Monthly Market Outlook – Jul 2022

25th August, 2022

U.S.

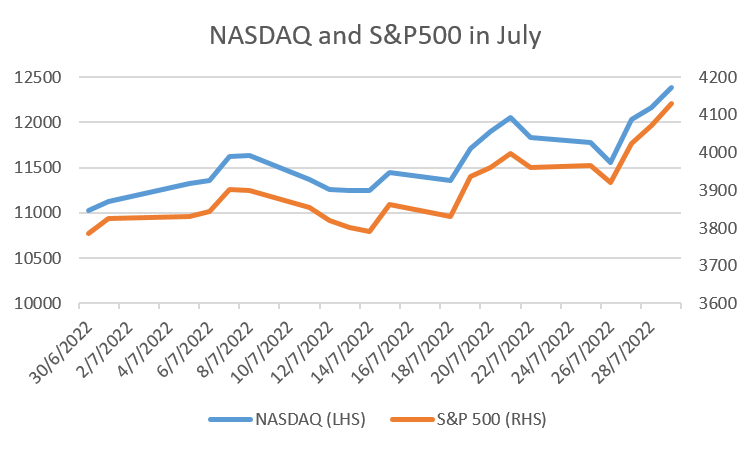

The US stock market rebounded in July, with all 3 major indexes experiencing a 5.62%-11.35% monthly growth. This is majorly driven by better than expected quarterly results reported by large companies in the US such as Apple, Tesla, Bank of America, Netflix.

The CPI in the US accelerated to 9.1% in June compared with 8.6% in May, showing the continuous increase in inflation and consumer prices. In response to the soaring inflation rate, the Fed raised interest rates by 75 bps which is in line with market estimates. Chairman Jerome Powell also announced that it would be likely for the Fed to slow down the pace of increases as they assess the effects of their cumulative policy adjustments on economy and inflation. Despite the Michigan consumer sentiment index increasing from 50 in June to 51.5 in July, consumer sentiment is likely to remain low with retailer Walmart downgrading its profit outlook.

NASDAQ and S&P500 index in July

Japan

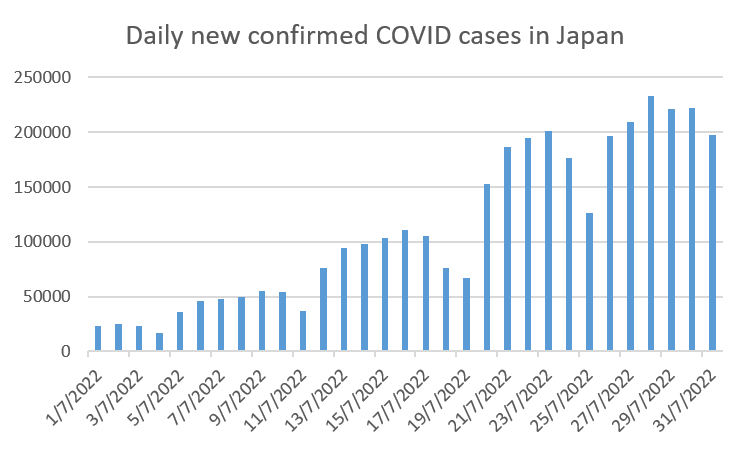

The core CPI in Japan was 2.2% in June, coming in above the central bank’s 2% target for the third consecutive month. On the other hand, due to the depreciating yen and increase in commodity prices, Japan’s trade deficit for the first half of the year was 7.9 trillion, setting record highs since 1979.

The Bank of Japan’s pressure to change its monetary policy decreased with the Liberal Democratic Party winning the Senate elections in July. Subsequently, during its meeting, the Bank of Japan continued its ultra-loose monetary policy by maintaining its 10 year Treasury bond yield at 0% by unlimited daily purchases. The pandemic situation in Japan remains serious, with around 200,000 new COVID cases per day, reaching record highs. Based on the pandemic situation and other macroeconomic factors such as war and energy prices, BoJ also revised inflation expectations from 1.9% to 2.3% and reduced its economic growth expectations from 2.9% to 2.4%.

