Monthly Market Outlook – Mar 2023

21st April, 2023

U.S.

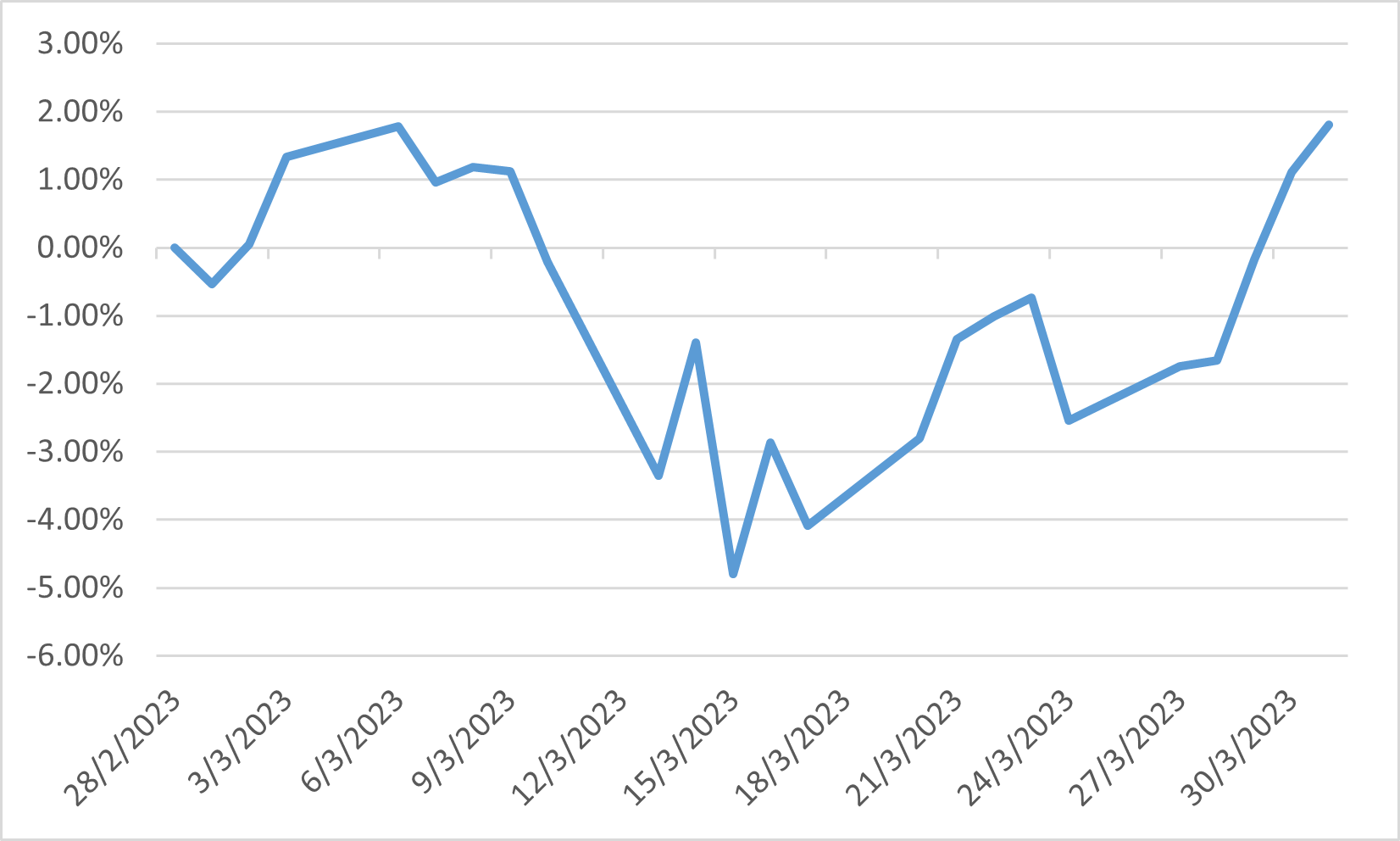

Due to the banking crisis, March 2023 was a turbulent month for the US markets. Despite this, the market showed resilience and ended positively in March, with a gain of 3.51%, 6.69% and 1.89% in the S&P 500, NASDAQ, and Dow Jones, respectively. The banking crisis remained a key variable for investors, with its impact on the economy being a crucial factor to weigh. However, the US stock market showed a surprising level of resilience post-banking crisis, indicating that investors were looking past the crisis.

