Monthly Market Outlook – Dec 2022

24th January, 2023

U.S.

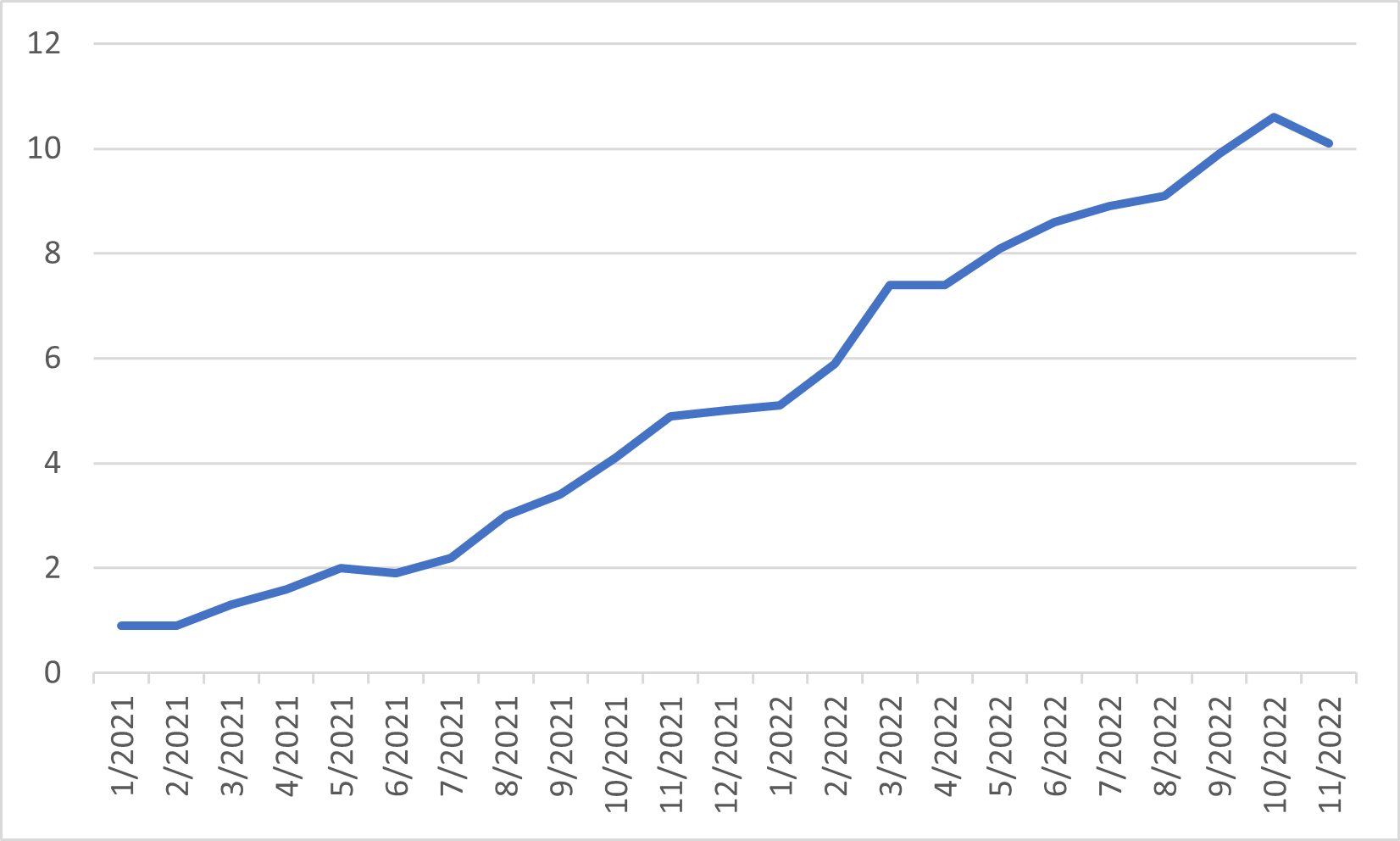

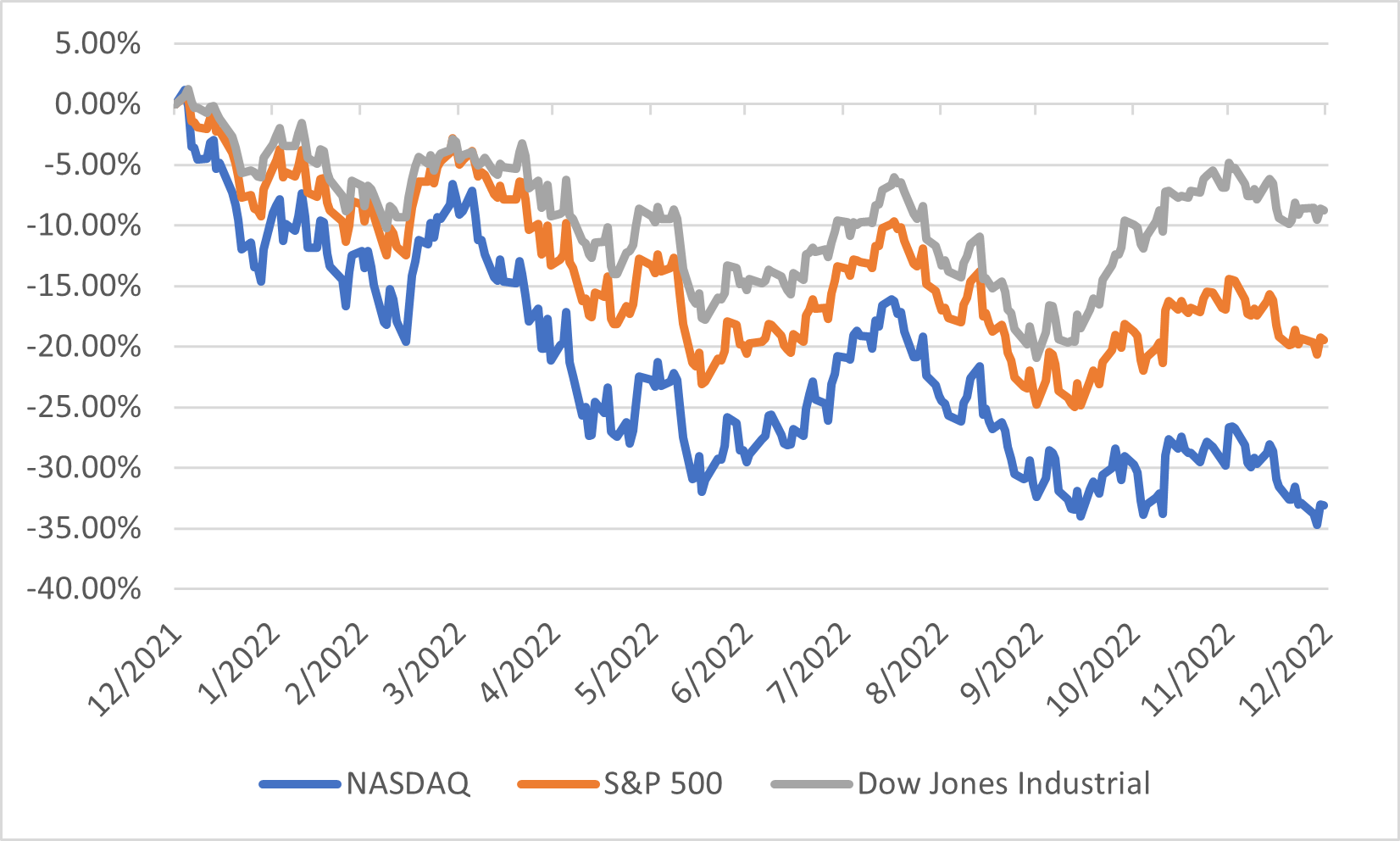

The U.S. stock market ended 8.73%, 5.90% and 4.17% down in December for NASDAQ, S&P 500 and Dow Jones Industrial Indexes, respectively. And it culminated in the worst year for the U.S. markets since the global financial crisis, with 33.10%, 19.44% and 8.78% down for the year for the above indexes.

