Monthly Market Outlook – Jul 2023

21st August, 2023

U.S.

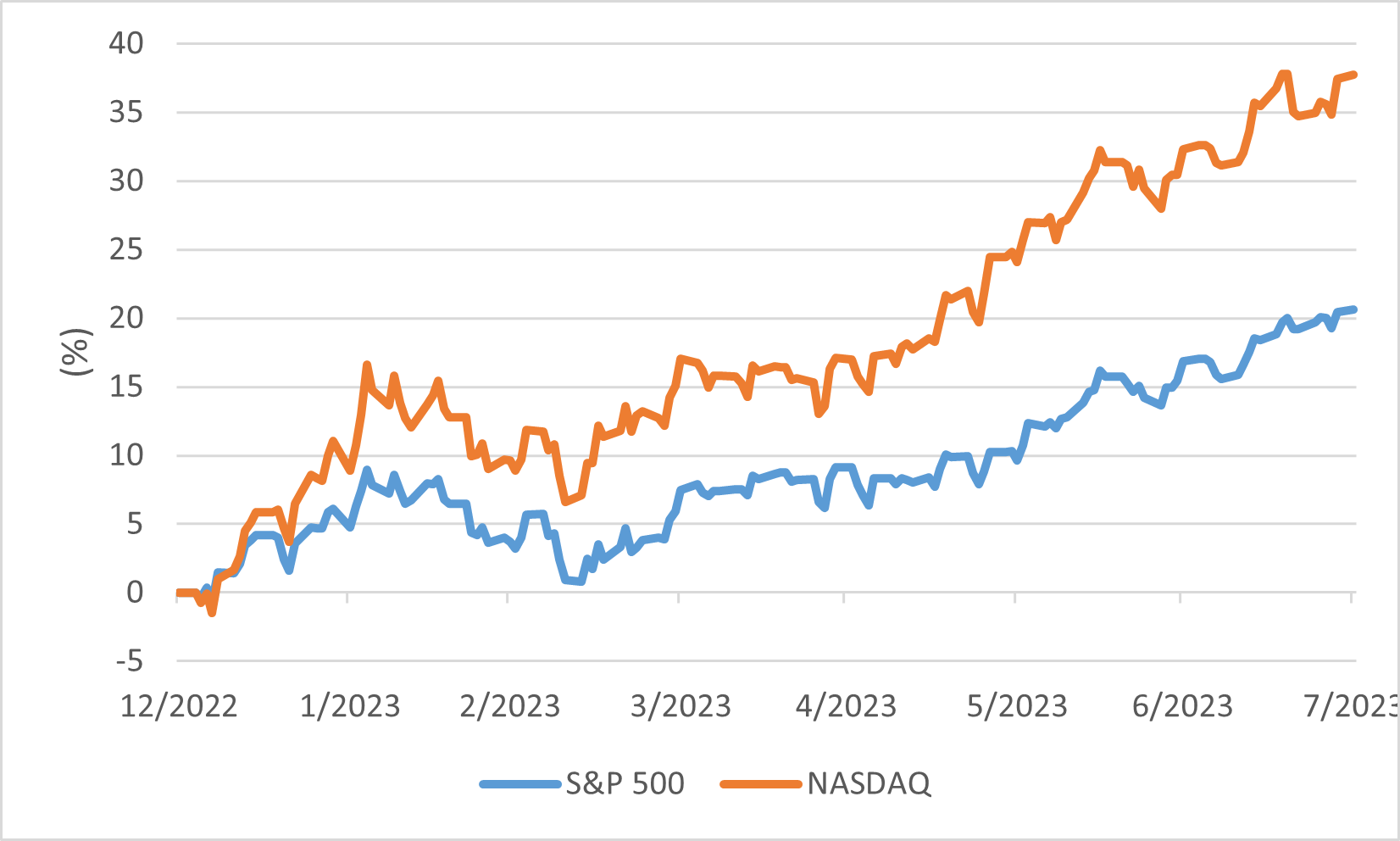

The major indexes in the U.S. - S&P 500, NASDAQ Composite and Dow Jones Industrial Average closed the month appreciating with 3.11%, 4.05% and 3.35%, earnings reports played a pivotal role in shaping market sentiment. The month saw several companies releasing their quarterly earnings, providing insights into their financial health and performance.

A significant factor in the market's performance has been the ongoing discussions around inflation. With the S&P 500 and NASDAQ Composite having staged an impressive 20.64% and 37.72% advance in total return so far in the year, questions about the market's ability to sustain this rally have emerged. Inflation has been a central point of concern, as rising prices can impact consumer behaviour, corporate earnings, and monetary policy decisions. Despite these concerns, the market continued to demonstrate strength, although discussions around its sustainability remained ongoing.

The rally was not without its challenges. The discussions around inflation, interest rates, and global economic factors have created an environment where investors are closely monitoring market movements and adjusting their strategies accordingly. Rising interest rates, for example, can have ripple effects on the financial markets, including the stock market, as borrowing costs increase and valuations adjust accordingly.

