Monthly Market Outlook – Nov 2022

23rd December, 2022

U.S.

The Fed meeting in November released a signal that would consider slowing down the hiking pace. At the same time, Fed emphasized that it does not represent a policy shift and the terminal rate will also be higher than previously expected. This implies that the Fed is using excessive tightening to control inflation as soon as possible. It led to the possibility of a soft landing of the economy getting lower and lower.

Economic data continued to point to US economic outlook remaining soft. PMI remained in contraction territory of 46.4 and continued to point to a fifth straight month of falling services activity. Non-Farm Payrolls showed that 263k jobs were added in November. That was higher than the consensus but lower than October's data, which marked the lowest level since April 2021. And CPI slowed for the fourth straight month to 7.7% in October, with the core components of food and energy advancing at a slower pace and pulling back from the multi-decade high.

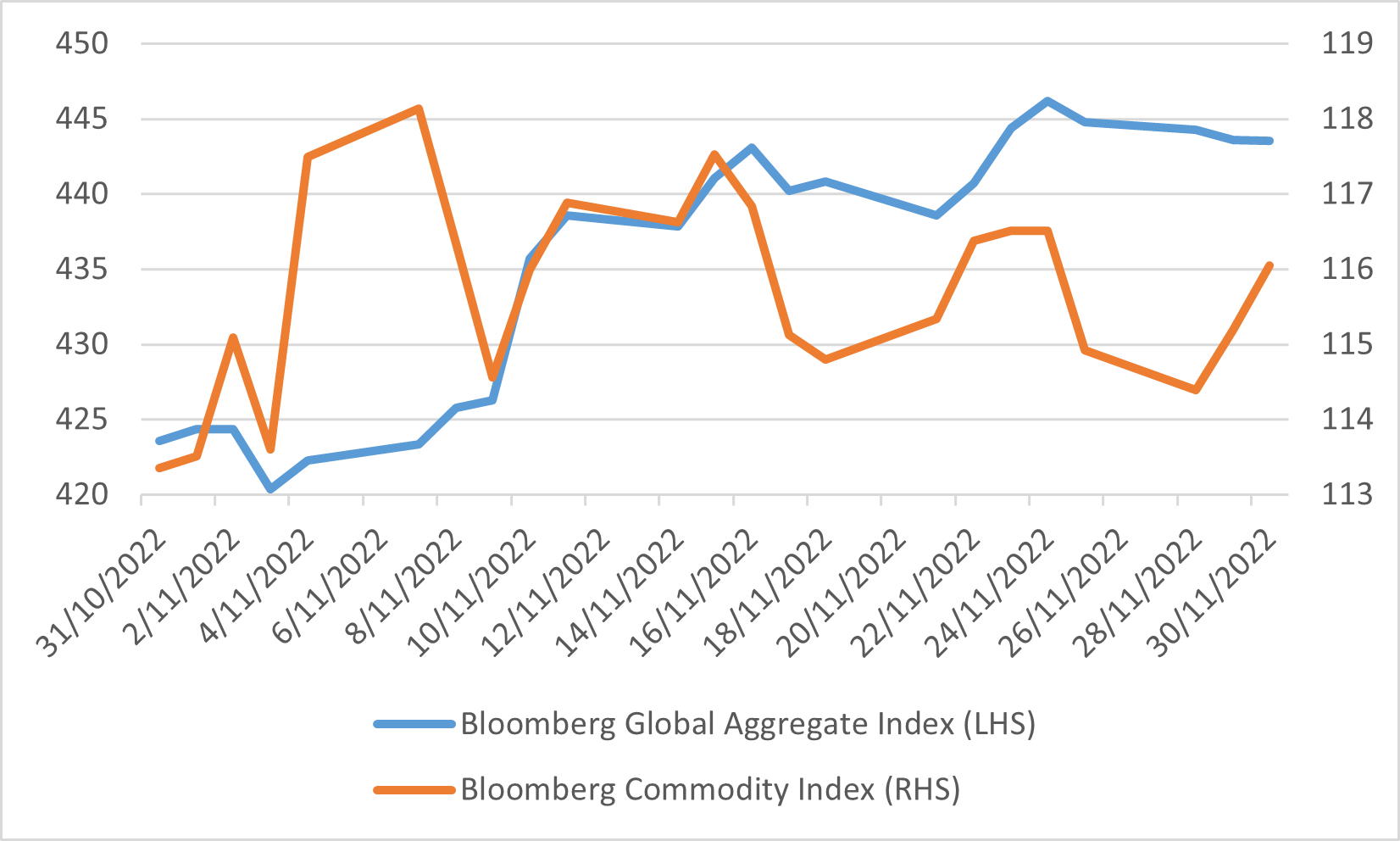

Those economic data once again ignited the market's expectations for a softening of the Fed's tightening attitude and a soft landing for the economy. Various assets rose sharply in November. The three major U.S. stock indexes - Nasdaq, S&P 500 and Dow Jones Industrial Average rallied by 4.51%, 5.59% and 6.04%, respectively; The indexes which represent fixed income and commodity - Bloomberg Global Aggregate Index and Bloomberg Commodity Index surged by 4.71% and 2.38%, respectively in November.

