Monthly Market Outlook – Oct 2022

24th November, 2022

U.S.

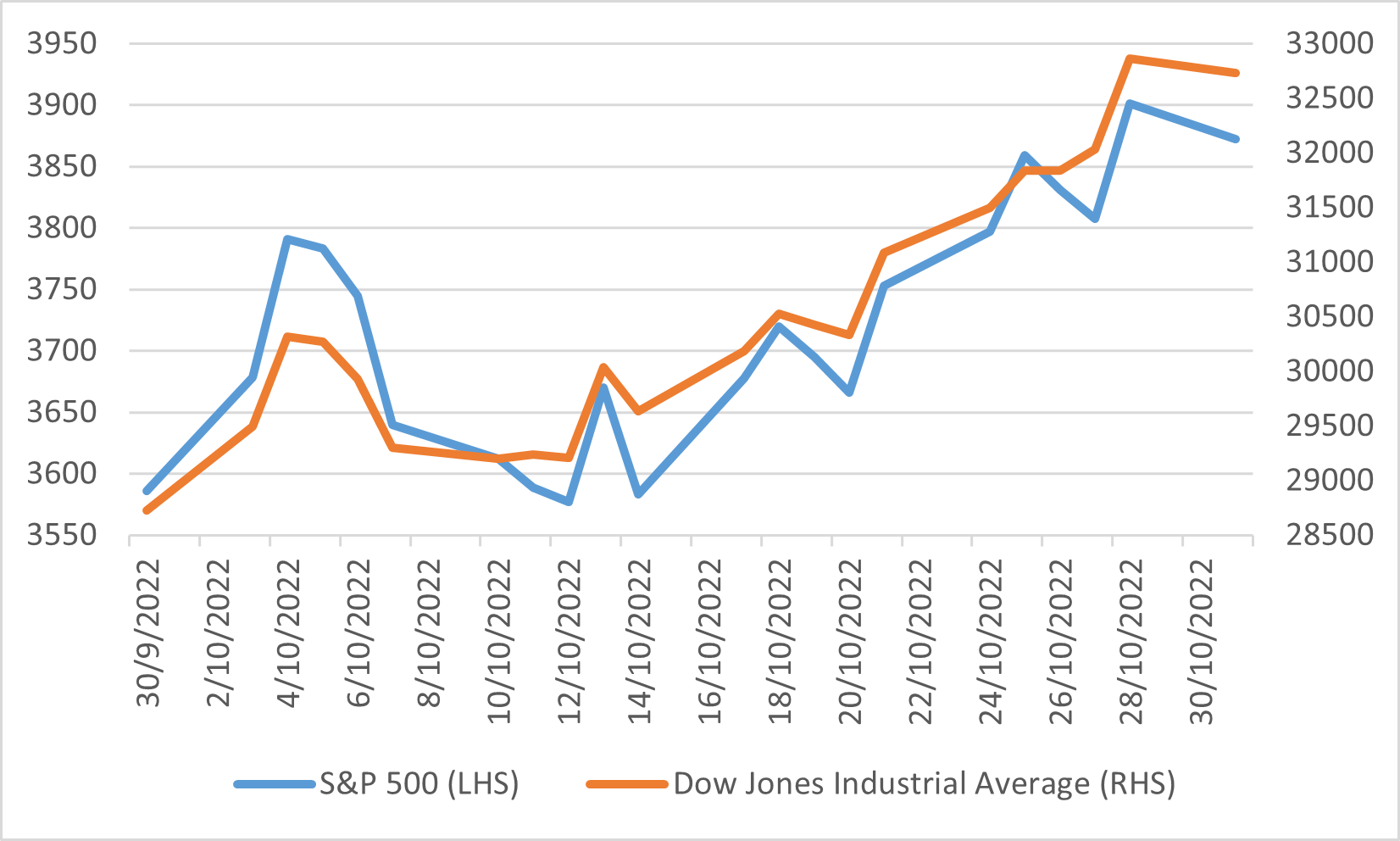

The market rallied in October after plunging to the new year-to-date low at the end of September. The US market ended the month higher, with S&P 500, NASDAQ and Dow Jones up 7.99%, 3.9% and 13.95% respectively. The rise came despite the Fed confirmed that tighter monetary policy is still needed to contain elevated inflation. Economic data was also mixed. The inflation rate in the US slowed for the third month to 8.2% in September, compared to 8.3% in August but still above the consensus of 8.1%. However, the core inflation rate accelerated to 6.6% in September. The highest level since 1982, from 6.3% in the previous month and above market forecasts of 6.5%. Industrial data looks to weaken further at the start of Q4, with the preliminary manufacturing PMI falling from 52 to 49.9 in October. Usually, a reading below 50 denotes economic contraction.

