Monthly Market Outlook – Apr 2023

22nd May, 2023

U.S.

The latest data indicates a remarkable increase in economic activity within both the manufacturing and services sectors, surpassing projections and pointing to a strong resurgence in overall economic momentum. April's Manufacturing PMI figures emphasized this expansion as new orders returned to growth. In contrast, new export orders exhibited a decline during the same period.

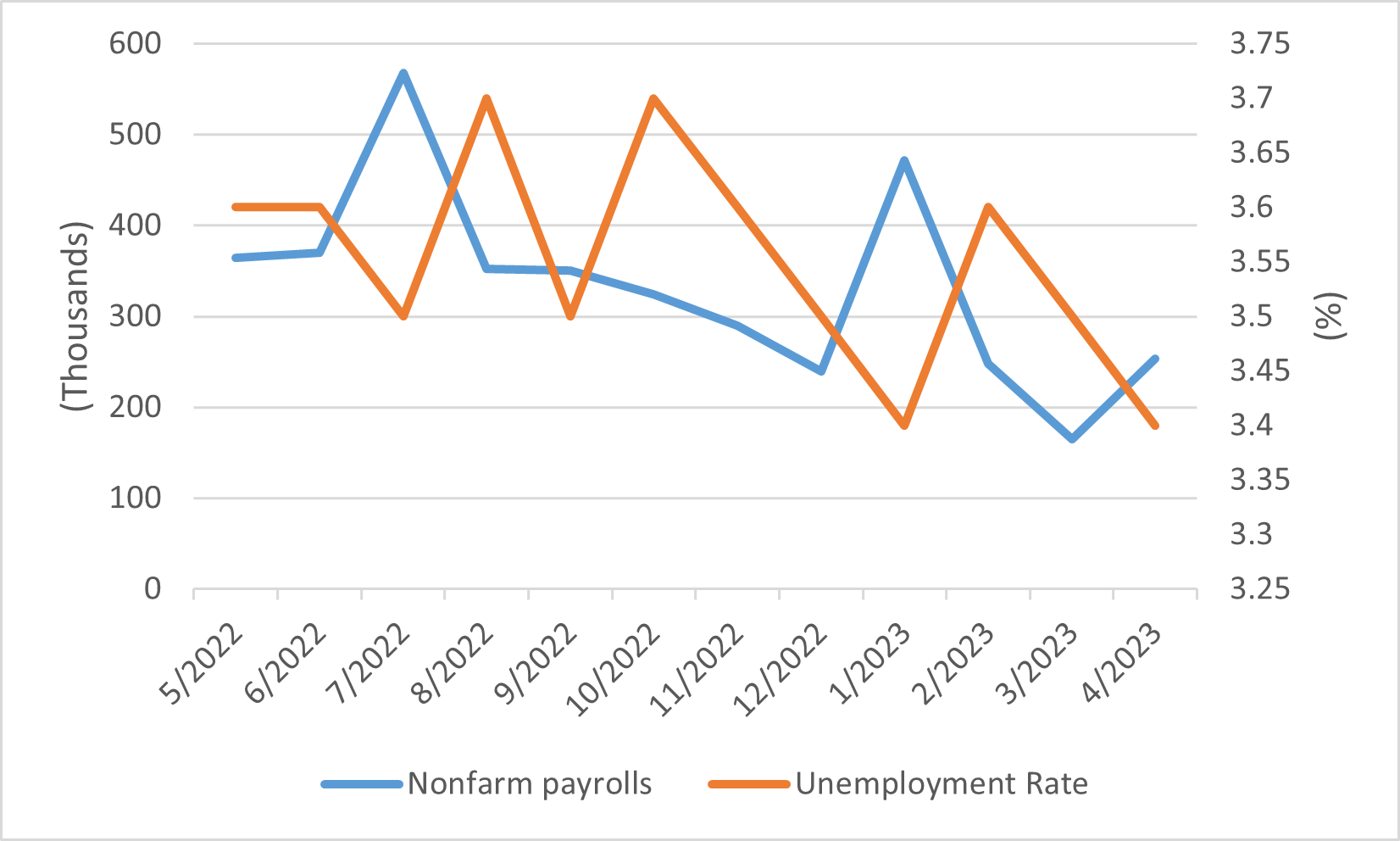

Despite the decline in export orders, firms maintained a positive outlook regarding future sales, which contributed to a notable rebound in nonfarm payrolls in April. This optimism also played a role in achieving the lowest unemployment rate of the 21st century.