Bloomberg Global Aggregate Index and Bloomberg Commodity Index

Japan

Japanese stock market continued to gain in November, Tokyo Stock Price Index and MSCI Japan ending with a rose of 2.91% and 2.93%, respectively. Meanwhile, the U.S. inflation data and the attitude change signal released by Fed has led to a reversal of the sharp weakening of the yen which has been seen throughout over the year. The USDJPY exchange rate closed at 138.07 in November, a 9.05% strengthening of JPY compared to the lowest level seen in mid-October.

Japan’s economy experienced negative growth in the third quarter with the GDP fell by 1.2%, mainly due to negative growth in net exports. Companies were unable to pass the costs to exports in the context of a slowdown in foreign economies. Weakness in domestic consumption also brought a negative impact, as Covid-19 spread again in Japan, severely affecting the growth of service consumption and the sales of consumer durables.

Meanwhile, Japan’s inflation rate continued to pick up, with the data released in November was showed the headline inflation climbed to 3.7%, while the core inflation surged to 3.6%. Both headline and core inflation had exceeded the market forecast of 3% and at the fastest pace in 40 years. However, the market expected the BoJ would not follow the global trend of raising interest rates as BoJ sees this year’s acceleration in inflation because of the cost-push episode that will be faded as import costs stop pushing.

