Monthly Market Outlook – May 2023

23rd June, 2023

U.S.

The US economy demonstrated moderate expansion during the first quarter, growing by 1.3%. Despite this growth, corporate profits saw a decline for the second consecutive quarter, albeit with better-than-anticipated results. Inflation displayed signs of moderation, with the CPI rising by 4.9% in April YoY, decelerating from March's 5% increase.

Artificial Intelligence (AI) became a prominent topic in the business sphere in May, with its growth potential capturing significant attention across financial channels. AI's influence on sectors such as finance, healthcare, and technology spurred widespread discussions and analyses.

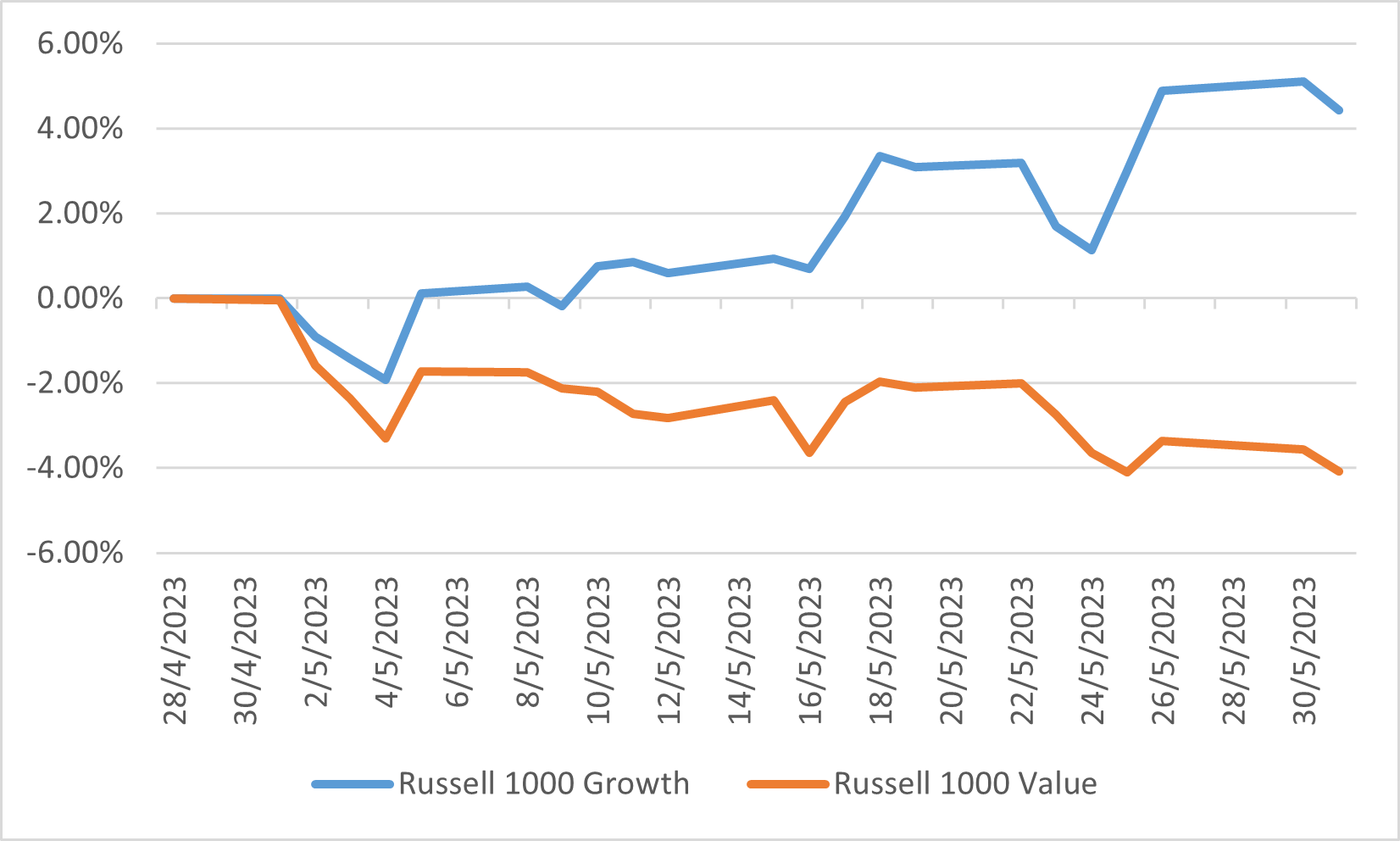

Equity markets exhibited mixed performance in May. The technology-focused Nasdaq Composite Index posted a notable 5.8% gain for the month and a 23.59% increase year-to-date. Conversely, the Dow Jones Industrial Average fell 3.49% in May and declined 0.72% year-to-date. The S&P 500 saw a modest 0.25% rise in May, bringing its year-to-date return to 8.86%. Sector performance varied in May, with growth stocks outpacing value stocks, as the Russell 1000 Growth Index gained 4.43% and Russell 1000 Value Index downed 4.09% in May. Small and mid-cap companies represented by the Russell 2000 index exhibited a flat performance, decreasing 0.66% year-to-date.

