Monthly Market Outlook – Jun2023

21st July, 2023

U.S.

In June, the US Federal Reserve made a notable decision, opting to forgo another rate hike despite the prevailing environment of increasingly restrictive monetary policy. Federal Reserve Chair Jerome Powell clarified that they did not use the term "pause" in their policy statements. However, the Federal Reserve's decision to hold rates steady in June was perceived as a pause in its tightening cycle by the market, though the central bank still conveyed its commitment to combatting inflation. Market participants anticipated at least one more rate hike in 2023 as part of the Fed's efforts to tackle inflationary pressures. Despite rising rates and a twist in the yield curve affecting Treasury strategies, segments like high yield performed well alongside equity markets. The Bloomberg US Corporate High Yield Index increased by 1.67% during the month.

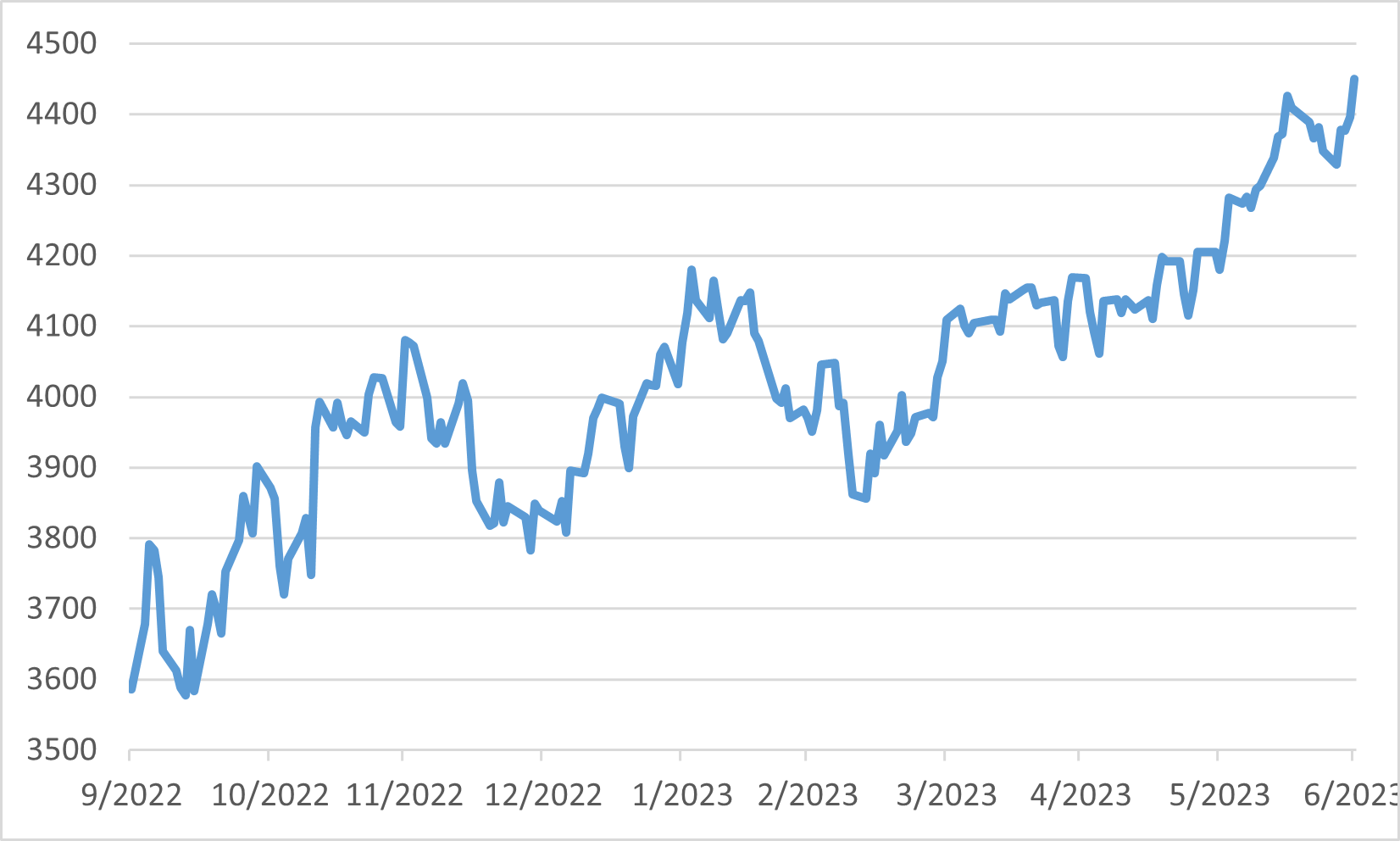

During the same month, US equities displayed positive performance, with the S&P 500 gaining 6.47%, the NASDAQ surging by 6.59%, and the Dow Jones Industrial Average rising by 4.56%. All 11 sectors within the S&P 500 showed positive results for the month. The technology sector played a pivotal role in the market's rally, led by mega-cap technology companies. This rally contributed significantly to the S&P 500's substantial growth from the bear market low experienced in October 2022.

Notably, the small-cap stocks demonstrated an impressive rally in June, with the Russell 2000 Small Caps index surging by 7.95%. This indicated a broadening of contributors to returns compared to the previous month.

