Monthly Market Outlook – Feb 2023

24th March, 2023

U.S.

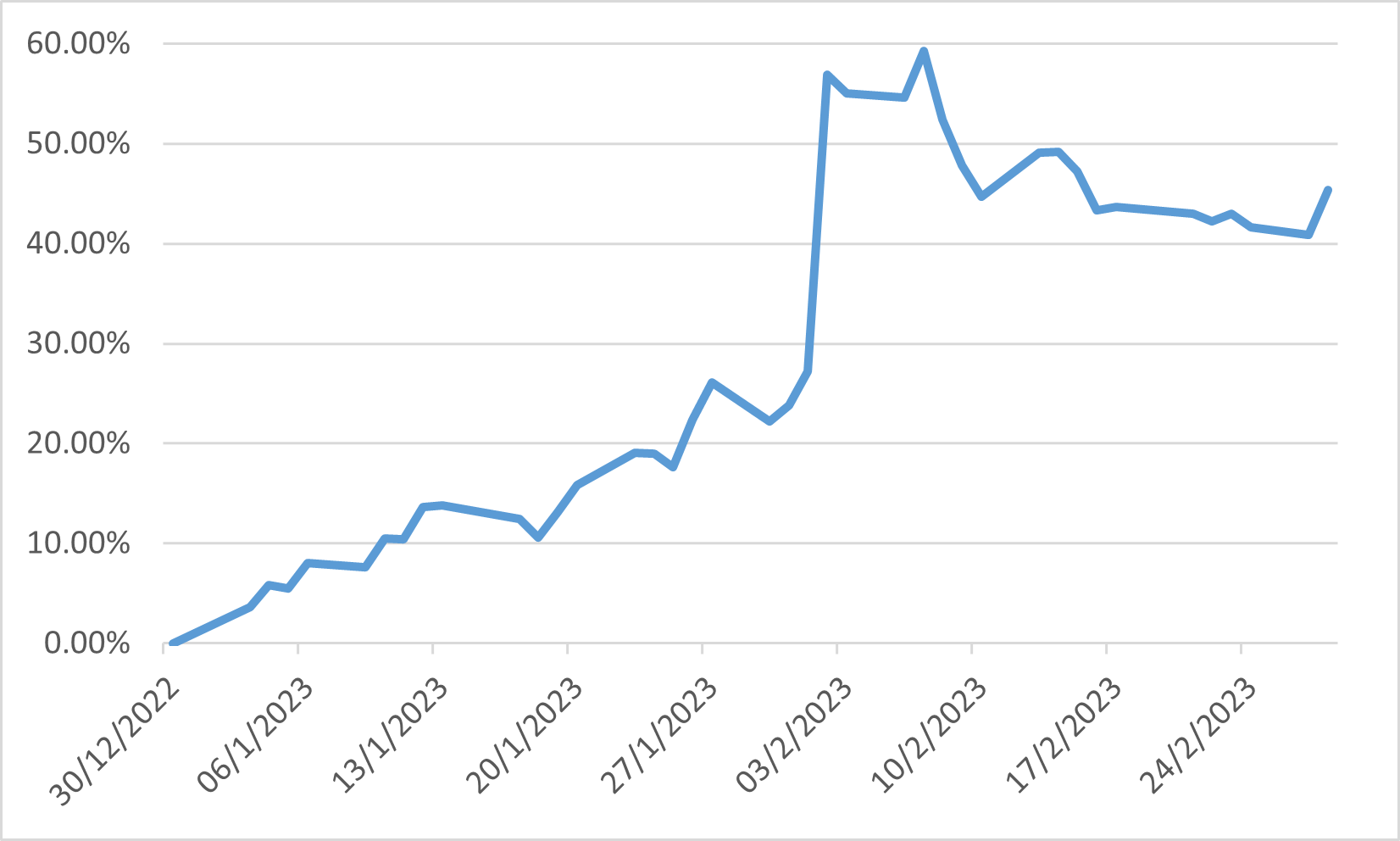

The US market experienced a lacklustre performance in February 2023, driven by ongoing interest rate hikes, inflation concerns, and defaults in the high-yield and leveraged loan markets. The S&P 500 was down 2.61% for the month, bringing its YTD return to 3.40%, while the Dow Jones Industrial Average fell 4.19% for the month and was down 1.48% YTD, and the US 10-year Treasury Bond interest rate rising 0.41% to 3.92%. The strongest performers during the month were companies in the technology sector, with Meta Platforms rising a further 17.43% and generating a 45.37% return YTD. On the other hand, commodity-driven companies were among the weakest performers during the month, as falling commodity prices caused them to fall out of favour with the market.

The US Federal Reserve was expected to continue raising interest rates, with market pricing suggesting a peak Fed Funds rate of 5.25%-5.50%, with further rate hikes of 0.75% predicted for the current cycle. The increase in expectations was mostly driven by the persistent inflation. Meanwhile, the labour market remained hot, with employment continuing to grow at a brisk pace and joblessness remaining low, despite slowing economic growth and difficulties in some sectors.