Inflation continued its slowdown trend for a sixth straight month after peaking in June with 6.5% in December, which was the lowest since October 2021, in line with the market forecast. Although the Fed reiterated its determination to hit the inflation target through the interest rate hike, the latest hike in mid-December was smaller than the previous though.

Meanwhile, the U.S. economy has recently weakened. The ISM manufacturing PMI fell to 48.4 in December, which pointed to the second straight month of contraction in factory activity. And the Composite PMI fell further to 45 in December from 46.2. While the unemployment rate remained low at 3.6% in December, the labour market has shown early signs of loosening. Non-farm payrolls posted 223k in December versus 256k in November, and the continuing jobless claims rose to 1.67 million from 1.3 million in June, indicating an increase in the difficulty in finding new jobs.

U.S. market performance in 2022

Japan

BoJ shocked the market in late December with a surprising tweak to its yield curve control policy that allows the 10-year government bond yields to climb to 0.5% from 0.25%. This was in a shift away from its long-running dovish stance of keeping rates ultra-low to boost the struggling economy, which caught off-guard all the investors. But BoJ kept its yield target unchanged and said it was a sign the move was a fine-tuning of existing ultra-loose monetary policy rather than a withdrawal of stimulus. Shares tanked in December. Nikkei 225 index turned down and burned all the previous gains from October and November, while the yen spiked following the decision and closed at a six-month high against the U.S. dollar at 131.12 in December.