Tokyo Stock Price Index and MSCI Japan Index

China

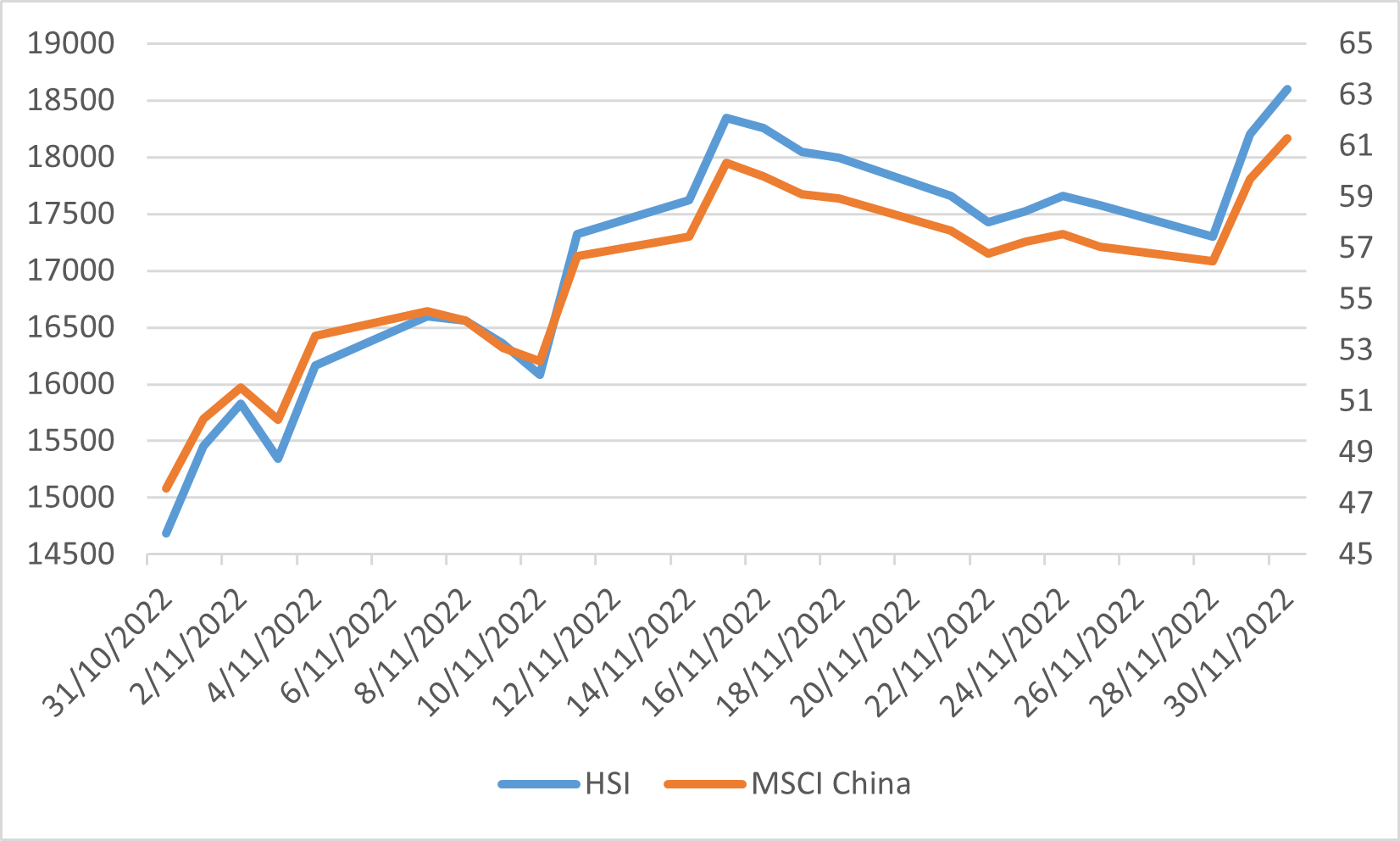

China and Hong Kong markets recovered strongly from October’s dip, with the CSI 300, Hang Seng, and MSCI China Indexes surged robustly by 9.81%, 26.62% and 28.86%, respectively. The rally came after the meeting between the U.S. and China leaders signalled to improve U.S.-China relations at the G20 in Indonesia. China also boosted market sentiment by announcing twenty measures to relax Covid restrictions and new support measures for the real estate sector.

However, Economic data in China was surprising mostly to the downside. The composite PMI remained at the contraction territory of 47, shrinking for the sixth month in a row. Mainly due to the rebound of the Covid-19 cases, affected the recovery of consumption, and real estate investment remained weak. Meanwhile, although the inflation rate in October dropped to 2.1% from 2.8% and was better than the consensus, food prices remained high. At the end-November, the PBOC announced that it cut its bank reserve requirement ratio by 0.25 percentage points on December 5. This is aimed at releasing the liquidity to stabilise the bond market as the recent increased volatility in yields.

