Monthly Market Outlook – Jan 2022

22nd February, 2022

U.S.

2022 US stock market got off to a weak start. The market faced various challenges ranging from more hawkish Fed after the beyond expected inflation rise to conflicts between Russia and Ukraine, these factors were putting markets in reverse. Nasdaq index was ended at 14239 down from 15644 at the start of Jan, near a 9% retrace. While the Dow index was down by over 3%, closed at 35131 in the first month of 2022. The market is expected to be under pressure continuously as a result of the upcoming rate hike cycle.

US CPI data in January indicated that the annual inflation rate in the US had accelerated to 7.5% the highest since February of 1982. The recent inflation trend gives rise to increasing concern that Fed will raise the interest at an even faster pace. Despite the inflation is expected to decline substantially in the second half of 2022 as a result of the resolve in the global supply chain crisis, it is still uncertain when would it be resolved. Thus, the investor needs to be alert for the coming inflation data and rate hikes.

Performance of Nasdaq index

Japan

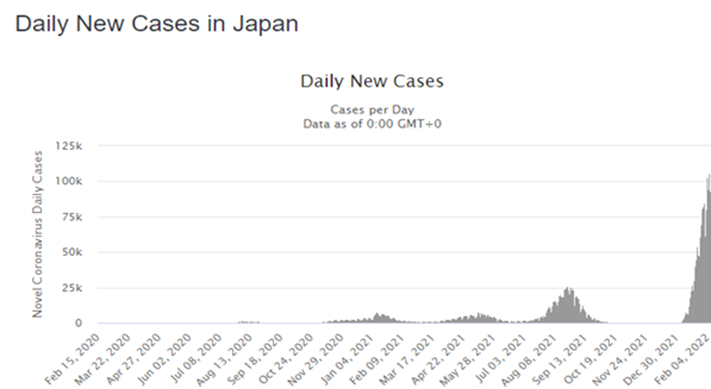

Japan's daily Covid-19 infections exceeded 60,000 in January, while total cases were above 4 million, the fourth record number since the outbreak of Covid-19. The rapid spread of the omicron variant has put great pressure on Japan's health care system, over 34% of hospital beds were being used by coronavirus patients.

On the other hand, Japan's trade deficit soars in January due to the lower overseas demand for cars caused by the spread of Omicron and the persistent rise in commodity prices. Export rose 9.6% YOY in January, well below the market forecast of 16.5%. While import increased 39.6% in January, missing the 37.1% market consensus. It brought the trade balance to a deficit of USD 18.99 billion.

Covid-19 daily new cases in Japan

China

The People's Bank of China had cut the rate in January for the first time in nearly 2 years. China's one-year loan prime rate was cut from 3.80% to 3.70% while the five-year loan prime rate was also lowered from 4.65% to 4.60%. It was said that the cut in rate aims to boost the economy as official data showed that China's GDP only grew by 8.1% in 2021, despite higher than the analyst expectation, it is the slowest in a year and a half. The rate cut, however, did not boost the China stock market, as the SSE Composite Index in Shanghai had dropped near 8% from 3639 to 3361 in January.

The plummet in the stock market did not stop global capital from flowing into Mainland. As Mainland Chinese stock funds saw net inflows of $16.6 billion in January, followed by near $11 billion in net inflows in December. The recent data had indicated the rising interest towards the Chinese market from global investors starting from the last quarter of 2021, as China is deemed as a safe play in 2022 due to the attractive valuation in its stock.

Performance of SSE Composite Index

Europe

The inflation in the 19-member region had sky-rocketed in January, reaching a record high since 1990. The surprised inflation data have turned the European Central Bank more hawkish. Although the central bank's benchmarking refinancing rate remains at 0% after the ECB's meeting early on, the analyst had raised the expectation in 2022 with two 25bp rate hikes in September and December followed by the hawkish pivot.

UK

Covid-19 pivot in the United Kingdom had signaled a new dawn in the fight against the disease. After reaching the record high of over 200,000 daily new cases of the Omicron variant, the data have consistently declined since then. In mid-January, the UK lifted all Covid-19 restrictions, such that wearing face masks will no longer be mandatory in public places. Followed by the above, the UK had further eased the travel restriction by removing coronavirus travel testing requirements for the vaccinated individuals. It is believed that the reopening in the UK will benefit the equities in the European market due to the re-acceleration in Economic activities.

Euro Area Inflation Rate in January