Monthly Market Outlook – Dec 2021

21st January, 2022

U.S.

2021 ends with a fresh pandemic outbreak with the Omicron variant, hitting a record high of 2 million daily new cases. After the outbreak of Omicron, surprisingly, the daily deaths data remains stable and is sitting at around 7000 daily, reflecting the Omicron variant has a lower rate of hospitalizations and deaths than the earlier Covid-19 variant. Yet, it is still putting huge pressure on the health care system, and hindering the recovery of economies as folks are forced to pull back on travel and leisure activity.

US also released the latest non-farm employment report which offered mixed signals for the last month of 2021. From the payrolls report, US economy added a total of 199,000 jobs in Dec 2021, which was well below the market expectation of 400,000. On the other hand, the household survey indicated the employment rate has declined continuously to 3.9%, nearly reached to the level before the pandemic. However, the impact of the Omicron variant was not fully reflected on the latest report, and effect on labor and stock market still remains unknown.

Apart from that, US also published another substantial data, the Consumer Price Index. It is reported that the annual inflation rate in the US reached 7% in the last month of 2021, a fresh high since June of 1982. The sky-high inflation rate might be grounds for Fed to raise the interest rate. In fact, the market expectation for a rise in interest rate in March is already over 60% according to the interest rate futures. A rise in interest rate would have a downward effect in the valuation of stocks, and further causes uncertainty to the stock market.

Japan

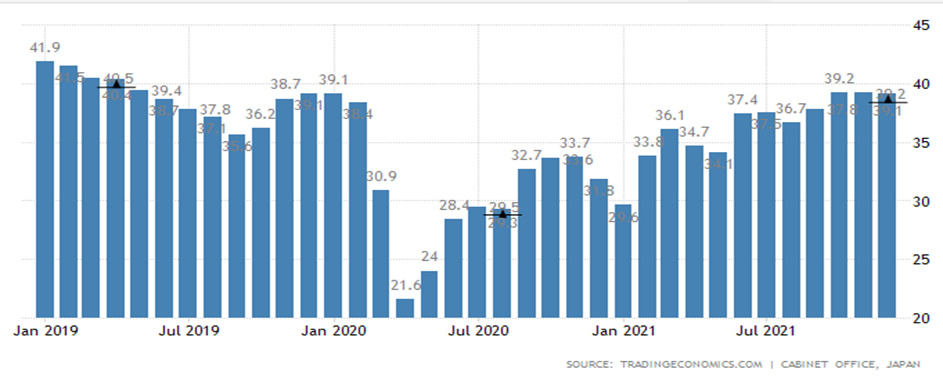

Japan consumer confidence index had remained stable in Dec 2021, it had slightly declined from 39.2 in the previous month to 39.1, which still sitting at a relatively high level since May 2019 after the ease of Covid-19, showing the high degree of confidence of consumer in the market. However, these data had not consider the recent outbreak of the Omicron variant. Investor should consider the potential effect from Omicron as it may poses uncertainty to the global market in the consecutive months.

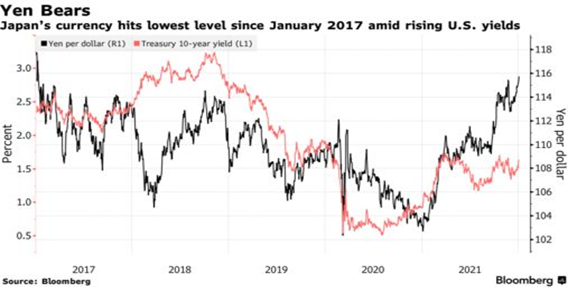

On the other hand, Japanese yen was weak in Dec as a relentless rise in US treasury yields widened the yield advantage. JPY opened at 113 and continuously felling throughout December due to the expectation on interest rate rise. Eventually closed at 115, the weakest level.

Consumer confidence index in Japan

Japanese Yen performance

China

China inflation rate declined from a 15-month high of 2.3% to 1.5% in the last month of 2021, which is also below than the market expectation of 1.8%. Meanwhile, the consumer prices rose 0.9% on 2021, which is far below the central bank’s target at around 3%. The market expectation on interest rate cut from the central bank is rising due to the unexpected inflation data. A lower interest rate would have a positive impact on China’s stock market as it encourages investors and institution to invest with a lower borrowing cost.

Inflation data aside, China had also released trade data. China’s import grew by 19.5% on a YOY basis in Dec 2021, missing the market expectations by 6.8% and was the weakest growth since June. On the other hand, export from China grew 20.9% from a year earlier, above the market forecasts of 20%. Overall, China had a strong trade performance in 2021 although a sign of economic slowdown was observed from the Dec data.

Inflation rate in China

Europe

Conflicts between Russia and Ukraine had begun since break up of former Yugoslavia back in 2014. Hostilities had simmered for years but Russia-Ukraine tensions further heat up after Russia moving troops toward the boarder. It is reported that Russian plans for a military offensive against Ukraine as soon as early 2022. As a result, it put great pressure on the Russia’s stock market, causing the RTS index plunged by around 16% after the peak reached in late-October. While the Ruble had also declined by over 7 % at the same time. Tension between the two countries may further escalate amid fears of Russia invasion, affecting the EU market and economies as a whole.

RTS index in Russia

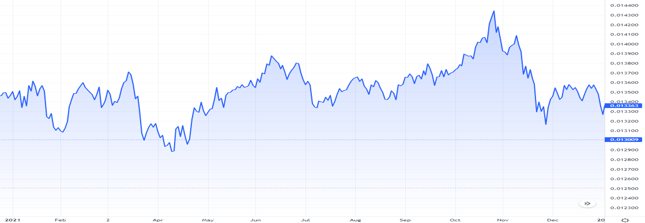

RUB/USD over the past 1 year

RUB/USD over the past 1 year