Monthly Market Outlook – Jan 2023

24th February, 2023

U.S.

In January 2023, the US equity market saw a significant shift in investor sentiment as inflation cooled for the sixth straight month. The stock market saw a solid start to the year, with the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite was rose around 6%, 3% and 11%, respectively.

Investor optimism was driven by several factors, including the continued ease of inflation, the rate soon to be peaked, and some encouraging economic data. US composite PMI improved to 46.6 in January from 45 but still remained in contraction territory. Employment data was more supportive, with Nonfarm Payrolls being the lowest since April 2022.

However, the market also saw some volatility towards the end of the month as investors were hunkering down ahead of the Fed’s meeting at the start of February. The Fed is expected to raise rates by a quarter of a percentage point, continuing to scale back the size of its increases.

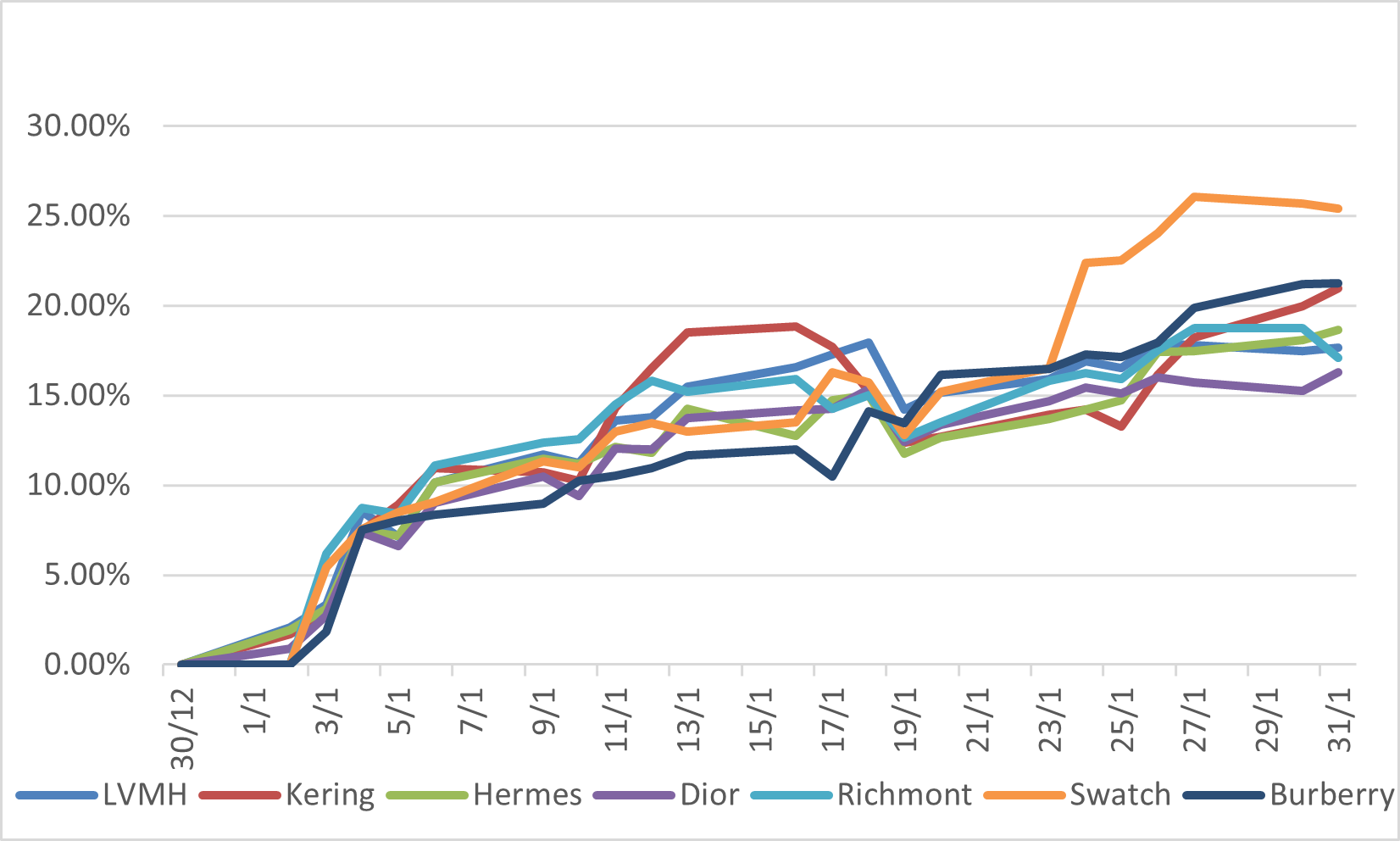

Despite the volatility, the overall sentiment remained positive, with many analysts predicting that the Fed will bring inflation under control without triggering a damaging recession. The technology sector, in particular, is a standout performer, with FAANG companies continuing to drive market growth.

FAANG companies' performance in January

Japan

In the first month of 2023, the Japanese equity market was performing well, reversing the decline seen in December, both Nikkei 225 and TOPIX rose more than 4%. The Japanese yen continually strengthened against the US dollar, which was in line with the trend seen from December, before giving back some of its gains at the end of the month.