Minutes of the September Fed meeting were released in mid-October and indicated that the central bank officials agreed that the hawkish policy is to remain the priority for as long as inflation remains unacceptably high. And the market is waiting to see if the democratic party will lose its majority in the mid-term elections, which will be held on 8-Nov.

S&P 500 index and Dow Jones Industrial Average Index

Japan

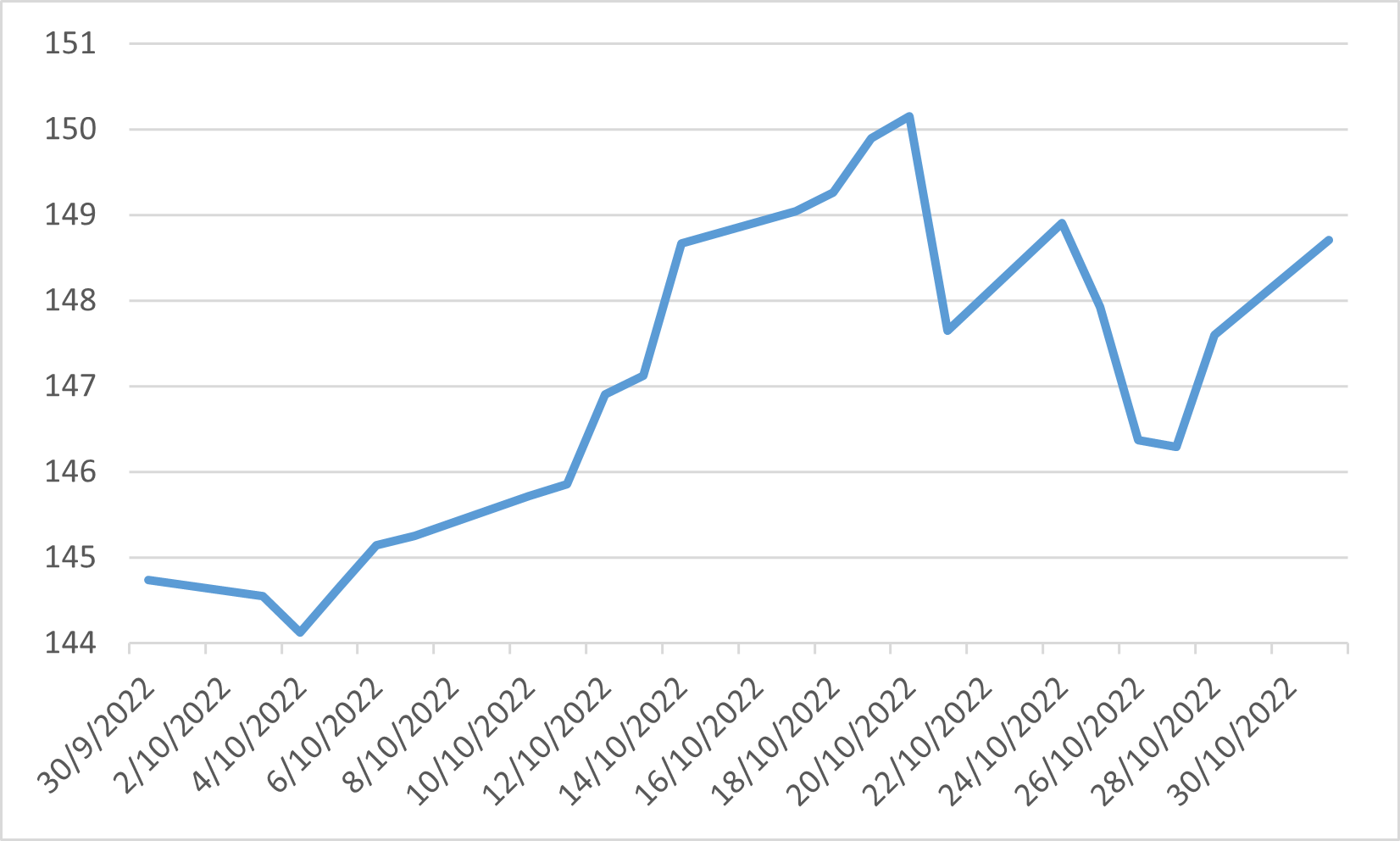

The Nikkei 225 index slightly recovered in October, ending with a 6.36% gain. Japan's trade deficit surged to JPY 2.09 trillion in September compared to the year before 637 billion, but still better than the consensus of 2.17 trillion. This was the 14th straight month of the trade deficit, the longest stretch since 2015.

Global inflation pushed the demand for imported US dollar settlement, which drove companies to sell more yen to buy the dollar and further promoted the yen's depreciation. The yen continuously weakened against the US dollar, breaking the 150 level for the first time since 1990 in mid-October and closing the month at 148.71 to the US dollar.