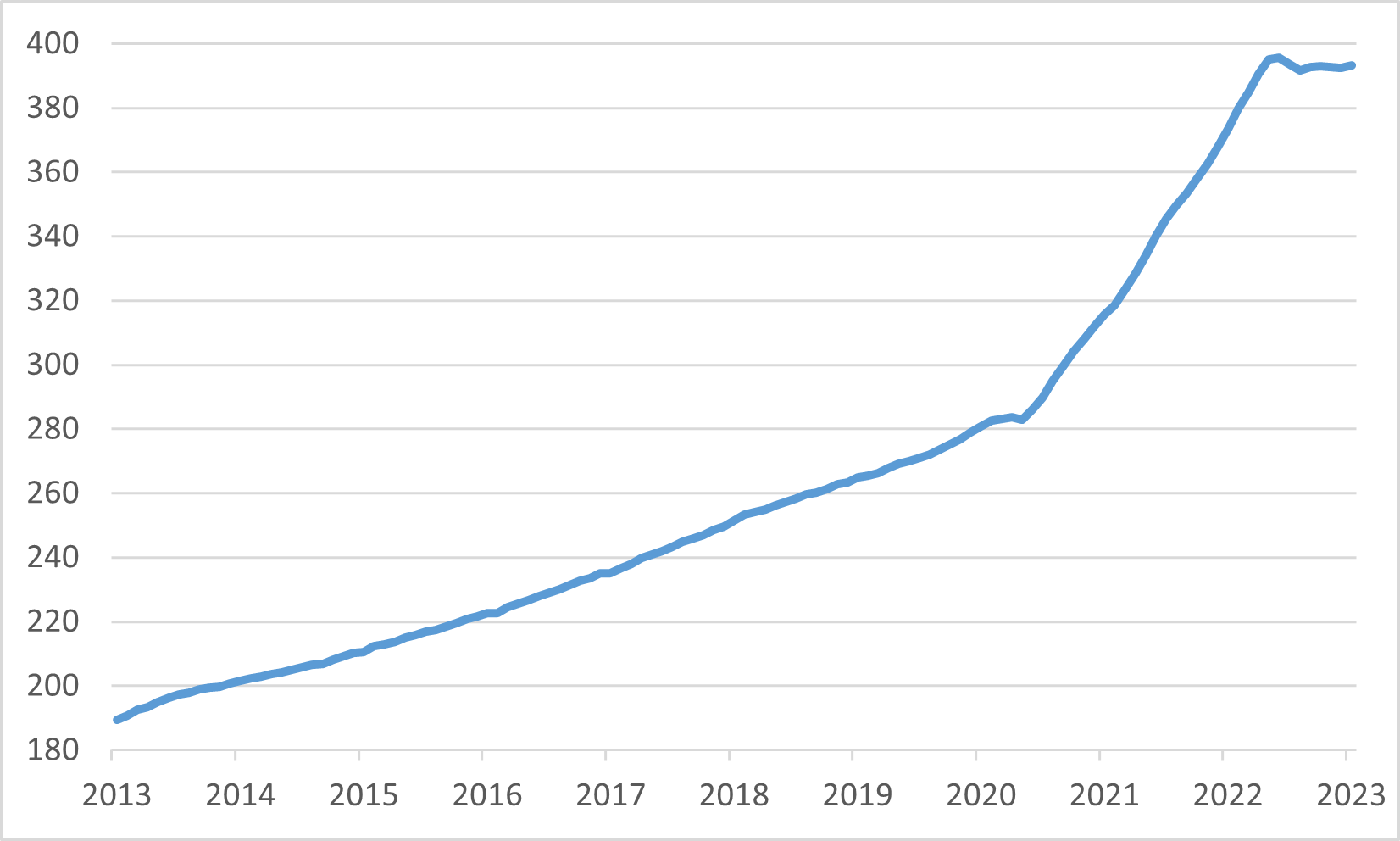

The banking sector turmoil led to worries about a credit crunch and growth slowdown, which affected market performances. The 2023 GDP growth forecast for the US was around 1%, although risks pointed to the downside. The forward breakeven inflation rate, which is the market’s pricing of future inflation, narrowed in March, with markets seeing inflation falling to near 2% due to the bank turmoil and nearing recession. Home prices have dropped slightly in recent months, but the house price index is still more than double what it was a decade ago, reaching 393.2 in February. This has resulted in high listing prices, which could potentially affect buying power.

Market volatility remained extreme, with massive swings on comments from Fed Chair Powell and Treasury Secretary Yellen. Looking past the banking crisis, two key market catalysts remained front and centre: inflation and the attitude of the Fed.

US House Price Index

Japan

The Japanese stock market in March 2023 saw a positive quarter, but the coast is unclear as there are still uncertainties that could affect the economy, such as the impact of the banking crisis. Despite these concerns, investors' sentiment towards the Japanese market remains optimistic. Warren Buffett has expressed his intentions to add to his Japanese stock holdings. One of the major developments in the Japanese economy in the first quarter of 2023 was the outcome of the annual spring wage negotiations, known as “Shunto”. The negotiations resulted in an overall 3.8% YoY wage increase, which includes a base increase of 2.3%. This is the highest number since the early 1990s, which is a positive sign for the Japanese economy.