Regarding equity markets, US equities consistently posted gains in April 2023. The S&P 500, NASDAQ Composite, and Dow Jones Industrial Average experienced total return increases of 1.56%, 0.07%, and 2.57% respectively during the month. Consequently, the year-to-date total returns reached 9.90%, 21.38%, and 1.69% respectively, highlighting the resilience and growth potential of the US stock market during this period.

Inflation also played a crucial role in shaping the market landscape in April 2023. Investors embraced the positive news as year-to-date inflation data in March reduced to 5% from 6% in February, owing to base effects that helped stabilise inflation levels.

US Nonfarm Payrolls and Unemployment Rate

Japan

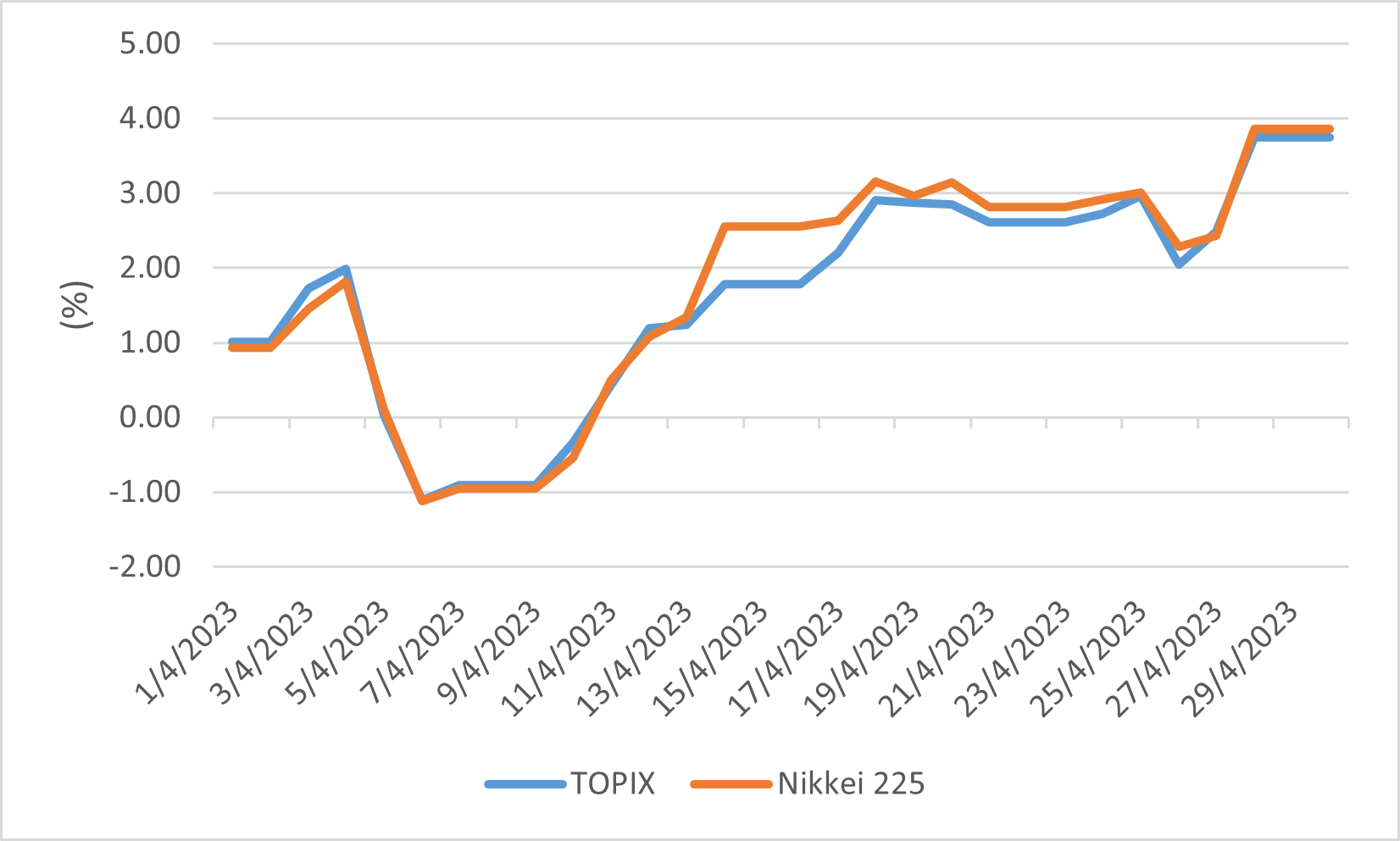

In April, the Japanese stock market maintained its positive momentum, with the TOIPX and Nikkei 225 total return registering a 3.74% and 3.86% increase respectively in local terms. This positive performance was supported by several factors, including favourable market sentiment and the dovish tone set by the first policy meeting of the Bank of Japan under new Governor Ueda's leadership. It is worth noting that the Japanese yen weakened further during this period, contributing to the market's positive momentum.