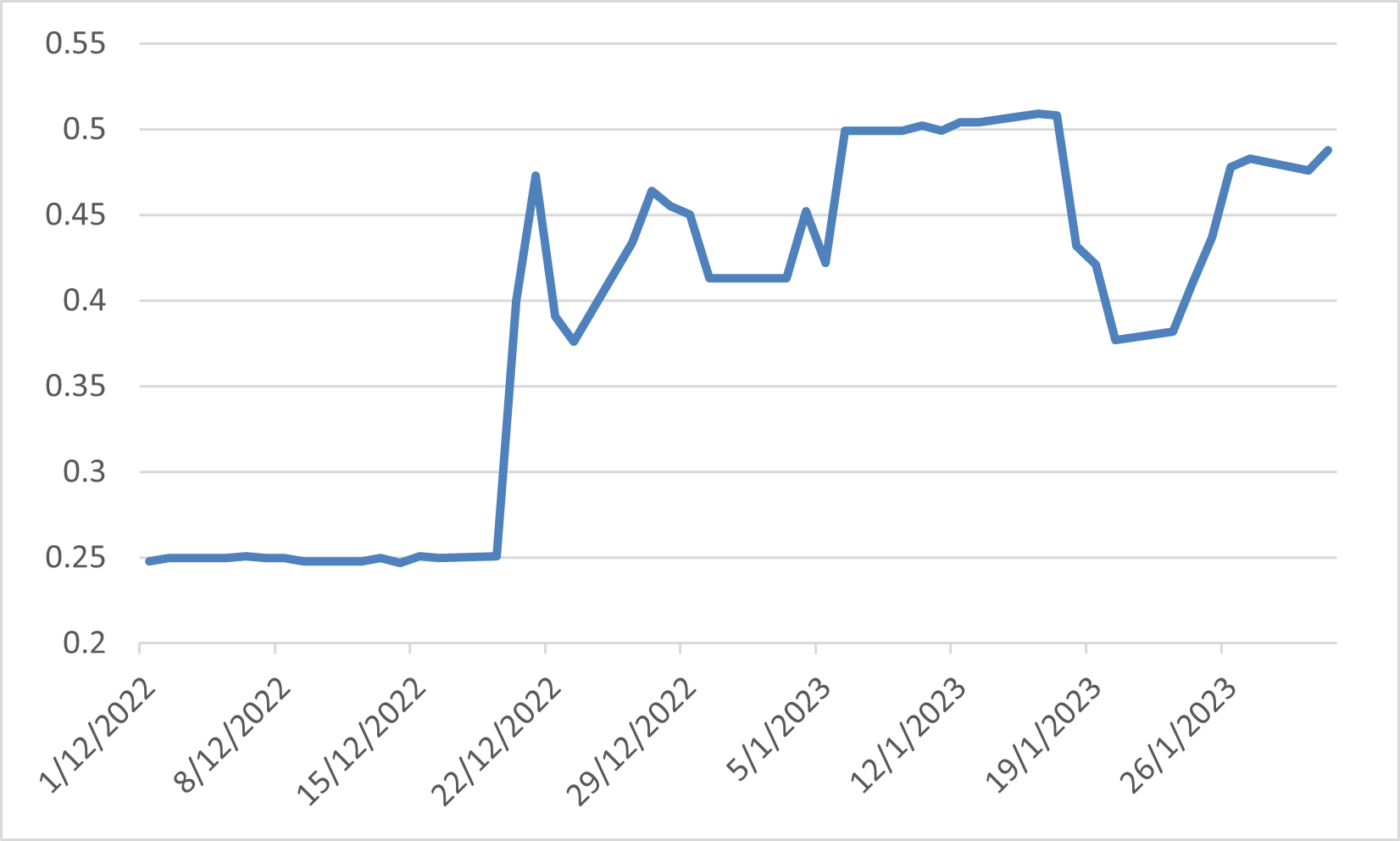

The market still focused on the BoJ, following the surprise adjustment to its yield curve control, widening the band for 10-year government bonds from +/-0.25% to +/-0.50% in mid-December. In early January, the BoJ had to intervene in bond markets as the market was testing the BoJ's new upper limit. Some speculation was that changes could be made in the following BoJ's meeting. However, the BoJ surprised the market again to be left unchanged on its dovish policies, which became the equity market's key driver in the month's second half.

On the other hand, Japan's CPI accelerated to 4.0% in December, hitting the highest record since January 1991, which was much higher than the BoJ's target. And led to the debate on the BoJ's view that the recent cost-push inflation would not be sustainable.

Japan 10-year government bond yield

China

The Chinese equity market continued its strong run in the first month of the new year. The Shanghai Composite, Shenzhen Component, and CSI 300 rose 5.39%, 8.94% and 7.37%, respectively. China finally reopened after several years of virus restrictions in early January, government measures to support the property sector and the loosening of the regulatory crackdown on technology companies had boosted the market sentiment.

Besides the improvement in regulatory conditions and the theme of reopening, the expectations of a softer interest rate hike cycle in the US were another booster of the equity market. Meanwhile, the Chinese yuan continually gained value against the US dollar for the third month in a row, with its value appreciating more than 2% in January and more than 8% from the lowest reached at the end of October 2022.