Meta Platforms YTD performance

Japan

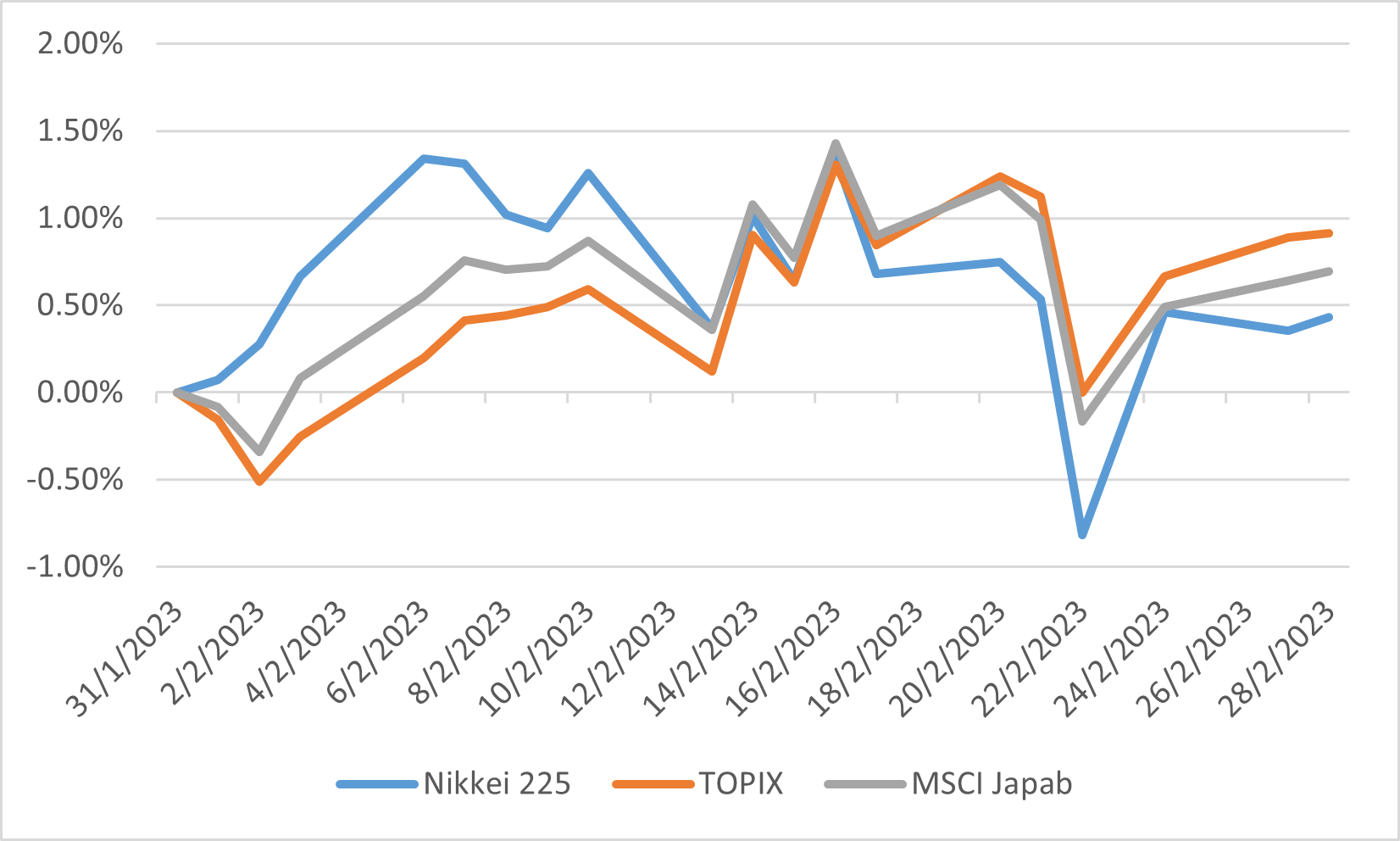

The Japanese stock market rose slightly in February. Nikkei 225, TOPIX and MSCI Japan Index rose 0.43%, 0.91% and 0.69%, respectively. The yen weakened sharply after testimony to the Diet by Kazuo Ueda, the nominee to be the new Bank of Japan Governor, as he appeared to prefer the status quo on monetary policy, supporting market sentiment especially for exporters. However, there are concerns about a shift in fund flows from Japan that could impact the global market if the yield control policy is phased out under the new BoJ head.

Japan posted a merchandise trade deficit of 897.7 billion yen in February 2023, which exceeded expectations for a shortfall. The value of imports was boosted by the yen's weakness and higher energy prices, which boosted the value of imports and led to the 19th straight monthly trade deficit. Meanwhile, the government’s Economy Watchers survey showed that Japan’s sentiment index posted the first rise in four months in February, and the outlook index posted the third straight rise, prompting the government to upgrade its assessment from the previous month. This suggests that business sentiment is starting to improve.

Nikkei 225, TOPIX and MSCI Japan's performance in February

China

In February, the Chinese economy showed signs of recovery from the COVID-19 pandemic with improvements in both the service and industrial sectors. China's service sector recorded gains in February due to strong support from new business and employment, which benefitted from the easing of pandemic-related restrictions. Additionally, China's industrial production growth strengthened in the January to February period, and retail sales rebounded after the relaxation of the pandemic. Furthermore, aggregate financing in China beat market expectations in February due to strong growth in new loans and government bond issuance.