Daily new confirmed COVID cases in Japan

China

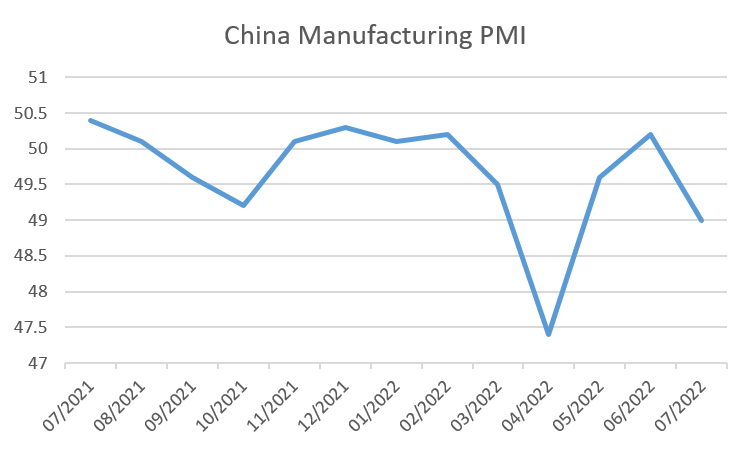

After the effects of the 33 point stimulus program initiated by the Chinese government wears off and the COVID rebound in China, the PMI in July contracted, falling to 49 from 50.2 in June. This also reflects the uncertainties around slowing global demand and property market risk, leading to a decrease in production levels. Yet, compared to April lows, we can see that there is an improvement and a recovery of the Chinese economy.

China’s GDP growth decreased to 0.4% year-over-year in the second quarter, marking the worst result since 2020. Among all cities, Shanghai has the sharpest decline with a 13.7% GDP decrease compared to the first quarter due to the COVID-19 lockdown which halted production and economic growth. With cases rebounding, cities are still under partial lockdowns with mass test carried out all over the country. Hence, with China’s zero-COVID policy intact, it may act as an obstacle for China to achieve its 5.5% annual GDP growth.

China Manufacturing PMI

Europe

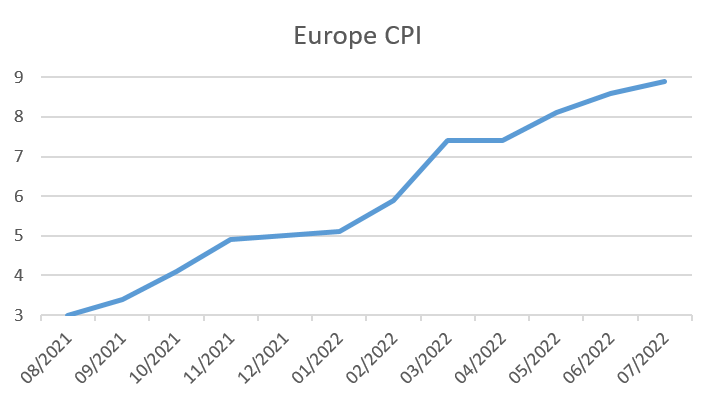

Largely contributed by rising energy and food prices, the Eurozone CPI rose further from 8.1% to 8.6% in June, reaching record highs. In order to curb inflation and support its bond buy-back plan, the European Central Bank raised interest rate by 50 basis points in July. This marks the first increase in interest rates in 11 years and brings the central bank’s deposit rate from - 0.5% to 0. With inflation, rising interest rates and further reduction of oil and natural gas flow from Russia, it is likely for some Eurozone areas, especially Germany and Italy to tip into recession.

The weakening Euro has fell to its lowest point since 2002 and had traded at parity with the USD in July. In addition, the S&P Global Eurozone Manufacturing PMI dropped from 52.1 in June to 49.6 in July with factory activity suffering the largest decrease since May 2020. New order for goods decrease with firms expecting to cut output in the coming year, painting a bleak economic outlook for the Eurozone area.

Europe CPI