Monthly Market Outlook – Sep 2022

24th October, 2022

U.S.

Although gasoline prices fell in August, August’s CPI still rose higher than the market expectations, driven by a sharp increase in rent, food prices and health care services. In particular, the core CPI rose by 0.6% MoM, an increase of 0.3% from July, indicating that the current round of inflation in the US is very sticky. Rate hike expectations rose further after the CPI data was released. As expected, the FED raised rates by 75bps to 3%-3.25% at the September meeting. Additionally, the FED significantly increased the year-end interest rate forecast to 4.4%, which exceeded the market expectations and led to a deepening of the yield curve inversion.

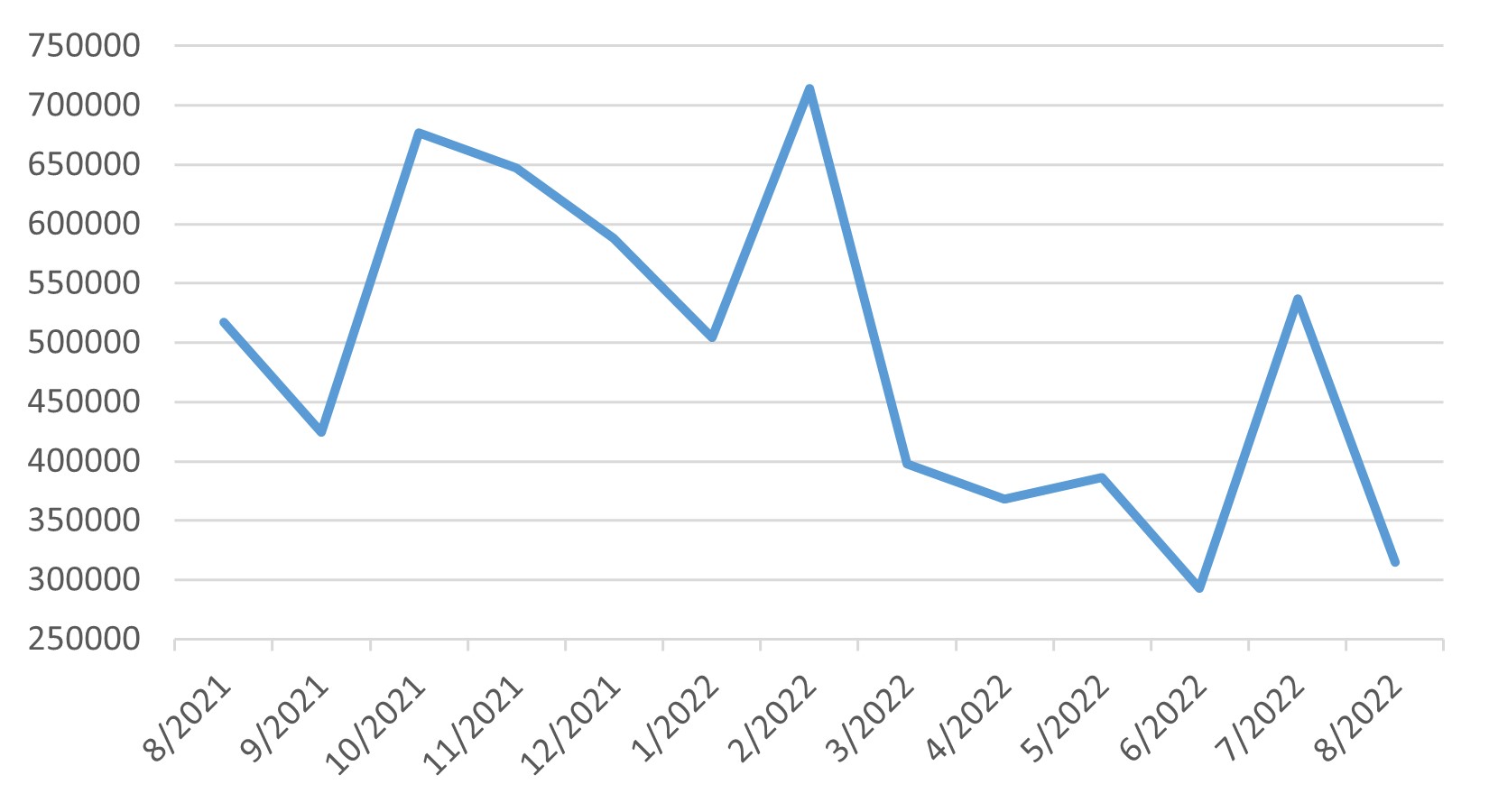

On the employment side, Non-Farm Payrolls increased by 315,000 in August, slightly exceeding the consensus of 300,000. And the unemployment rate rose to 3.7% from 3.5% in July due to an increased labour force participation. The labour market is at an inflection point from tight to loose as the macro economy weakens, and employment data is expected to soften in the coming months.

