might look forward to the Japanese market. The new PM launched a 30 trillion fiscal support to help domestic-oriented sectors. Small and mid-cap companies are expected to benefit most as they are mainly focused on domestic business. Also, the Japanese government considers restarting the Go To Travel Campaign which the encourages domestic travel by providing subsidies to boost the economy. Meanwhile, it eases the entry restrictions for business people, students, and technical trainees. It takes a big step to co-exist between economic growth and the pandemic. Though Yen appreciates slightly in these few weeks, it is still at a low level. Export-oriented Japan would benefit from weak Yen. Based on the above-mentioned factors, the outlook for the Japanese stock market is still optimistic.

China

The global energy shortage and the tight supply of raw materials further push up the commodities prices. The inflation risk continue to rise in China. In Oct, the China consumer price index (CPI) rose by 1.5% from a year earlier. While the China producer price index (PPI) rose by 13.5% YoY and hit a 26-year high. Due to the control of energy consumption, the price of dense energy-consuming products would continue to rise. PPI is believed to maintain at a high level, this would affect the CPI accelerating upward in the following few months. The higher inflationary pressure might limit the room for further monetary policy easing.

The crisis of Chinese property seems to be dawning. A series of articles was published in the state-owned media that regulators might adjust the rules to allow property developers to sell debt in the domestic interbank markets. Another report stated that regulators are considering to allow state-owned enterprises and others to purchase domestic housing projects, without intake the related debt into its debt ratio, thus it would not significantly increase debt and hit the “three red lines” through acquisition. The sentiment is lifted by the belief that China would take steps to ease the cash crunch for embattled developers and boost property stocks and bonds. In fact, bank lending to property developers rose sharply in Oct, recording RMB 348 billion new mortgage lending, 42% more than the previous month. Its momentum is expected to extend to November.

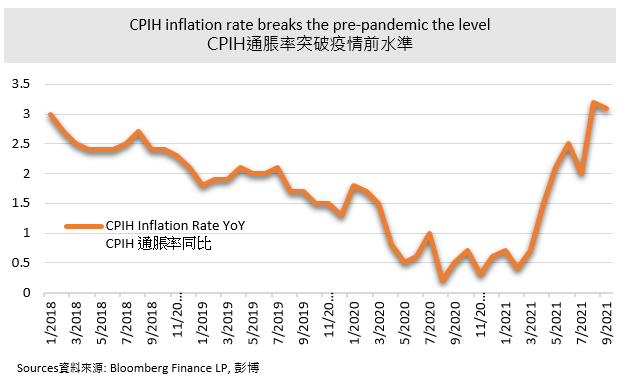

UK

Inflation has been risen sharply in the UK since 2Q this year. Till Sept, the CPIH inflation rate which is a comprehensive index that includes housing cost resumed to and broke the level the same as pre-pandemic. When the market unanimously believe the Bank of England (BoE), the first G7 country would raise the interest rate to control inflation. However, BoE announced the meeting result at the beginning of Nov, which would keep the interest rate on hold and continue the current bond purchase plan. They see the overshooting inflation “are very unlikely to be satisfied next year”, thus there is no urgent need to raise interest rate at this moment. Officials also cut the growth forecast next year from 6% to 5%.

After the announcement, the sterling falls sharply against major international currencies. However, BoE also pointed out that to achieve a 2% inflation level, interest rates would need to be raised in the next few months, as soon as Feb next year in terms of achieving employment and inflation goal. Sterling might keep its weakness in the following few months and recover from its lows after the signal of interest hike given from BoE.