Hang Seng Index and MSCI China Index

Europe

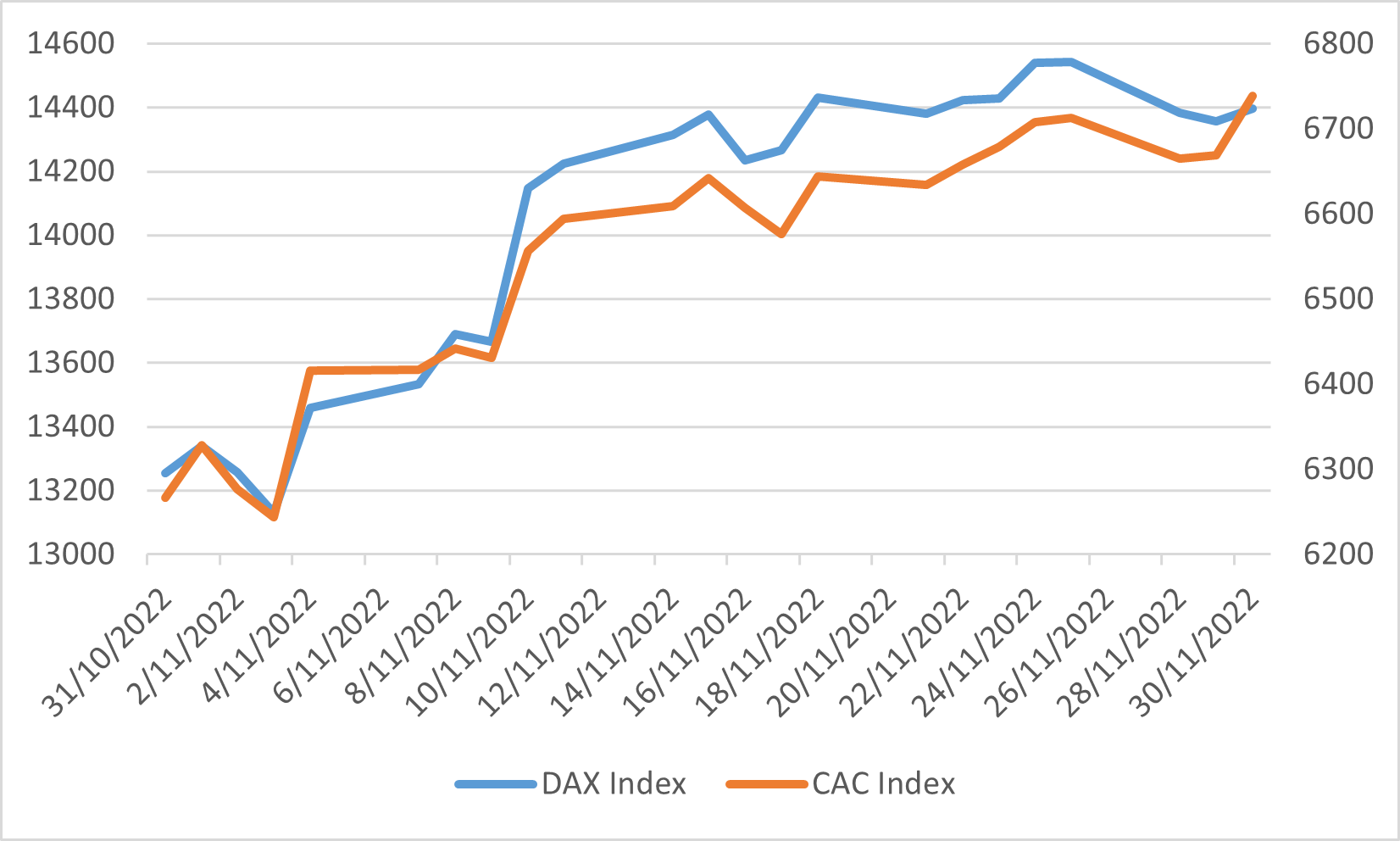

European markets ended the month up again, extending the gains made in October. DAX and CAC 40 indexes ended the month with 8.63% and 7.53% gains. This was boosted by inflation that may be moderated in the eurozone and the U.S. and allayed fears of energy shortages as unusually warm autumn reduced the demand. However, energy costs remained one of the biggest drivers of high inflation, leading the Euro area inflation rate to surge to 10.6% in October, which was higher than the consensus of 10.4%, set a new highest record and the other main driver was the food prices. On the other hand, the composite PMI in November slightly rebounded to 47.8 from 47.3 in October but still remained in the contraction territory.

DAX Index and CAC 40 Index