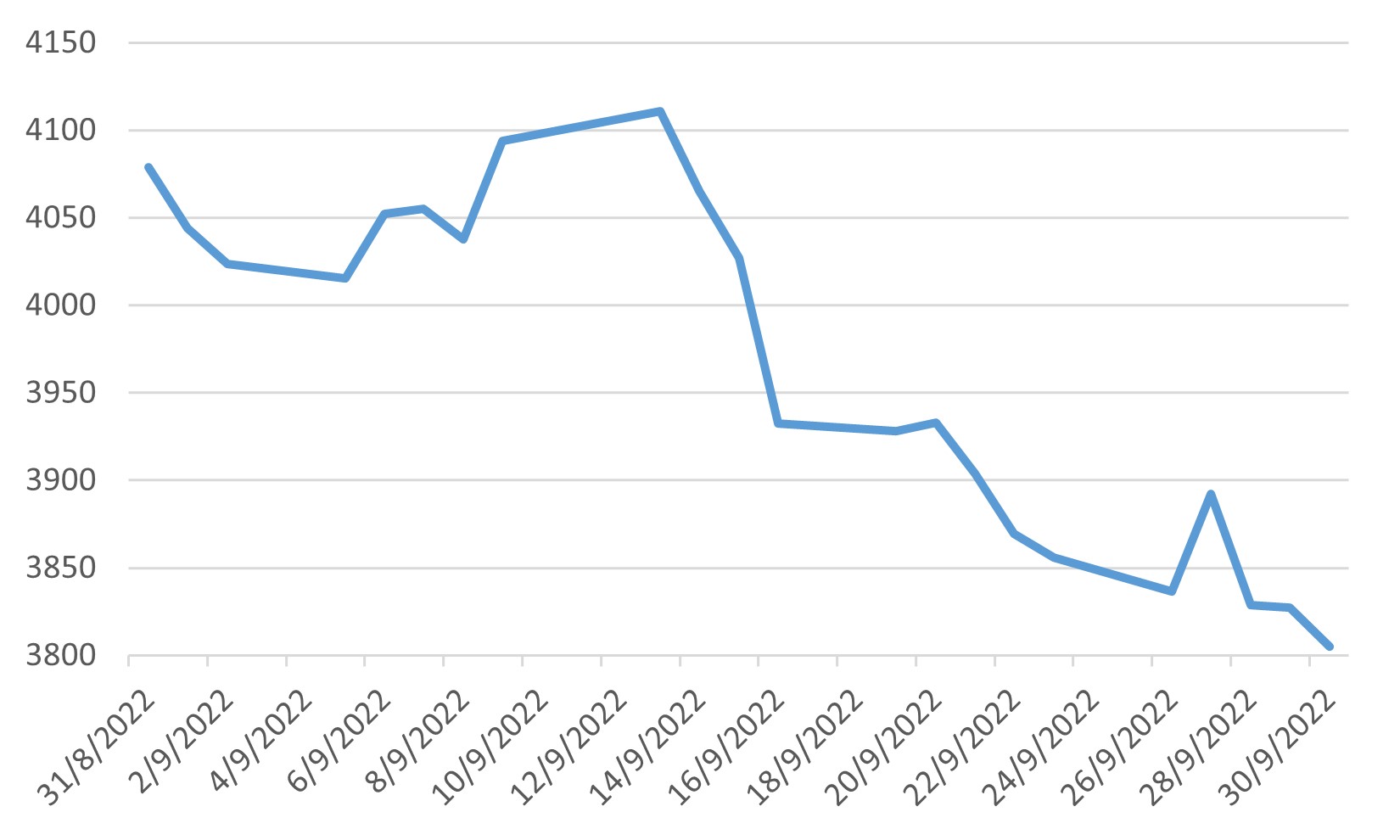

And the rate forecast and the fear of recession further harmed the market. S&P500, NASDAQ and Dow Jones plunged 9.34%, 10.5% and 8.84% respectively in September.

US Non-Farm Payroll

JapanAfter a rose in July and August, the Japanese stock market followed the global equity markets to drop in September to end the month down 7.67%. The yen continuously weakened against the US dollar, easily breaking the 140 level for the first time since 1998 and closing the month at 144.74 to US dollar.

The BoJ kept its Policy unchanged, and the interest rate gap with the US widened significantly after the successive decisions by the FED to raise rates. This differential has been a significant factor in the consistent weakening of the yen so far in 2022. In mid-September, Japan's Ministry of Finance intervened directly in the currency market when the yen depreciated rapidly, toward 146 against the US dollar. It was the first such direct intervention by Japan government to support the yen since 1998.

The inflation in Japan continued to increase, with the headline inflation reaching 3% while the core inflation was reaching 1.6%. Meanwhile, the Q2 preliminary GDP showed an annualized growth rate of a 2.2% expansion, which was below the market forecast of 2.5% and picked up sharply from an upwardly revised 0.2% rose in Q1. The detailed breakdown was more positive, with some resilience in capital expenditure and consumption.

USD to JPY exchange rate

China