S&P 500 performance after October 2022

Japan

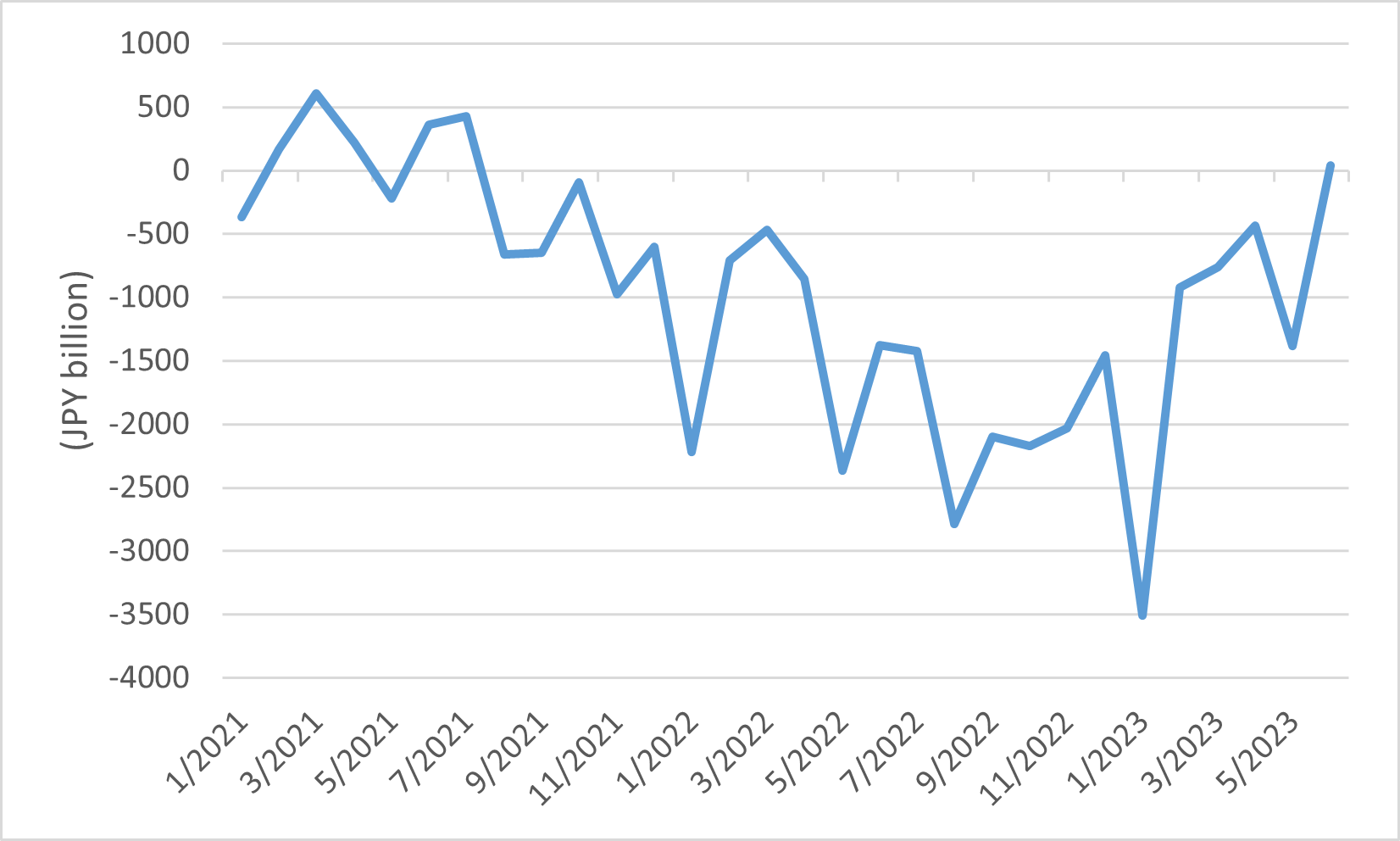

Japan's exports recorded a modest year-on-year increase of 1.5% in June, falling short of market expectations of a 2.2% gain. In contrast, imports experienced a decline of 12.9% year-on-year during the same period. This unexpected shift led to a notable surprise in Japan's balance of trade, as the country unexpectedly swung to a surplus for the first time since July 2021. The trade surplus amounted to 43 billion yen ($308 million), defying earlier forecasts of a 46.7 billion yen deficit. While this outcome is likely to alleviate some pressure on the country's economic recovery, risks still linger concerning the overall growth outlook.

In tandem with the positive economic data, the Japanese stock market continued its remarkable rally in June, reaching a 33-year high for the Nikkei 225. Notably, foreign investors played a significant role in driving market gains, showing particular interest in large-cap value stocks. During the month, the TOPIX 12-month forward PE Ratio reached mid-14x levels, indicating market optimism. Moreover, fuelled by the enthusiasm surrounding artificial intelligence (AI), the technology sector played a pivotal role in propelling the market's upward trajectory.

In contrast to other central banks globally that raised interest rates, the Bank of Japan (BOJ) opted to maintain unchanged interest rates in June. The BOJ's decision was influenced by easing inflationary pressures within the economy. However, similar to its counterparts, the BOJ faces challenges in striking a balance between promoting low and stable inflation, fostering robust economic growth, and ensuring financial stability. These considerations will be crucial for the BOJ as it navigates the path ahead.

Japan's Balance of Trade

China

China's GDP growth in the second quarter of 2023 reached 6.3%, falling short of market expectations of a more robust 7.3% expansion. While there was an improvement compared to the first quarter, the growth rate still remained below forecasts, mainly due to weak export demand and declining property prices, negatively impacting consumer confidence.