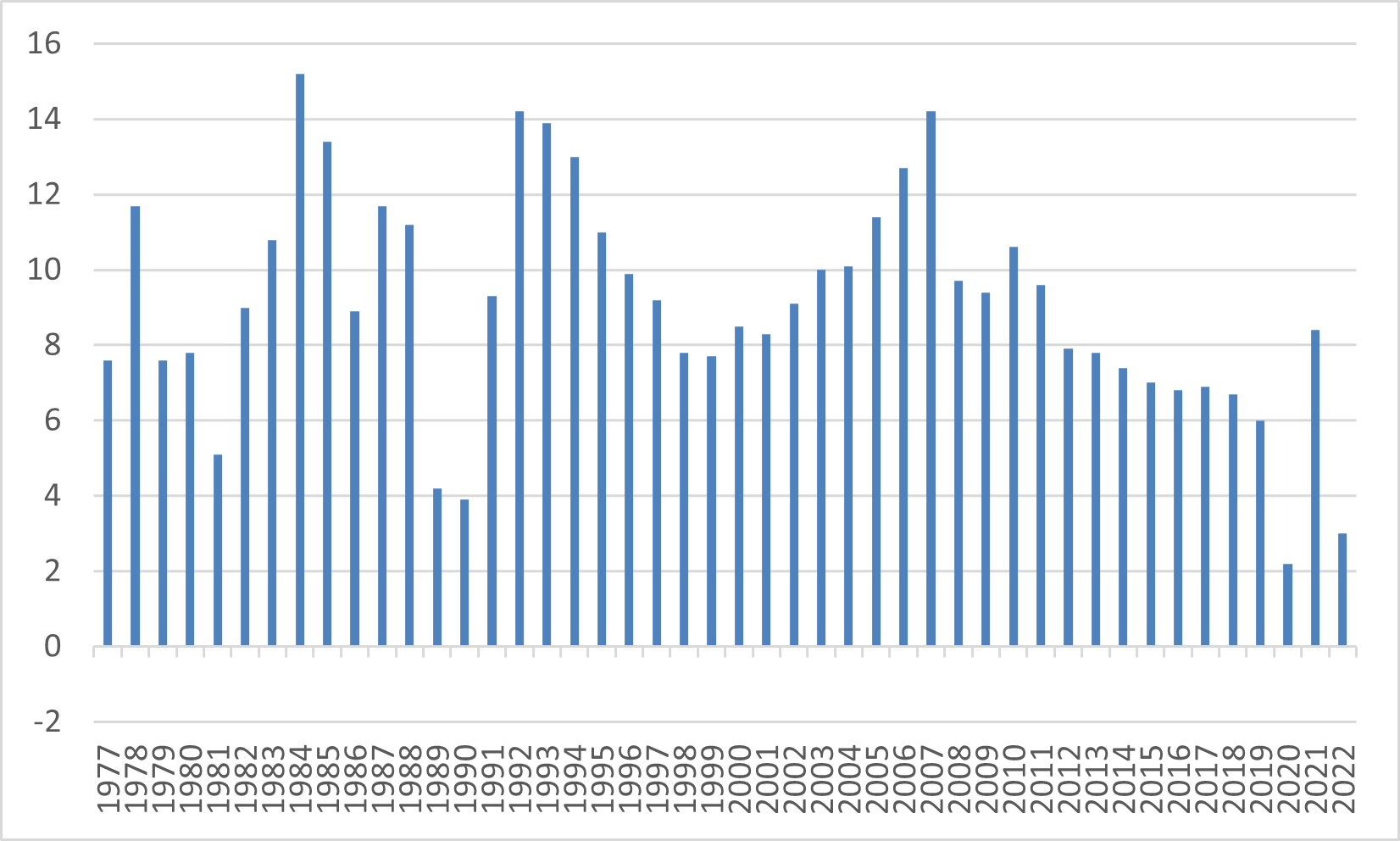

However, the annual growth rate of China’s GDP declined to 2.9% in Q4 2022; retail sales remained weak. Full-year GDP in 2022 was around 121 trillion Chinese yuan, growing by 3%, but missed the official target of 5.5% and marking the second slowest pace since 1977 amid the disruption by the zero-Covid policy and mass infections.