Meanwhile, the inflation rate in Japan remained at a high level, with headline inflation of 3% in September and remained unchanged from August, while the core inflation reached 1.8%, compared to 1.6% in August. Although these numbers were approaching the BoJ's target levels, Governor Haruhiko Kuroda remained pessimistic about the sustainability of inflation in 2023. Therefore, BoJ maintained its dovish policy at the October meeting.

USD to JPY exchange rate

China

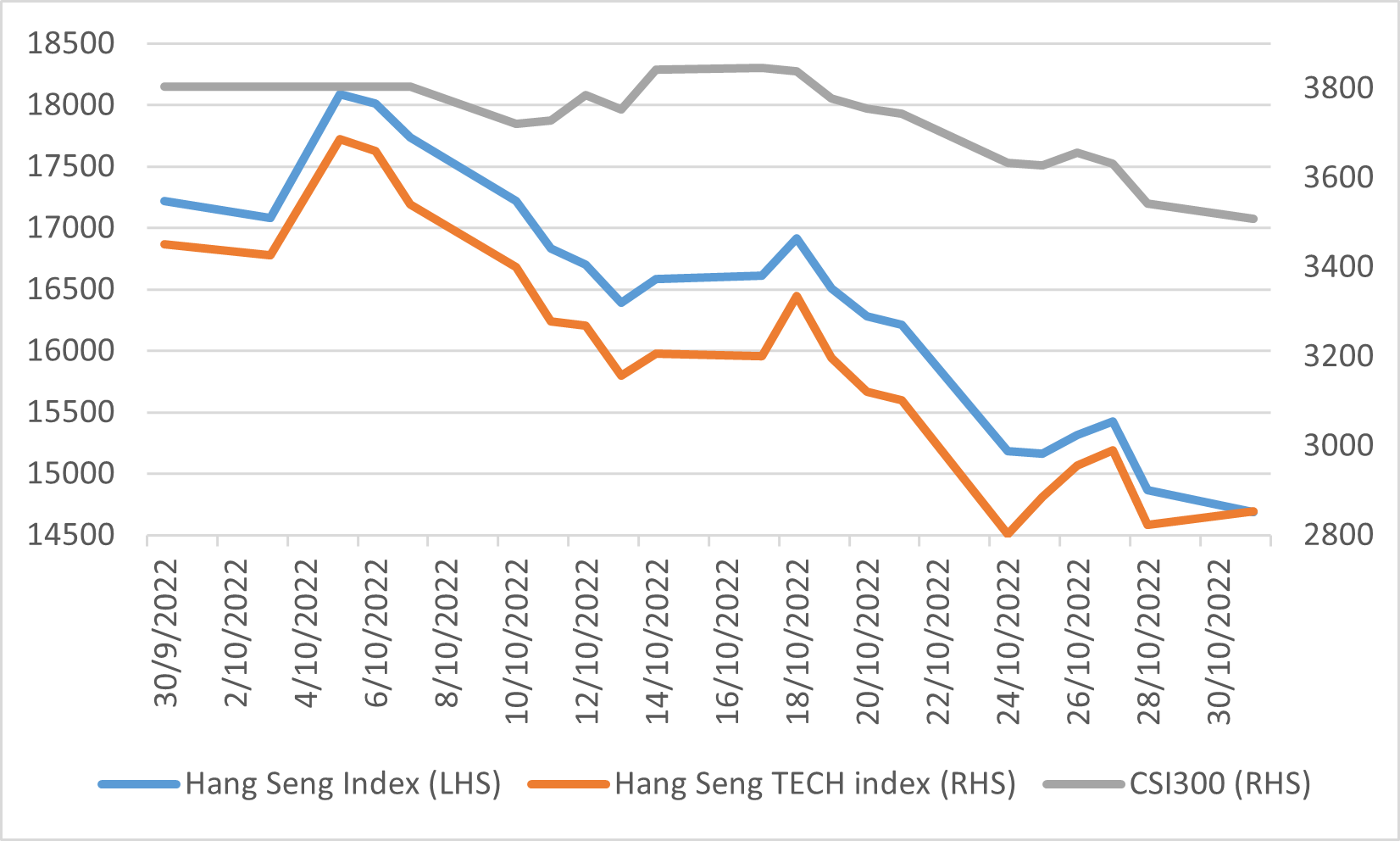

China and Hong Kong markets were driven lower by sharp sell-offs in October. CSI 300 index, Hang Seng index and Hang Seng TECH index plunged 7.78%, 14.72% and 17.32% respectively. This was followed by the 20th National Congress of the Chinese Communist Party confirming that Chinese Premier Xi Jinping would remain as leader for the third five-year term and the new politburo, now consists of loyalists to President Xi. The markets were concerned that President Xi may continue to pursue policies that focused on reducing China’s exposure to foreign interests and influence at the expense of economic growth and that it was unlikely that anyone would challenge President Xi’s decisions, which could negatively impact the economy and private companies. And national congress has not released any signs that the zero-Covid policy will be eased in the near future. Meanwhile, the US government’s new restrictions on China‘s access to US semiconductor technology also dampened market sentiment.