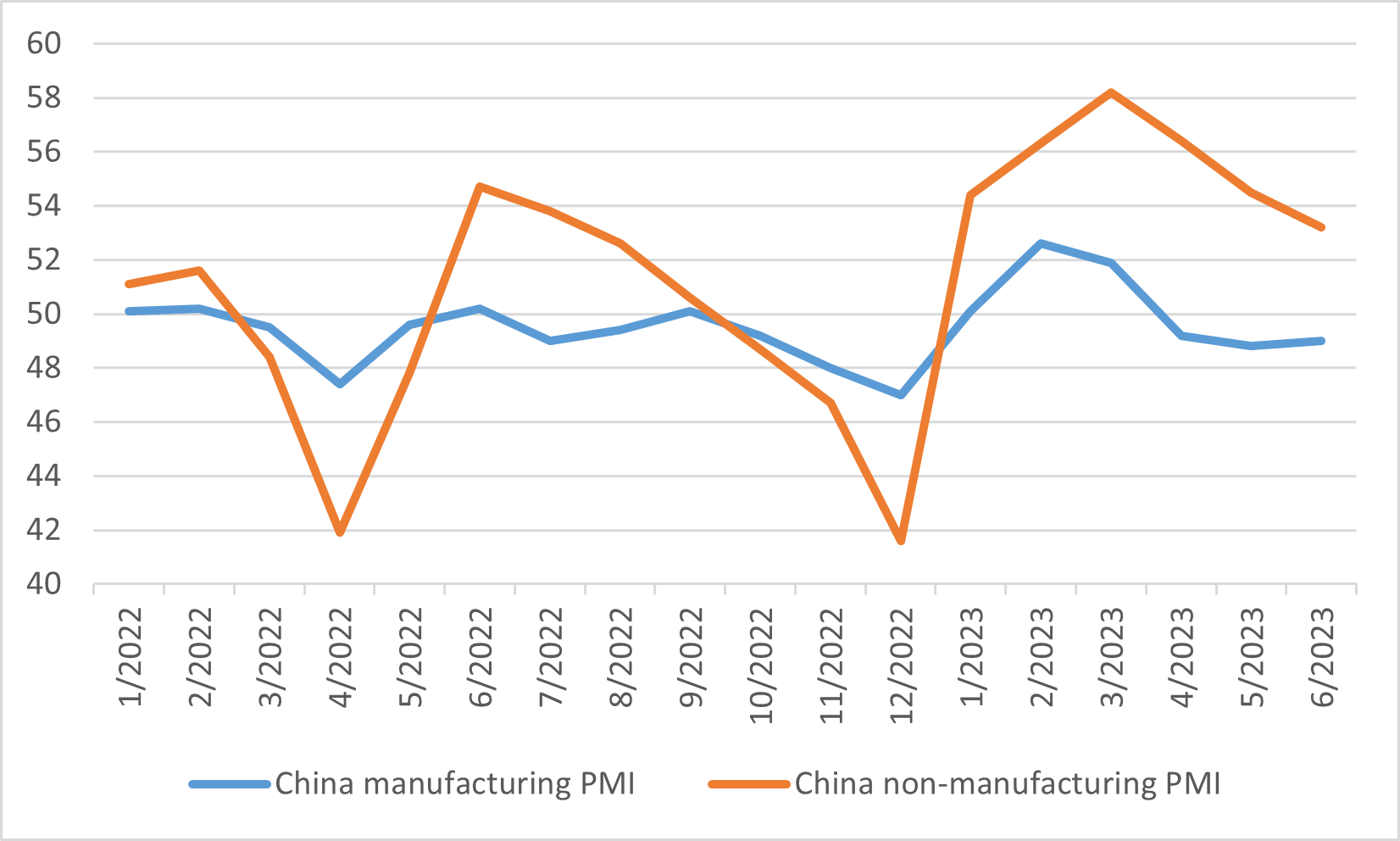

Adding to the concerns, China's factory activity contracted for the third consecutive month in June, indicating a mixed recovery as growth momentum weakened. Both manufacturing and non-manufacturing activities displayed signs of weakness, reflecting the impact of the global economic slowdown on China's external demand. The official manufacturing PMI for June came in at 49.0, slightly above the 48.8 recorded in May but still indicating contraction. The non-manufacturing PMI also weakened, reaching 53.2 in June, marking the fourth consecutive month of decline. Policymakers faced the challenge of stimulating economic momentum amidst a complex geopolitical and international economic landscape.

The sluggish pace of economic growth in the second quarter raised concerns among policymakers about the need for further policy support to sustain economic activity. Striking a delicate balance between supporting the economic recovery and avoiding excessive stimulus to mitigate debt risks and structural distortions posed a significant challenge for Chinese authorities. In this fragile economic environment, careful policy interventions were essential to stabilize economic momentum and address unemployment issues.