The Japanese economy showed signs of resilience and recovery in April 2023. GDP growth for Q1 2023 was projected at 1.4% in seasonally adjusted annualized terms, outperforming both the Euro area 0.6% and the United States 1.1%. The Bank of Japan reported a narrowly negative output gap at the end of the previous year, suggesting that the economy was likely benefiting from catch-up growth. Despite the growth in advanced economies expected to decelerate, Japan's real GDP growth rate was forecasted to remain steady at 1.1% in 2023 and 1.2% in 2024.

Foreign investors took a fresh look at Japanese stocks in April 2023, as a stock market policy shift and the prospect of an end to deflation fueled hopes of increased inflows. These developments generated optimism, foreign investors had committed substantial capital, including investment tycoon Warren Buffett.

TOPIX and Nikkei 225 April's total return

China

In April 2023, the Chinese equity market faced numerous hurdles, resulting in a mixed performance. The CSI 300 and Shenzhen Component indices witnessed total return losses of 0.50% and 3.23% respectively, while the Shanghai Stock Exchange Composite index gained 1.57% in total return. Ongoing tensions between the United States and China significantly impacted the Chinese equity market. Escalating US-China tensions, particularly surrounding Taiwan and potential new restrictions on foreign direct investment in China, contributed to a decline in emerging market equities, including China. These tensions, along with a correction in Chinese artificial intelligence and technology stocks that experienced recent surges, pressured the overall Chinese equity market.