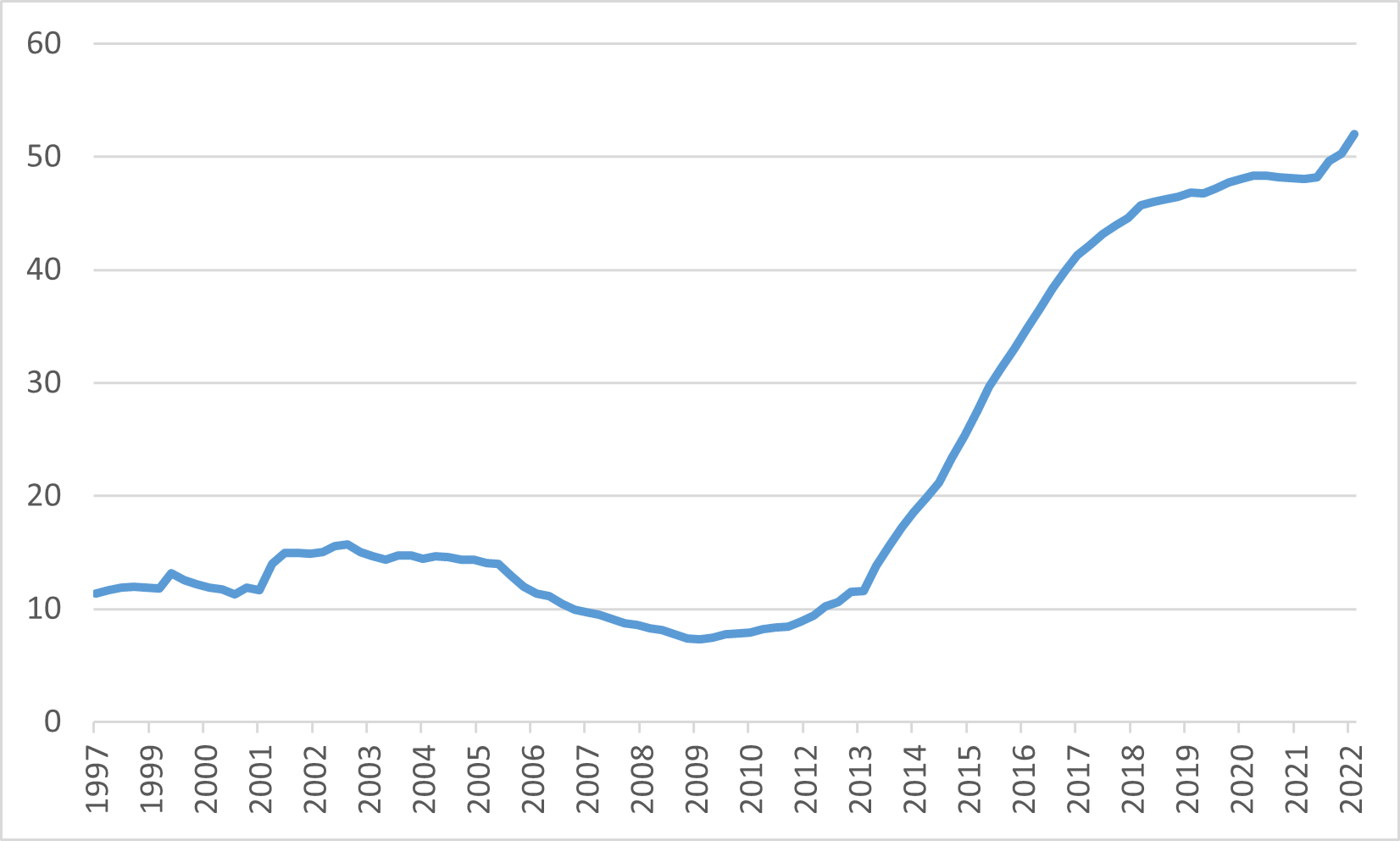

In terms of monetary policy, it appears likely that the BoJ will loosen its yield curve control policy, which currently allows 10-year bond yields to move in the range of -0.5 – 0.5%. The government bond market has become increasingly dysfunctional as the BoJ owned more than 50% of the outstanding Japanese government debt, which is the first time in history. This move by the BoJ is expected to help the bond market function more smoothly and refunction.

