Monthly Market Outlook – Mar 2022

22nd April, 2022

U.S.

The University of Michigan Consumer Sentiment Index (MCSI) ended March 2022 at 59.4, down by 0.5% from the previous decade-long low of 59.7 recorded in the first half of March. Consumer confidence deteriorated representatively, and the main driver was rising worries about inflation. However, the U.S. labour market remains strong. The February jobs report was much better than expected, with total nonfarm payrolls easily beating consensus estimates. The unemployment rate fell to 3.8%, despite the labour force participation rate moving up modestly to 62.4% and the wages rose 5.1% year-on-year.

The Fed continues to get more hawkish. Its position has moved from hiking every meeting for the rest of the year to possibly moving in 50-basis-point at some of them. This highlights the U.S. inflation challenge and focuses on the Fed on how to bring it down. In almost two decades, this potentially most aggressive rate hike path has triggered worries that the U.S. economy could fall toward weaker growth or into a recession.

Congress passed a $1.5 trillion spending bill to fund the federal government for the remainder of fiscal 2022. Combined with the $2.5 trillion increase in the debt ceiling passed last December, the U.S. government eliminates the imminent risk of a fiscal crisis.

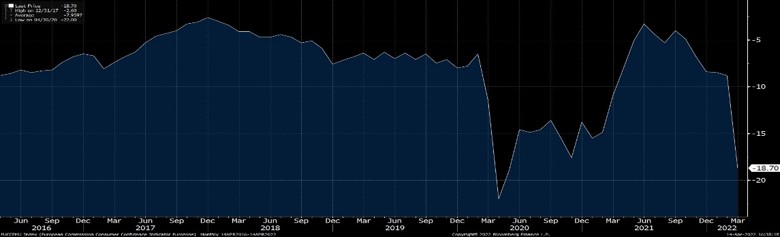

The University of Michigan Consumer Sentiment Index

Japan

The Russian-Ukrainian conflict, U.S. entry into the rate hike cycle, and the consequent surge in crude oil and other commodity prices had affected Japanese stocks, was leading the Nikkei 225 index to hit a new 52-week low on March 9 at 24,681.74. Then rebounded continuously starting from mid-march, as Russia and Ukraine launched multiple peace talks rounds, crude oil prices fell back to pre-conflict levels and ended at 27,821.43.

The number of COVID-19 confirmed cases in Japan has gradually declined since its peak in early February. The Japanese Government further eased restrictions. It eased the number of people in gatherings and the maximum number of people entering the country in a single day. Japan's manufacturing PMI fell only slightly in February. The service PMI rebounded, and the CPI rose to a nearly three-year high.

Japan introduced some gasoline subsidies that should help to support household consumption through the energy price shock. In addition to facing supply constraints caused by the virus, the manufacturing sector also faced factory closures due to the 7.3 magnitude earthquake in Fukushima.

Nikkei 225 Index

China

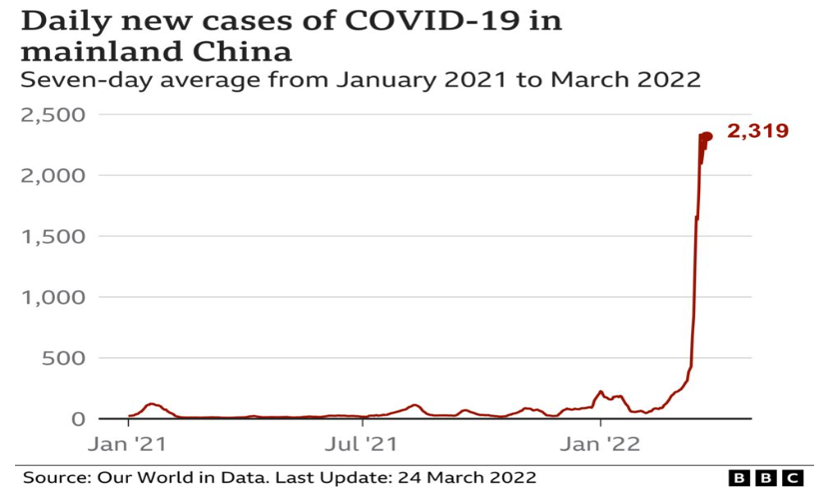

SSE Composite Index and SZSE composite index dropped 6% and 10% in March due to the rebounded number of COVID-19 cases to the highest level in China in over two years during March despite the Chinese government pursuing one of the world’s strictest virus elimination policies. Shanghai, China’s financial capital with 25 million people, went into a partial lockdown in March to contain a surge in COVID-19 cases. The latest wave of COVID-19 outbreaks prompted fears that other parts of the country could also go into lockdown.

The State Council’s Financial Stability and Development Committee held a conference on March 16 to address these issues. It pledged to provide more economic support to offset the economic damage from the COVID-19 pandemic. On the regulations side, the committee said, would make it more predictable, transparent and better coordinated. They are also working with U.S. regulators on solving to meet U.S. financial disclosure requirements. While this effectively sets the floor for investor confidence and market performance, it remains to be seen how actual action will deliver on these promises.

The Ministry of Finance has announced a small business income tax reduction from 25% to 20% for 2022-2024. And further reductions in government fees and taxes are expected.

Daily new cases of Covid-19 in mainland China

Europe

Europe is a massive importer of oil, natural gas and wheat from Russia, making the region highly vulnerable to the Russia-Ukraine war. The region could be at risk of economic deceleration due to a prolonged period of high energy prices and food prices. However, the high excess savings accumulated during lockdowns, healthy labour market and fiscal stimulus could mitigate the situation.

Consumer confidence fell sharply in March due to a rise in prices. However, the labour market is still improving, and wages are rising similar with the U.S. European institutions are discussing launching an energy and defence fund and issuing a new European bond, which could be crucial to buffer against sharply rising energy costs. Individual countries such as France, Italy and Germany are also approving measures to absorb some of the higher energy bills for all households.

Given Europe's dependence on Russia for oil, gas, industrial metals and food, there will be greater emphasis on food and energy security. Europe needs to diversify its energy sources, such as the U.S. and the Middle East. At the same time, investment in renewable energy needs to be accelerated. Some of the Europe countries can turn into nuclear power while others have to build more wind, solar and hydropower generation capacity. Every Europe country will need more power storage and transmission capacity to cover the energy loss of direct pipeline from Russia.

European Union Consumer Confidence Indicator