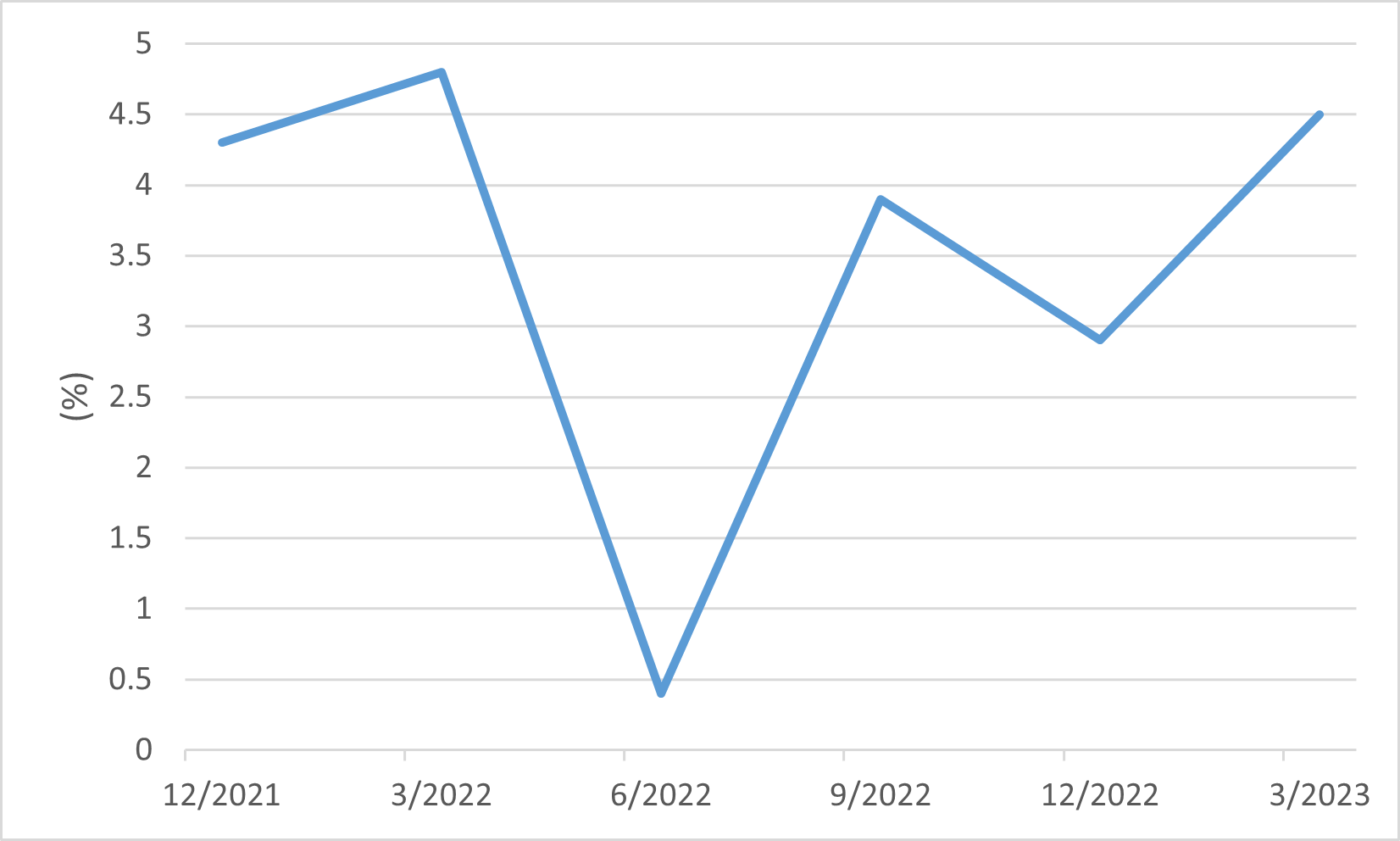

Nonetheless, China's economy displayed signs of progress during Q1 2023. The nation's year-on-year GDP growth accelerated to 4.5%, up from the 2.9% growth in the previous quarter. Several factors supported this growth, including the country's recovery from COVID-related disruptions. However, US-China tensions and sector-specific corrections influenced investor sentiment within the Chinese equity market. Global investors withdrew funds from Chinese equities via the Stock Connect cross-border trading link, reflecting a cautious approach by international investors during this period.

China GDP Annual Growth Rate

Europe

In April, Eurozone inflation exhibited a substantial decrease to 6.9% for March data, down from 8.5% the previous month. Furthermore, the Eurozone's Composite PMI index climbed to an 11-month high of 54.4, marking a 0.7-point increase from the prior month and reflecting the most rapid growth in 11 months. Additionally, consumer confidence improved from -19.1 in March to -17.5 in April, reaching its highest level since February 2022. These indicators collectively point to an enhancement in both economic activity and consumer sentiment within the Eurozone. Owing to the aforementioned positive economic data and encouraging earnings results, the Euro STOXX 50 concluded April with a 1.79% increase in total return.