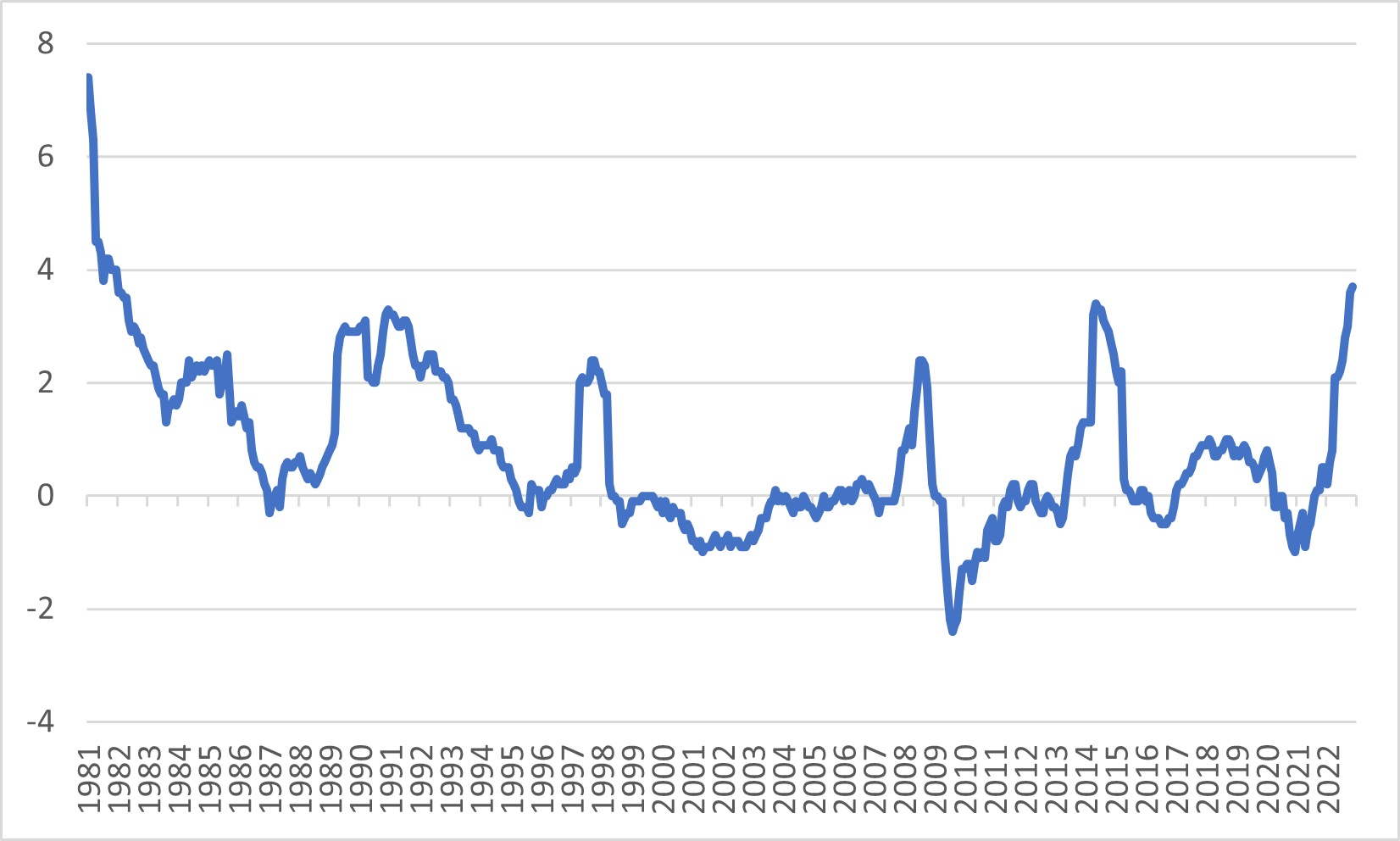

CPI in Japan rose to 3.7% in November from a year earlier, which hit a fresh four-decade high. This was the highest level since the 4% in 1981, given that the weakened yen and the companies continued to pass on rising import costs to households. And this remained above the BoJ’s 2% target for the eighth straight month. BoJ reiterated that such cost-push inflation would not last long, so its 2% target has not been achieved sustainably.

Japan Nationwide CPI

China

As the economy continues under pressure, the Chinese authorities finally announced a series of measures to ease its dynamic zero Covid policy. Most of its travel restrictions are also expected to be eased on or before early January. Meanwhile, the China Securities Regulatory Commission announced to ease of restrictions on equity financing for the ailing industry. The market sees this move as the China government loosened restrictions on the real estate sector. These buoyed the market. The Hang Seng index and Hang Seng TECH index surged 6.37% and 8.70% in December, respectively.

On the other hand, US-China relations made a breakthrough in the financial markets after the risk of Chinese companies' kick-off from U.S. stock exchanges has been temporarily removed as the U.S. accounting watchdog obtained full access to inspect and investigate the audit papers of those Chinese firms.