China manufacturing and non-manufacturing PMI

Europe

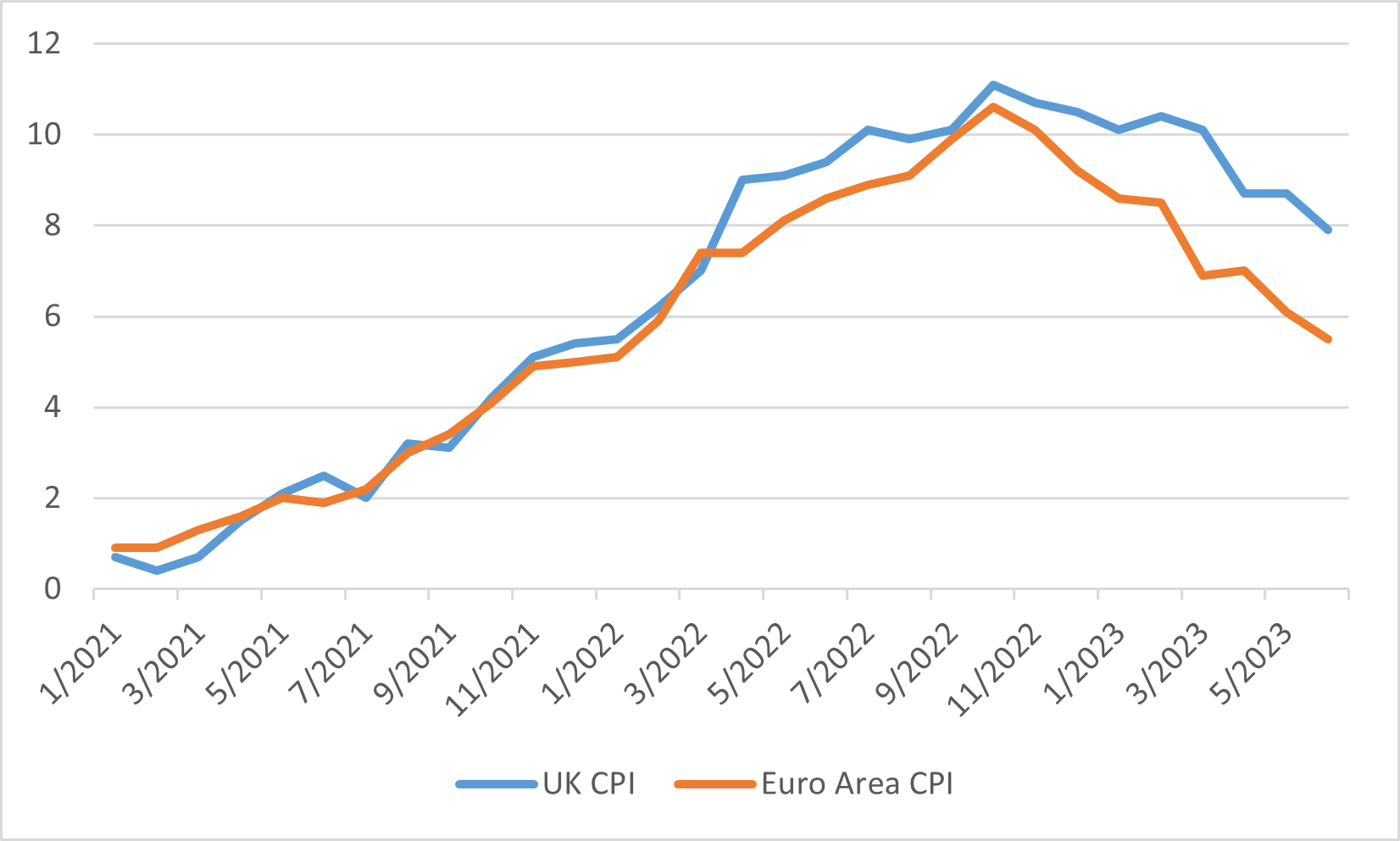

In June 2023, central banks in the UK and Europe responded to inflation concerns by raising interest rates. The Bank of England took a noteworthy step, implementing a 50 basis points increase in rates, demonstrating its commitment to combat inflationary pressures and achieve financial stability. This move had ripple effects on financial markets, particularly impacting fixed-income investments, where prices and yields moved in opposing directions. As a result, investors kept a close watch on central bank actions to gauge their potential impact on economic growth and overall financial stability.

Despite the rate hikes in both the European and UK markets, there was a notable decline in the inflation rate, bolstering market sentiment. This positive shift was reflected in UK and Eurozone shares, which rebounded after experiencing weakness in May. Specifically, the FTSE 100, DAX, and CAC 40 indexes rose by 1.15%, 3.09%, and 4.25%, respectively. Investors welcomed this development as it provided some reassurance amid the backdrop of rising interest rates and inflationary concerns.

UK and European CPI