The rapid spread of coronavirus across China again in end-September raised concerns about the further lockdown and dampened market sentiment. Meanwhile, foreign investors risked off from Chinese stocks and bonds in response to the weakening outlook made worse by China’s zero-Covid policy. The CSI 300 Index, Shanghai Composite and Shenzhen Composite dropped 6.72%, 5.55% and 8.78% respectively, all of which went back to the lowest level since April 2022. Investors sold USD1.4 billion and 700 million of Chinese bonds and stocks respectively.

According to data from the National Bureau of Statistics of China, the recovery of consumption accelerated in August, and the growth rate of manufacturing, infrastructure investment and industrial production continued to pick up, but real estate investment remained at a relatively weak level. The consistent weakness in the real estate market led investors to increase concerns about the recovery speed of China’s economy. Meanwhile, the market is waiting to see if any economy-supporting policy will be released after the 20th National congress of the Chinese Communist party.

CSI 300 Index

UK

UK foreign secretary Liz Truss won a ruling Conservative Party ballot to become the UK’s new prime minister. And the new prime minister unveiled the most aggressive tax cut for citizens and businesses in nearly 50 years on 23rd September. However, the market was worried about the deterioration of the UK’s finance. The investors sold the sterling, British government bonds and stocks sharply. The sterling crashed below $1.10 against the US dollar on the same day and plunged to the lowest level since 1985. Meanwhile, investors dumped UK government bonds as well, the yield on the benchmark 10-year UK government bond moved opposite prices and leapt by a quarter percentage point within one hour. The FTSE100 index also crashed 1.77% the following day, hit its lowest level since March and dropped 5.36% in September.

GBP to USD exchange rate