A Glimpse at Global Developed Markets in 2018

10th January, 2018

US economic backdrop remains solid, but equities need to survive earnings tests

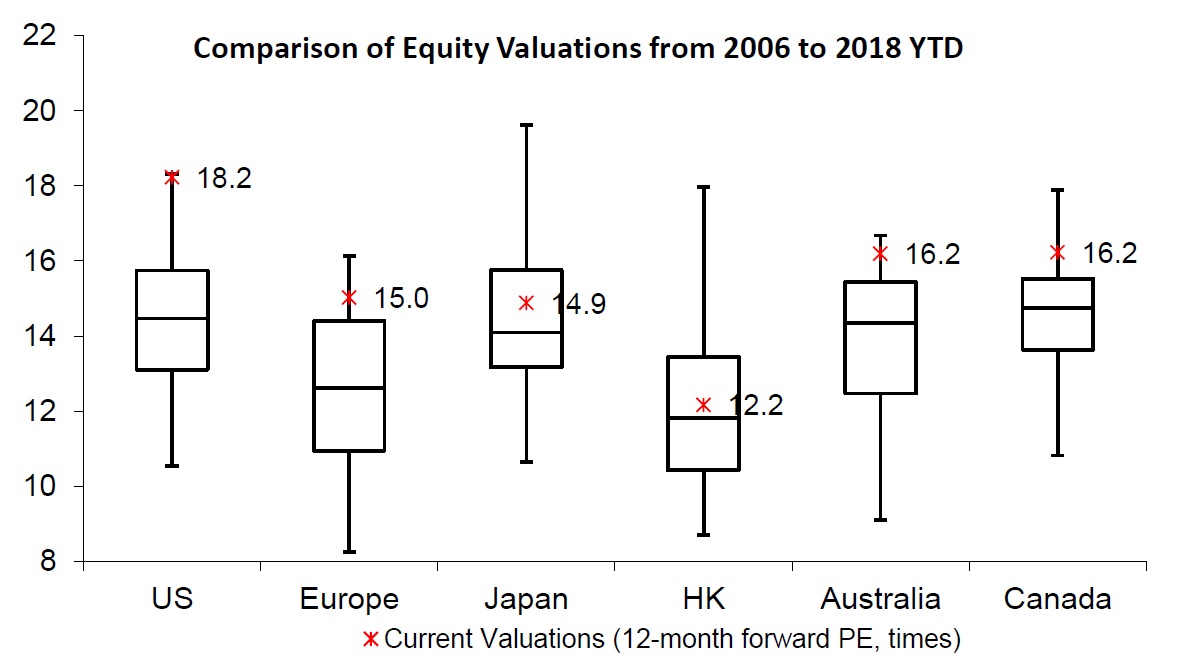

The US equity market has had an encouraging year, remarkable not only for its strong annual return of 21% achieved by the region’s broad-based benchmark S&P 500, but also for its consistency and extremely low volatility. The index delivered gains in 13 of the past 14 months, and the maximum drawdown for the index was only about 3% over 2017, far less than the historical average drawdown of 14% in a year. The impressive performance was largely driven by the fading of imminent political risks in major economies and a synchronized global recovery that support corporate earnings growth. Heading into 2018, we continue to see a rosy growth picture in the US. According to Schroders, the nation’s growth is forecast to speed up to 2.5% YoY as tax reforms kick in, which shall further boost sentiments for risky assets. However, current valuations of US equities are stretched compared to historical records and other markets, with the S&P 500 trading at a 12-month forward P/E ratio of 18.7x with a lofty projected earnings growth of 28.3%. Should the constituent companies fail to meet expectations, this “old” bull market could face increased volatility and greater pressure of correction.

Imminent political uncertainty shall not keep investors away from European equities

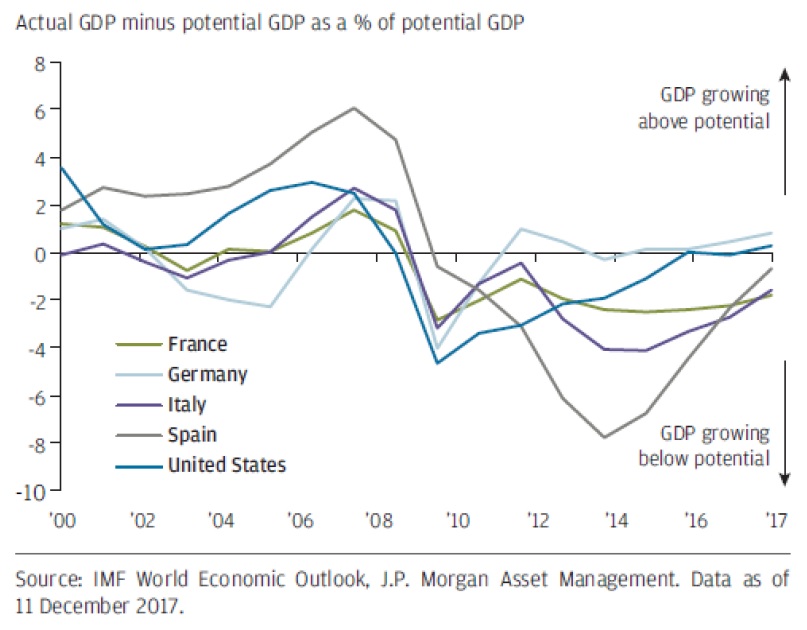

Despite a good year for the European economy and corporate earnings, European equities underperformed other regional markets in 2017 in local currency terms, highlighting the remarkable returns delivered elsewhere. The drag can largely be attributed to the strong rally of the euro as well as the uncertainty stemming from the region’s major political events such as the Catalonian Independence Referendum. This year there are still political hurdles ahead, namely Merkel’s attempt to form a coalition government in Germany and the Italian elections. While developments in the political arena shall have the potential to create more volatility, we do not expect such events to dominate markets in the way of those in 2017, and tend to believe that stakeholders or voters are more likely to be persuaded by the ongoing economic recovery and stick with the mainstream parties. Currently, the economic momentum in Europe remains robust, as indicated by strong PMIs and falling unemployment rates. Besides, there is still much room for the Eurozone economy, which double-dipped with the sovereign debt crisis in 2012, to catch up with the US in its economic cycle and revert to its pre-crisis level, particularly for countries like France, Italy and Spain. We therefore continue to maintain a constructive view on the region’s equities and favor an unhedged exposure to the market.

The prospect of Japanese equities shall be promising in 2018

The Japanese equity market was one of the best-performing regional markets in 2017, and we think it can maintain its strong momentum in 2018 thanks to the sustained global synchronous growth and its highly pro-cyclical nature. The Japanese equity benchmark (Topix) is essentially made up of cyclical stocks, with 67.5% in total in industrials (23%), discretionary consumption (19.5%), technology (12.5%) and financials (12.5%). Under the confluence of pickup in both global and domestic economic growth, ongoing corporate efforts to improve margins and a weak yen caused by BoJ’s relatively easy monetary policies, we expect a favorable trend in the earnings of Japanese equities this year. Besides, the region’s equity market is attractive in terms of valuations. Its current forward PE ratio of 15x is about 10% below the PEs of global equity markets (MSCI World), which is inexpensive when compared to its counterparts among developed markets. Considering the above factors, we therefore maintain an optimistic view on Japanese equities for 2018.