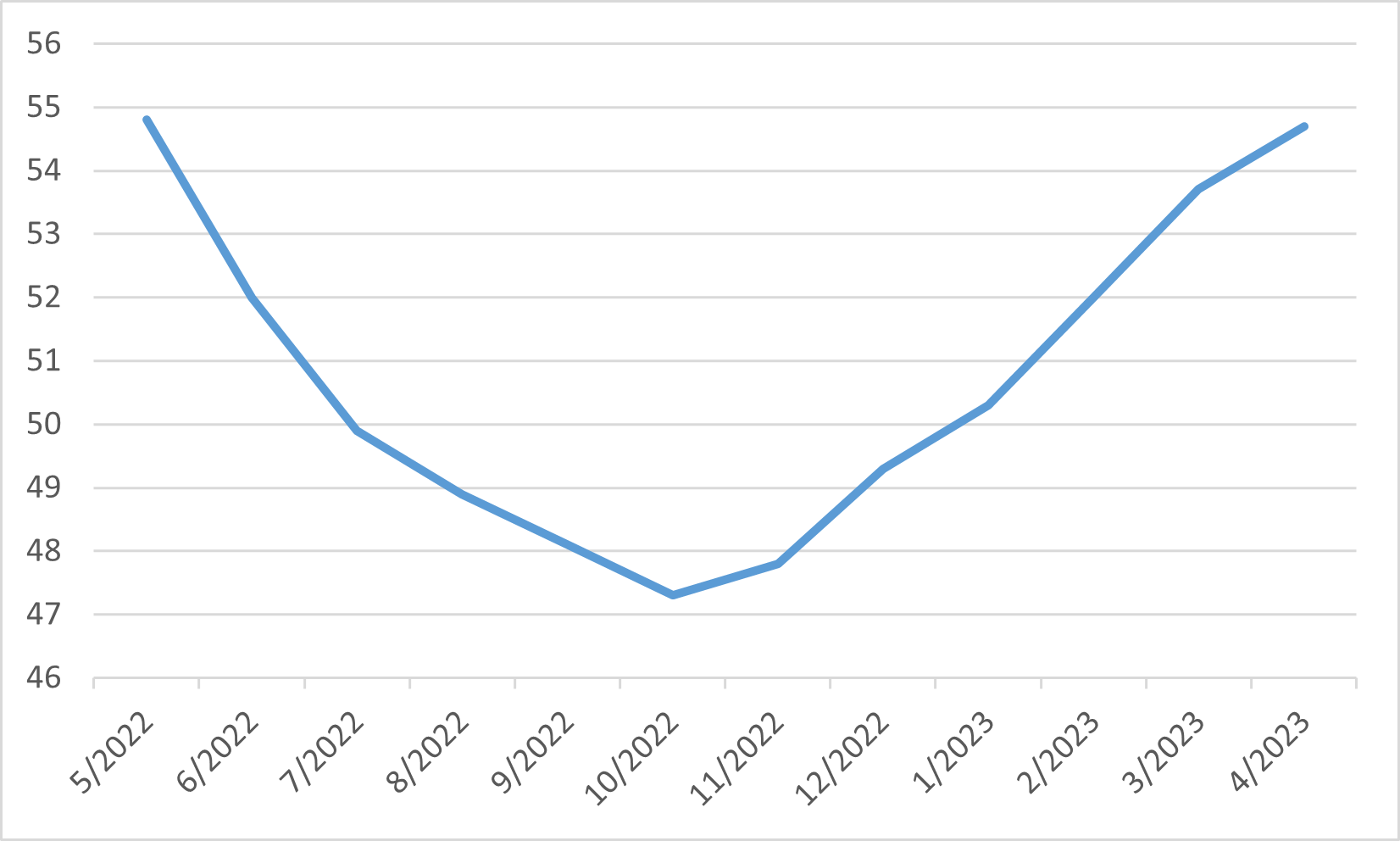

Eurozone Composite PMI