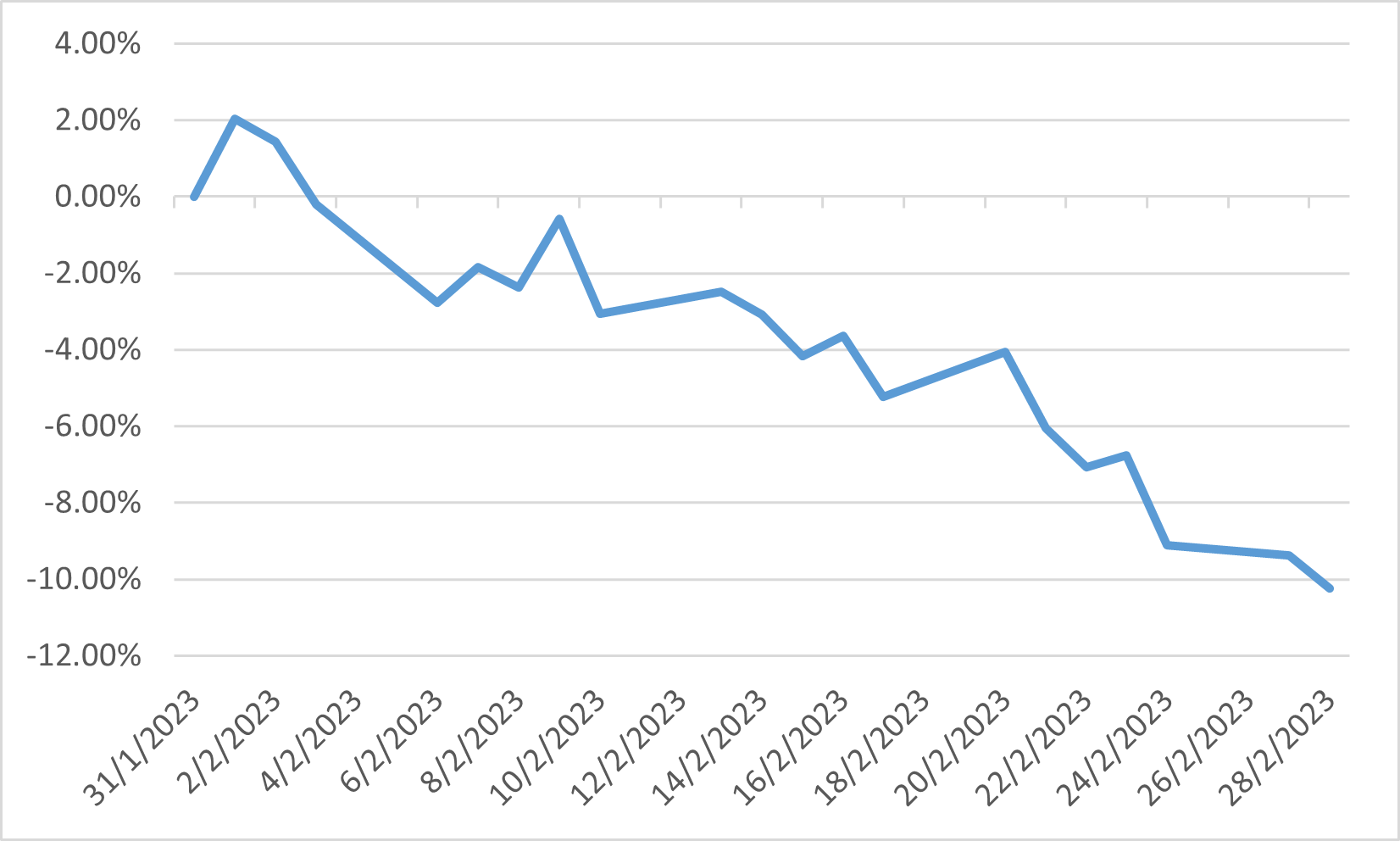

However, the Chinese equity market experienced significant corrections in February, with the MSCI China index surrendering 10.24%. This decline was attributed to escalating geopolitical risks and regulatory risks. News of an investigation into China Renaissance Bank's CEO and the US Secretary of State's statement that China is considering lethal support to Russia in its efforts in Ukraine contributed to the decline in the equity market. Meanwhile, the renminbi maintained its value against major currencies such as the US dollar, Euro, and Japanese yen, according to the central parity rates of the Chinese currency announced by the China Foreign Exchange Trade System.