China Real Annual GDP

Europe

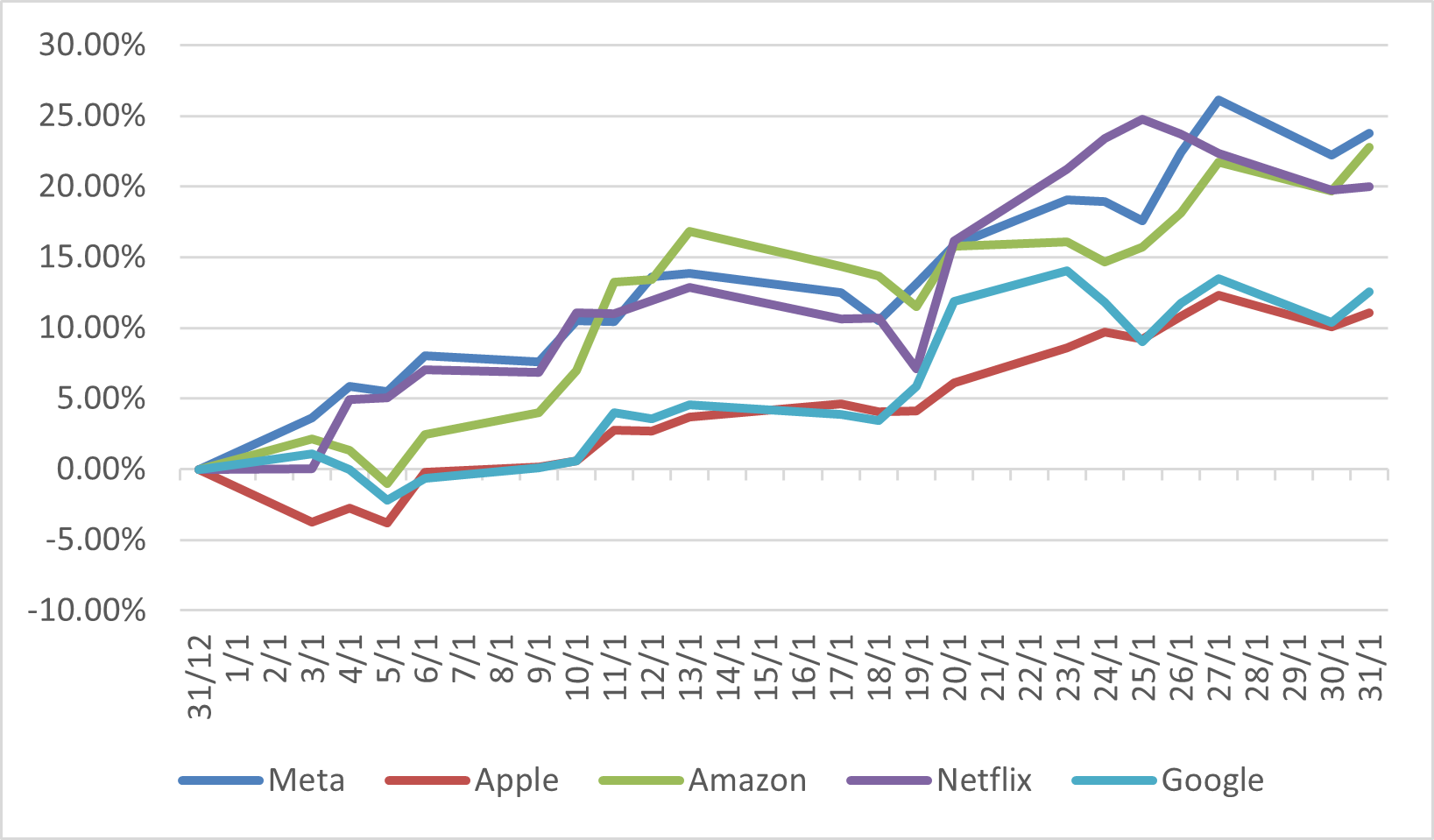

European stocks started solidly in the first month of the year. Top performing sectors included information technology and consumer discretionary, which are sensitive to the economic outlook. Within the consumer discretionary sector, luxury goods particularly outperformed the others which benefited from China's reopening progressed faster than expected.

The European Union's inflation rate continued its slowdown trend to 10.4% in December 2022 from 11.1 in November but has remained at an elevated level. As the natural gas prices maintained a relatively cheaper level, energy was no longer the highest contribution to inflation. The top contribution came from food, alcohol and tobacco in December. Meanwhile, ECB continued its rate hike by 0.5% to 2.5%, which hit the highest level since the great recession in 2008. And the ECB signalled to raise another 0.5% in March.

European area Luxury goods stocks return in January (local currency)