Russell 1000 Growth and Value Index performance

Japan

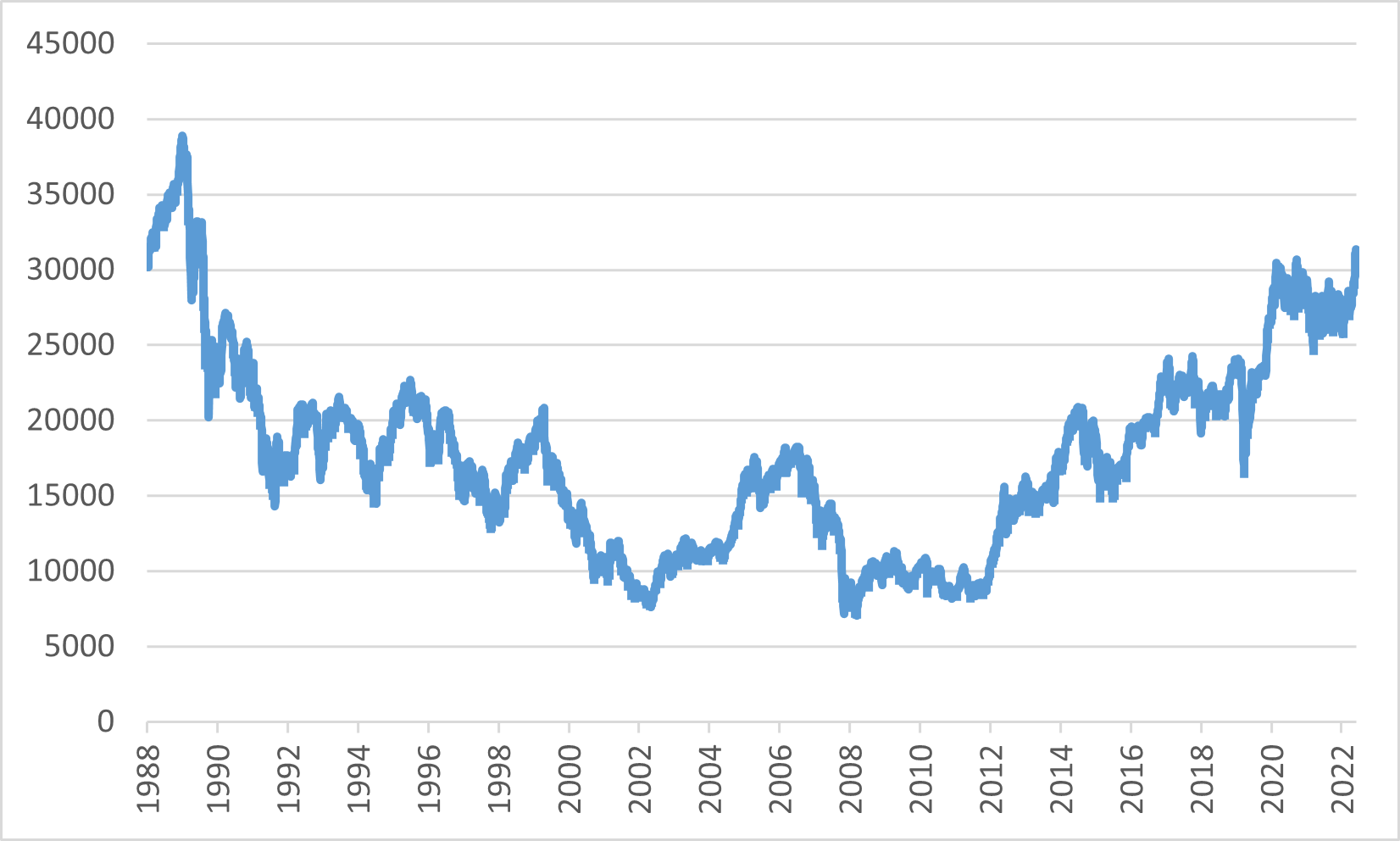

In May 2023, the Japanese stock market experienced a striking resurgence, reaching a 33-year high and garnering considerable attention from global investors. Numerous factors contributed to this surge, including the return of inflation, improved shareholder returns, and an endorsement from renowned investor Warren Buffett. The Nikkei 225 stock index, which remains only a fifth below its all-time high set during Japan's bubble era, has risen by 18.37% year-to-date, supported by a weakened yen that has favored companies with overseas operations. Additionally, increased share buybacks by Japanese firms have played a crucial role in propelling the market to new heights, with the total amount of share buybacks projected to reach a record level in 2023.

The booming Japanese stock market has captivated investors globally as the US and China confront economic challenges. Global institutional investors expressed confidence in Japan's stock market and anticipate further growth. However, some analysts have expressed concerns that the market rally may disappoint investors, given the significant historical levels the market has achieved and the potential for a slowdown in the US and Chinese economies.

In the broader economic context, Japan's automotive industry has also witnessed positive growth, with new sales YoY growth for the ninth consecutive month. The Japanese auto market recorded a 25% YoY growth in May, with sales reaching 326,730 units. This expansion signifies a recovering economy and mirrors the overall optimism in the country's business environment.

Nikkei 225 Index since economic bubble

China

May was a challenging month for China’s stock market, as investors voiced concerns about the nation's economic recovery and the impact of various headwinds. Despite initial optimism following the easing of pandemic restrictions, Chinese stocks faced significant downward pressure, with the Hang Seng Index and CSI 300 experiencing declines.

One of the key reasons for the decline in Chinese stocks was the mixed data on the country’s manufacturing sector, which is seen as a vital indicator of overall economic health. Factory performance in China raised concerns, as some reports indicated weaker than expected results. The uncertainty surrounding the recovery of China’s factories had a negative impact on investor sentiment.

