2018 Outlook on Emerging Markets: Major Drivers and Risk Factors

10th December, 2017

Emerging market (EM) equities have been delivering strong gains year-to-date and it was no exception last month. Encouraging macro-economic data among developed economies drove the emerging market equities higher by about 3.5% in November. Nevertheless, as the Fed’s December meeting is getting close, where a further rate hike by 25bps is widely expected, upward momentum of emerging markets currencies and equities has weakened slightly.

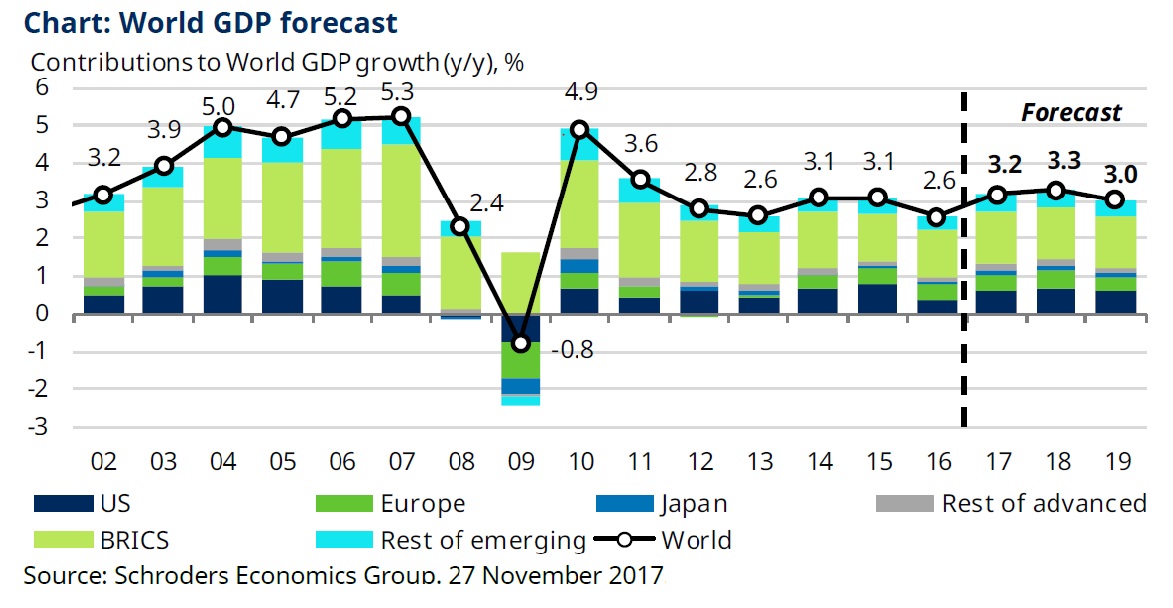

Heading into 2018, we believe EM will continue to benefit from a synchronized recovery in global growth. According to Schroder, global growth is expected to be sustained at 3.3% in 2018, which continues to nourish global trade and in turn support EM equities. This will translate into improvement in corporate earnings among EMs in 2018. The synchronized global growth also means a narrower divergence between economic conditions and monetary policies in the US and major emerging economies. This explains why the dollar has been stumbling year-to-date even under the rate normalization of the Fed. We expect that in 2018 the dollar will continue to be moderately weak, which shall provide a favorable environment for EM equities.

However, one major risk factor that could derail the current uptrend is the abrupt tightening of financial conditions in China. The 19th National Congress of the Communist Party highlighted the importance of deleveraging and financial stability in the world’s second largest economy, causing government bond yields to spike up in early November. This spawned concerns over whether deleveraging and reduced liquidity could lead to significant growth slowdown and defaults. In fact, recent macro data such as M2 supply, aggregate loan amount and PMIs did show some signs of macro softening. We shall keep a close watch for any further hints of growth deceleration as a result of curbing credit expansion.