BOJ's Japan Government Bond ownership

China

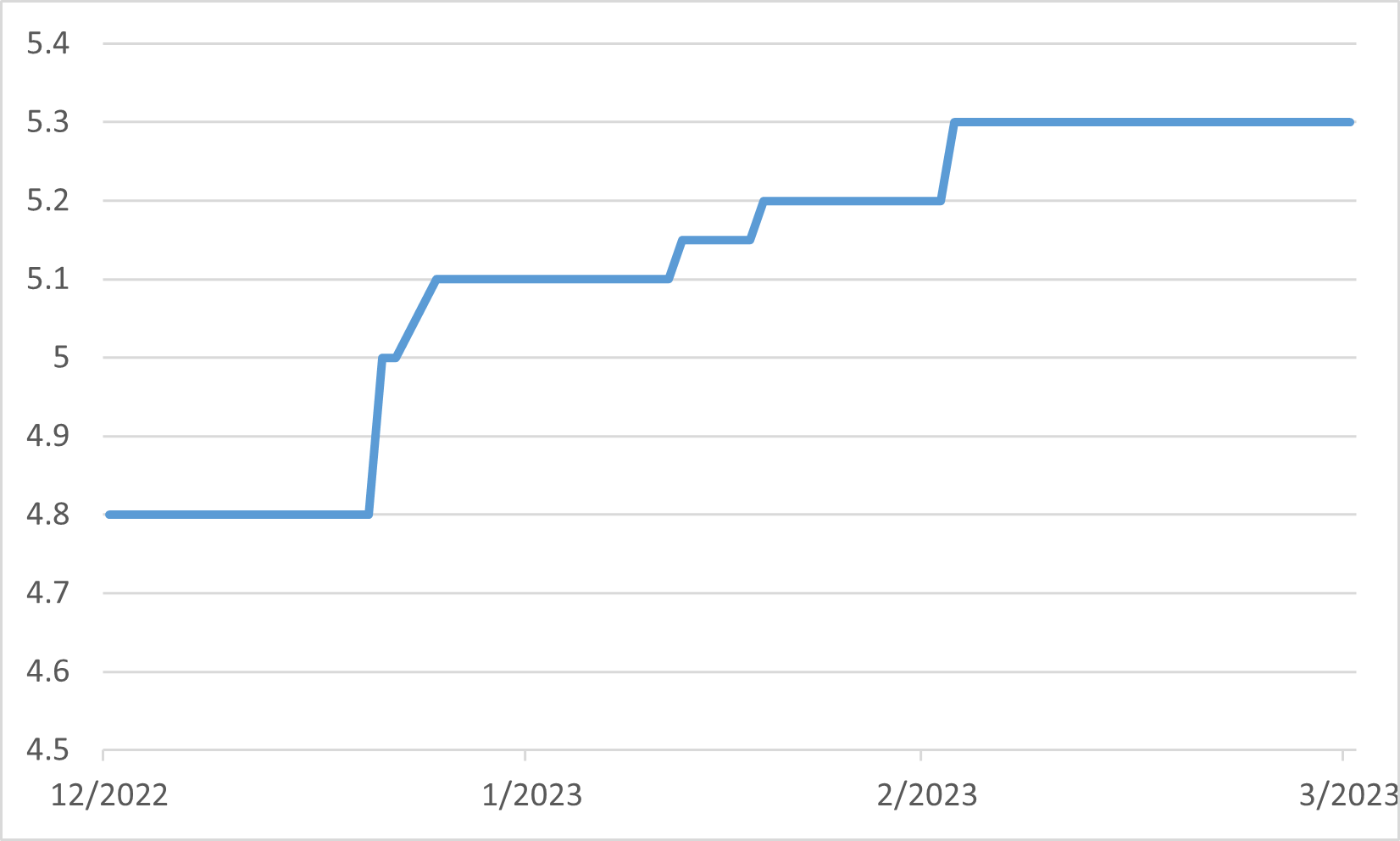

The Chinese economy was expected to grow by 5.3% on average in 2023, up from a 4.8% forecast made in December 2022. The Chinese government’s official growth target for 2023 was set at around 5%, which was referred to as “modest” but deemed realistic by some analysts. The market has held optimistic expectations for China’s consumer market in 2023, with the country’s GDP projected to grow more than 5% under an assumption of an export slowdown. Premier Li Quang also shored up sentiment in late March, saying authorities have the confidence and ability to sail the giant ship of the Chinese economy steadily ahead.

The Chinese equity market continued its strong run in March. The MSCI China Index, Hang Seng Index and Hang Seng TECH Index rose 4.5%, 3.1% and 9.65%, respectively. Thanks to the government’s further support for the internet and gaming sectors. The lack of opposition by the authorities toward Alibaba’s plan to split into six units indicated China could be easing its regulatory scrutiny for the internet sector.

However, the March 2023 consumer inflation rate in China hit an 18-month low, while factory gate prices continued to decline due to weak demand, highlighting the need for policymakers to take further steps to stimulate the economy. In addition, China’s Premier Li Qiang announced a crackdown on the financial industry in early March, causing some uncertainty in the market.

China GDP forecast

Europe

The European stock market experienced a volatile period in March due to a series of central bank rate hikes, turmoil in the banking sector, and global economic uncertainty. However, despite these challenges, economic activity surprised on the upside throughout the quarter on the back of falling energy prices and the resilience of the services sector.

During the first half of the month, European stock markets faced losses as investors took stock of the week’s central bank rate hikes and the latest news. The losses were further compounded by the high-profile implosions of Silicon Valley, Signature Banks, and the acquisition of Credit Suisse by UBS, which sent tremors throughout the financial sector.

Despite these challenges, the European stock market closed out the month with a positive gain. The Euro STOXX 50 index closed the month with a gain of 1.81%.

Eurozone Composite PMI