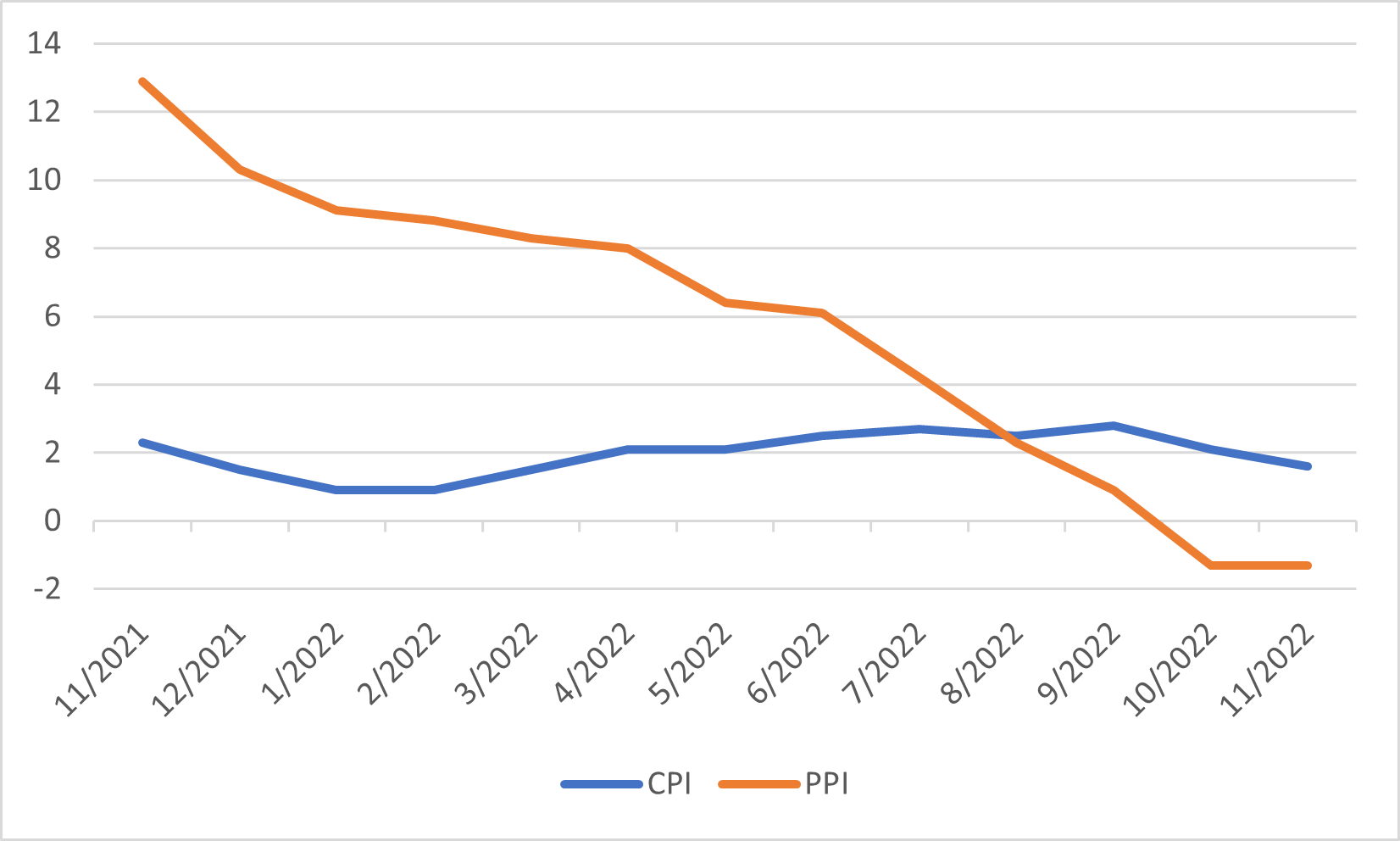

China's annual inflation rate dropped to an eight-month low of 1.6% in November, which was in line with the market consensus and down from a 2.1% growth in October, while the producer prices fell by 1.3%, unchanged from an annual contraction seen in October. These data suggest that the economy is weak in activity and soft demand, which has been affected by the pandemic restrictions.

China CPI and PPI

Europe

European equities ended the last month of the year down sharply, the MSCI Europe Index down nearly 4% for the month and 12% for the year as the renewed worries of the economic slowdown and rising interest rates.

Euro area inflation fell in November for the first time since June 2021, down from the record high of 10.6% in October but still higher than the market consensus. This allowed the ECB to opt for a smaller rate hike than previously and raised its key interest rate by 50bps to 2% in the December meeting. However, ECB president Christine Lagarde warned ECB is not pivoting and wavering. ECB would need to raise rates “significantly” further to tame inflation. Moreover, the ECB plans to shrink its balance sheet by 15 billion Euros per month from March to the end of the second quarter.

Euro Area Inflation Rate