Monthly Market Outlook – Nov 2021

22nd December, 2021

U.S.

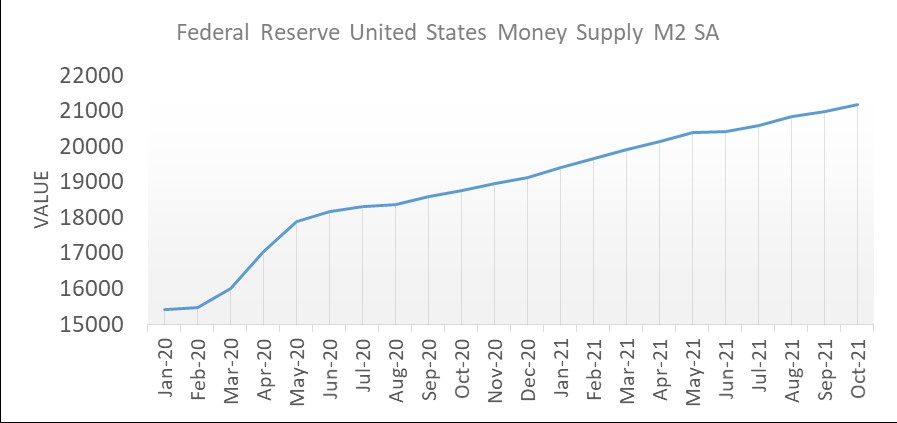

Stocks been swinging with huge volatility over the past month as all eyes were on the Fed as the market awaited the latest policy decision and outlook – a decision that drew particular attention given the inflation environment. To its credit, the Fed brought no major surprises. As expected, it announced it will wind down bond purchases at a faster rate, acknowledging the elevated consumer price pressures that have persisted through the back half of the year. It did, however, convey a slightly more hawkish tone, which included an outlook for potentially three rate hikes next year. In a market that has depend on extraordinarily easy monetary-policy settings, it was the initial positive reaction in stocks to this tone that was perhaps the surprise in December.

Therefore, we continue to think most stocks will see valuations come down as central banks remove monetary accommodation and growth slows more than investors expect. Market probably favors defensively oriented stocks over cyclical ones. This includes Healthcare, REITs and Consumer Staples. Meanwhile, consumer discretionary and certain technology stocks look to be the most vulnerable as we experience a payback in demand from this year's overconsumption. While other cyclical areas like energy, materials and industrials could also underperform, ownership of these sectors is not nearly as extreme as the discretionary and tech, nor are they as expensive.

While major U.S. equity indices remain vulnerable, in our view, many individual stocks have been in a bear market for most of the year. As a reminder, almost 80% of all stocks in the Russell 2000 have seen a 20% drawdown during 2021. For the Nasdaq, it's close to 60%, while 40% of the S&P 500 has corrected by 20% or more. In our view, it makes sense to look for sectors that have already corrected, rather than the ones that have held up the best. We would recommend a barbell of these sectors with the more classic large cap defensive names that fit our current macro view.

Japan

Japanese equities rose plunged 4.5% in November and rebounded in December. Investor sentiment was lifted by the U.S. Federal Reserve’s tapering decision, as many feel that the move signals confidence in the post-pandemic economy, and Japan’s open market is highly leveraged to the global economic recovery.

Following its December monetary policy meeting, the Bank of Japan (BoJ) maintained short-term interest rates at -0.1% and the target for 10-year JGBs at around 0%, as widely expected. The central bank extended its special program (launched in response to the coronavirus) to support financing, mainly of small and medium-sized firms, by six months until the end of September 2022. It will reduce some of its crisis-era monetary support by completing its additional purchases of commercial paper and corporate bonds by the end of March 2022, as scheduled.

The BoJ remains among the world’s most dovish central banks. Governor Haruhiko Kuroda commented that its policy stance is contingent on Japan’s economic situation and independent of the decisions of other central banks, many of which across the developed world are beginning to reduce policy accommodation.