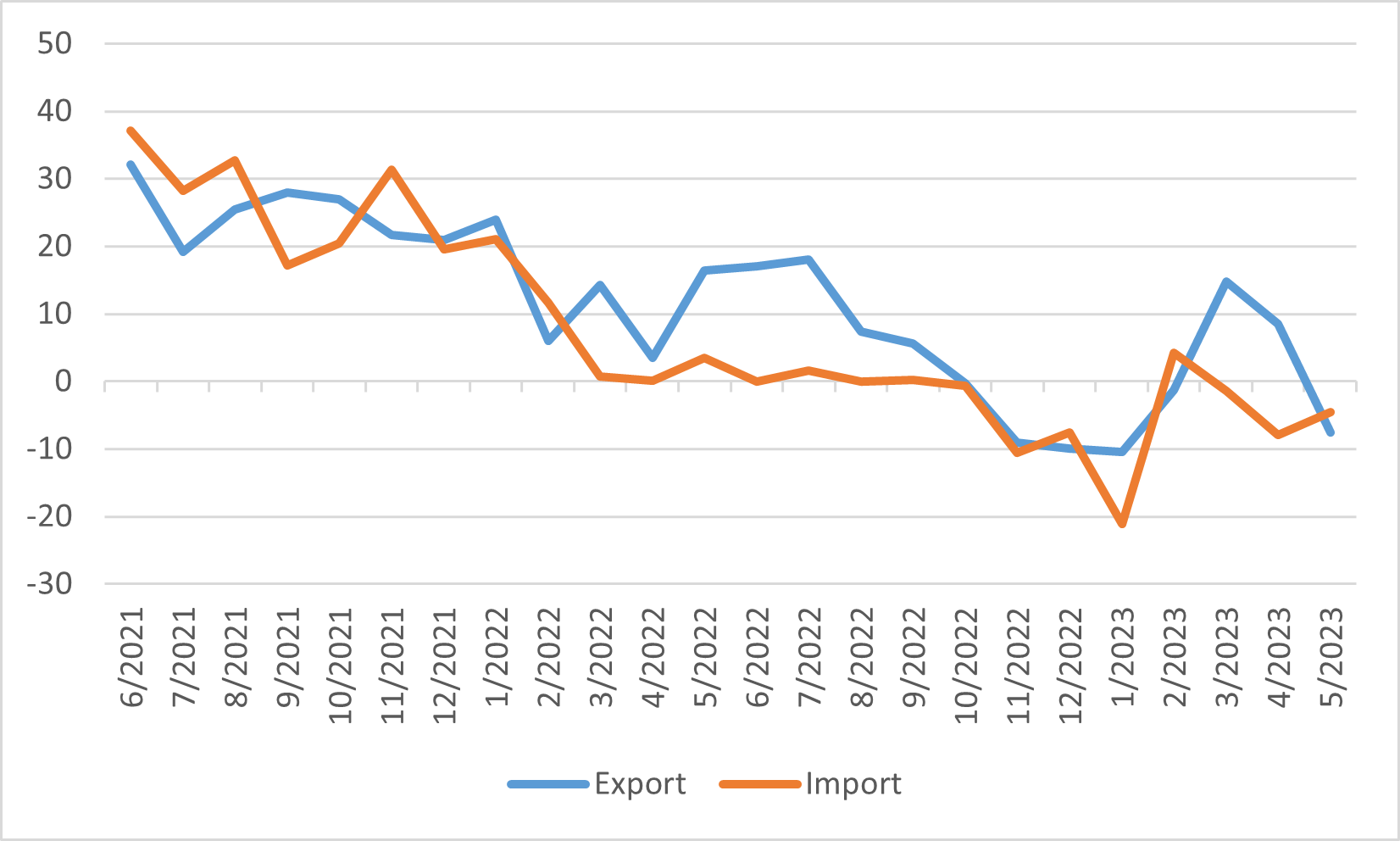

Furthermore, China's May trade data added to the concerns. The trade figures fell short of expectations, with exports experiencing a sharp decline of 7.5% compared to the forecasted 0.4% fall. Imports also saw a smaller decline of 4.5% YoY. Weaker trade performance raised questions about the country's economic stability and its ability to sustain growth.

These factors, combined with geopolitical risk, led Chinese stocks to lose their gains for the year, and the Hang Seng Index briefly entered a bear market at the month end. Investors' sentiment turned cautious as uncertainties surrounding China's economic trajectory intensified.