MSCI China Index's performance in February

Europe

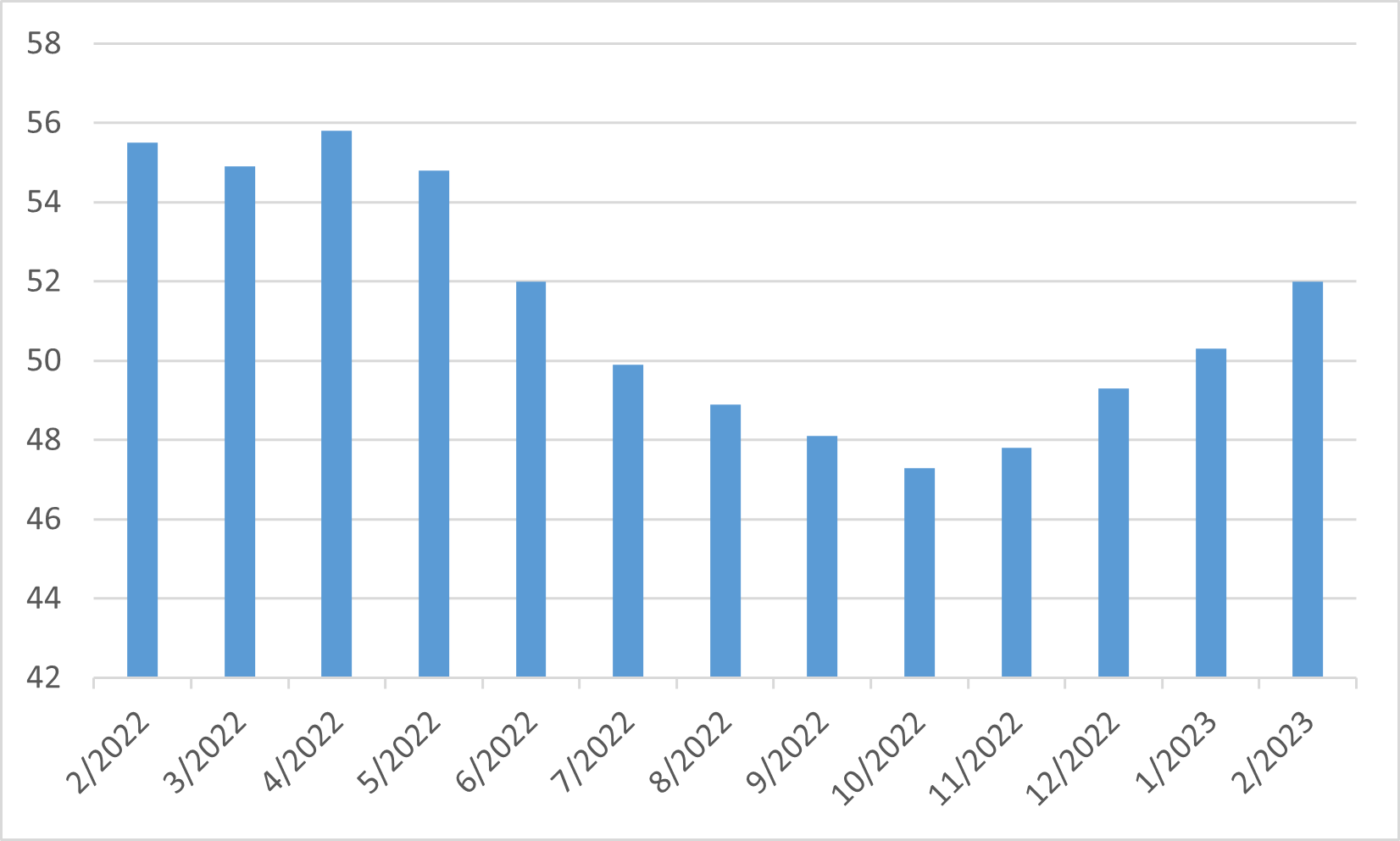

The eurozone stock market experienced gains in February, with communication services, financials, industrials, and consumer staples being the top performing sectors. However, real estate, IT, and healthcare posted negative returns. The flash Markit composite purchasing managers' index for February rose to 52, up from January's 50.3. This signifies the strongest expansion of business activity since June of the previous year.

The European Central Bank increased interest rates by 50 bps, raising the main refinancing rate to 3.0%. Another rate increase was expected in March. While January's easing inflation had suggested a potential slowdown in rate hikes, preliminary data for February showed inflation ticking up again in France and Spain, casting doubt on the possibility of an end to rate increases.

Eurozone Composite PMI