China

China

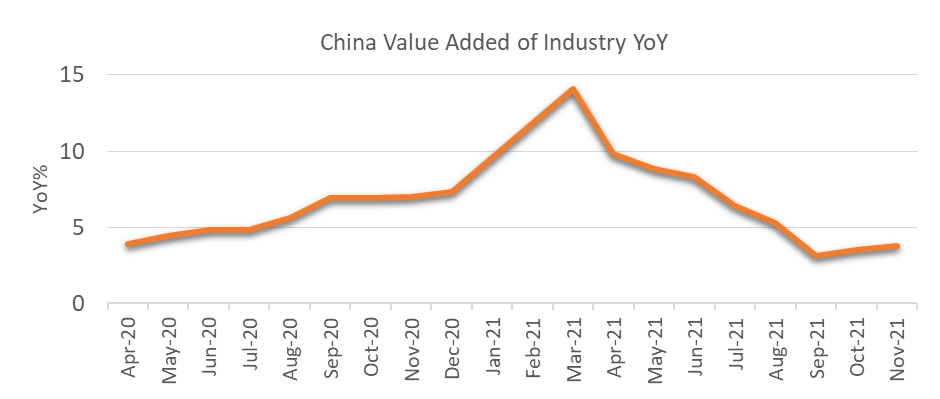

Chinese markets fell amid the resurgence in global COVID-19 cases and U.S.-China tensions after Washington placed investment and export restrictions on dozens of Chinese companies for their role in allegedly repressing China’s Muslim minorities and in supporting Beijing’s military. The CSI 300 index retreated 1.5% in November, and the Shanghai Composite Index flattened.

More signs of currency intervention appeared in data showing that the central bank recorded in November its biggest net purchase of foreign exchange in more than six years. China’s foreign exchange regulator is also reportedly involved in efforts to cap the yuan’s rise by speeding up the approval process for companies to convert yuan into dollars and remit the funds to pay offshore dollar debt. However, we believe that the change will not likely have much impact on the yuan’s direction versus the dollar.

In economic readings, data showed that China’s factory output grew faster than expected in November, but new pandemic curbs hit retail sales and fixed asset investment growth lagged forecasts. November data also revealed that new home prices suffered their biggest month-on-month decline in six years, with the country’s lower-tier cities and developers bearing the brunt of the downturn. Government revenue from land sales fell for the fifth straight month in November, another sign of stress for the beleaguered property sector.

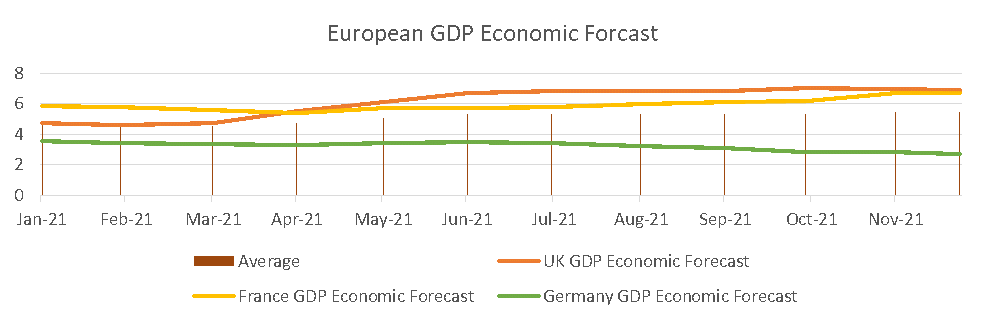

Europe

Shares in Europe fell as governments tightened restrictions to curb the spread of the coronavirus and central banks became more hawkish. In local currency terms, the pan-European STOXX Europe 600 Index ended November slightly less than 5%.

Core eurozone bond yields whipsawed, ending lower. They initially declined sharply, as the spread of omicron sparked fears about the economic recovery. Yields then rebounded on hawkish moves by major central banks and the European Central Bank’s (ECB) decision to scale back its emergency bond-buying program. Bond yields then came under pressure after ECB President Christine Lagarde indicated that an interest rate increase was “very unlikely” next year and on coronavirus concerns. Peripheral eurozone bond yields rose overall. UK gilt yields advanced after the Bank of England (BoE) surprised the market with a short-term interest rate increase.

The ECB kept its main policy rates at existing levels. It also said it would end its emergency asset purchase program in March but temporarily increase its Asset Purchase Program to smooth the transition. The ECB signaled that any exit from ultra-easy monetary policy would be slow, as the pandemic was again depressing business and consumer sentiment and threatening economic growth.