China Export and Import Trade YoY%

Europe

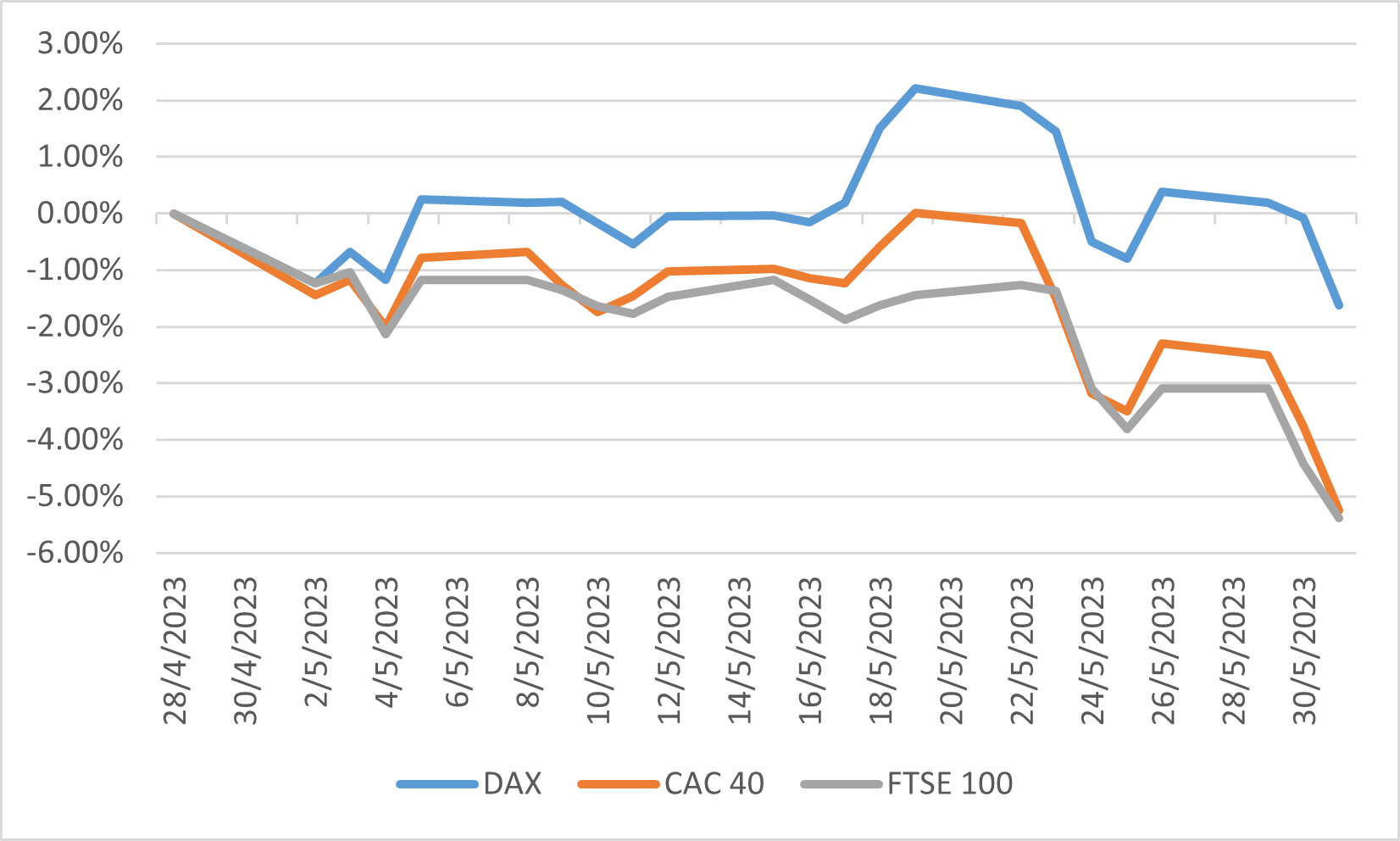

Eurozone shares weakened in May after a generally positive year so far. The DAX, CAC 40, and FTSE 100 indexes declined 1.62%, 5.24%, and 5.39% respectively. All sectors fell aside from the information technology sector, which was bolstered by the growth potential stemming from AI.

More recent data indicated slowing momentum in the current quarter. The Eurozone composite purchasing managers' index dropped to 52.8 in May from an 11-month high of 54.1 in April. Meanwhile, the headline inflation rate rebounded to 7% in April from a one-year low of 6.9% in March, due to a 3.3% increase in energy price inflation. In response to this inflation backdrop, the European Central Bank raised all three key interest rates by an additional 0.25%.

Eurozone's indexes performance in May