Monthly Market Outlook – Apr 2022

23rd May, 2022

U.S.

With the U.S. headline inflation increased to the highest level since 1981 at 8.5 %, the Fed highlighted that they wanted to take the rate back to neutral as soon as possible. The markets have now priced 50 bps for the Fed's next three meetings, and Fed Chairman Jerome Powell hinted that the path was entirely feasible during a discussion at the IMF. The bond market reacted sharply to Powell's more hawkish tone. In April, the U.S. 2-year and 10-year Treasury yields rose 38 bps and 59 bps, respectively, with most global government bond yields rising in tandem. The rising U.S. yields continue to support the U.S. dollar, and the U.S. Dollar index is now up 7.6% year to date.

The major indexes in the U.S. endured four consecutive weeks of losses in April, as the hawkish Fed and some disappointing earnings results and forecasts from the giants compounded growth fears. The S&P 500 moved into correction territory, down roughly 13% year to date. Meanwhile, the technology-heavy NASDAQ fell further into the bear market, down approximately 21%.

U.S. Consumer Price Index

Japan

The BoJ maintained a dovish stance at its April monetary policy meeting, keeping interest rates near zero and maintaining the scale of its asset purchase. The central bank strengthened its easing view by announcing that it would conduct fixed-rate bond purchases on a daily basis rather than on an ad-hoc basis. That put downward pressure on the 10-year Japanese government bond yield, which fell back to 0.22%. The BoJ’s decision signalled that it continued divergence from the monetary policy tightening pursued by other major central banks and sent the yen to fall sharply. The yen is down 11.3% against the USD this year, near a two decades low.

The yen's sharp depreciation is favourable to the high-tech sectors such as semiconductors, electronic components, precision machinery, and automobiles, which account for a large proportion of exports. On the flip side, high oil prices bring a trade deficit, deterioration in trade and imported inflation, which will harm the economy. Considering the long-term deflation in Japan and the repeated COVID-19 pandemic have exacerbated the sluggish domestic demand. Japanese companies are generally cautious about raising prices, making those companies face ordeals to pass on the increased cost to consumers, leading to more significant business operations difficulties.

USDJPY Exchange Rate

China

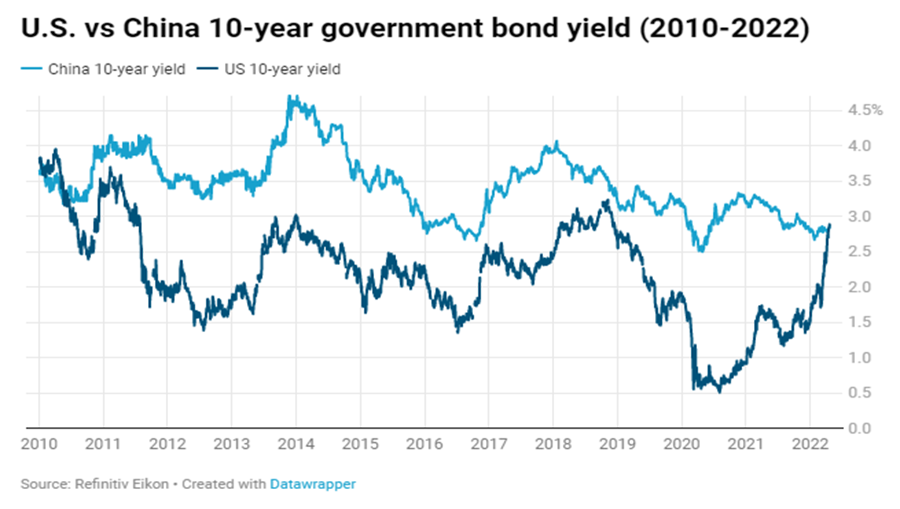

Chinese authorities have been keeping COVID-19 under tight control for the past two years, and they are now struggling to contain a major outbreak. Shanghai – the financial capital of China, had spent the whole of April in full lockdown. And market sentiment weakened further toward the end of the month when reports emerged of new containment measures being implemented in the Capital – Beijing. Although the Communist Party’s Politburo pledged to boost economic stimulus to meet the growth targets and support the “healthy development” of the technology sector, China’s 5.5% growth target looks challenging to achieve when the government still prioritises the zero COVID-19 policy. Lead to the stock markets came under further pressure, with MSCI China Index downed by 4.1% in April, while the U.S 10-year Treasury yields had passed the China 10-year yields for the first time since 2010. The RMB also fell around 4.1% against the USD in April, the largest monthly drop on record, as foreign investors sold Chinese assets favouring U.S. markets.

U.S. vs China 10-year government bond yield (2010-2022)

Europe

There was no sign of any resolution to the Russia-Ukraine war as the fighting intensified in the Donbas region. The significant impact on energy markets remains particularly notable given the difficulties faced by Europe’s energy independence from Russia. Natural gas prices had slightly cooled down in April but still climbed 94% year to date. And the oil prices has paused to rise due to both release of strategic reserve and lower demand expectation from China.

The Euro area economy grew 0.2% sequentially in the first quarter as the rising commodity prices and the disruption from the Russia-Ukraine war weighed on the pace of growth. This is less than the preliminary estimate of 0.3% from the European Commission forecasted before the war. Eurozone inflation accelerated to 7.5% in April, the highest level since the Euro was launched.

Natural Gas YTD Price Return