Hang Seng Index, Hang Seng TECH index and CSI 300 Index

UK

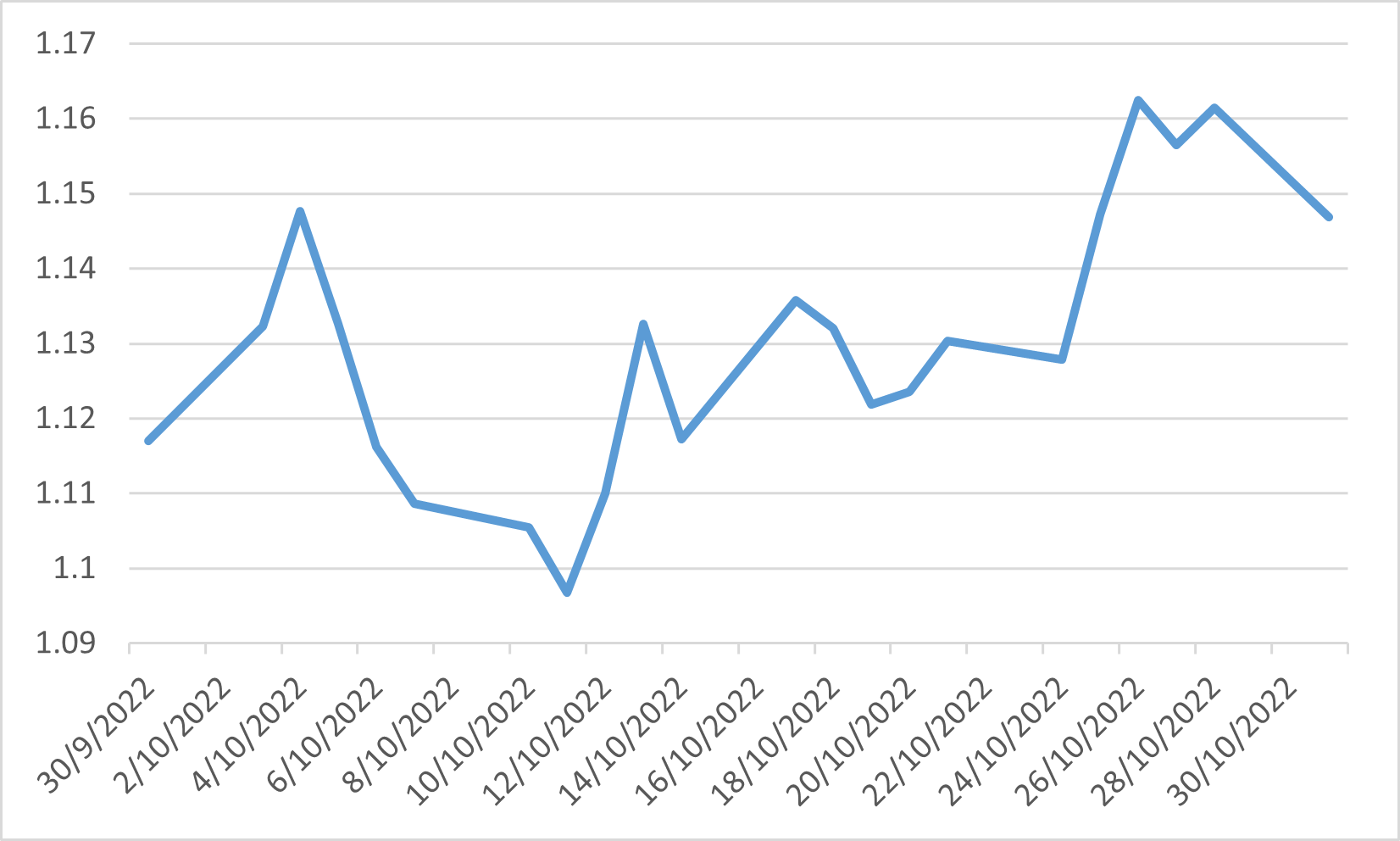

After just 44 days as prime minister, Liz Truss announced her resignation on 20 Oct and became the shortest-serving prime minister in British history. Former finance minister Rishi Sunak became the first British Indian to assume the role and the third leader in seven weeks of the UK being roiled by political and economic chaos. The financial markets appeared to be welcomed Rishi Sunak becoming the new prime minister. The pound was rallied back to 1.16, its highest level since before Liz Truss’s mini-budget after the chairman of the 1922 committee said that Rishi Sunak was the only valid candidate for the top job. FTSE 100 index also rallied back around 4% from its year-to-date lowest point in mid-October.

GBP to USD exchange rate