S&P 500 & NASDAQ performance

Japan

In July 2023, the Japanese stock market showcased various dynamics that shaped its performance. The TOPIX index experienced a 1.48% increase, demonstrating the continuation of its rally. In contrast, the Nikkei 225 index witnessed a minor decline of 0.05%.

The Japanese stock market's rising streak encountered a pause in July, with the market trading sideways. This shift came after the Bank of Japan expected inflation to slow for a while due to the fading effect of past rises in import prices, before picking up again into 2024. However, despite this temporary halt, the Japanese stock market remains a focus for investors, and analysts have been closely observing market trends and events that could influence its trajectory. Amid continued foreign investor interest, Japanese equities demonstrated resilience. A strong second quarter of 2023 was observed, supported by a weak yen that benefited the country's economic landscape.

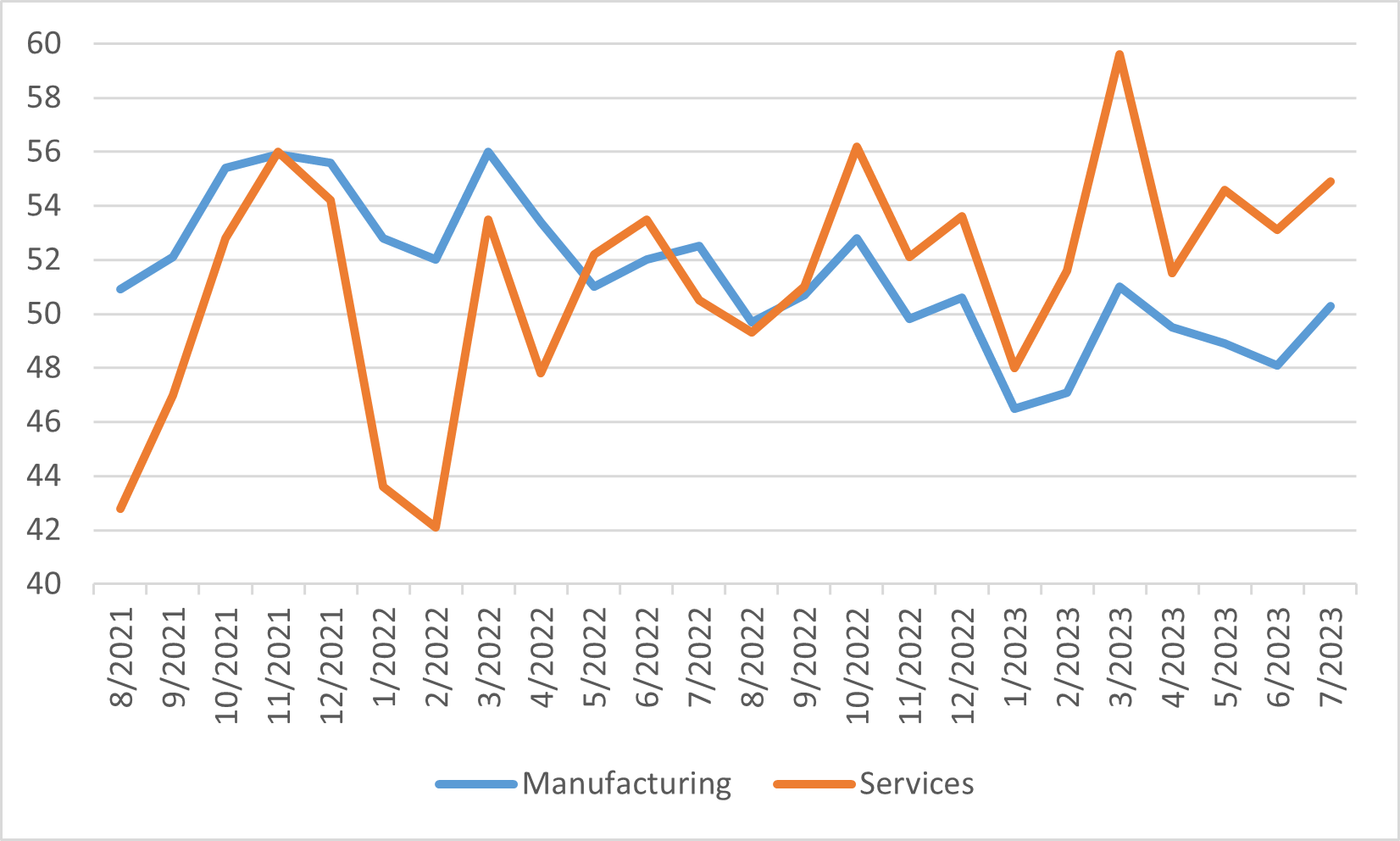

One significant factor affecting the Japanese economy in July was its sustained economic growth. Japan's private sector economy continued to expand at a robust pace during the first half of 2023. Flash PMI data indicated strong growth and indicated the country's ability to sustain positive economic momentum.

Japan Manufacturing and Services PMI

China

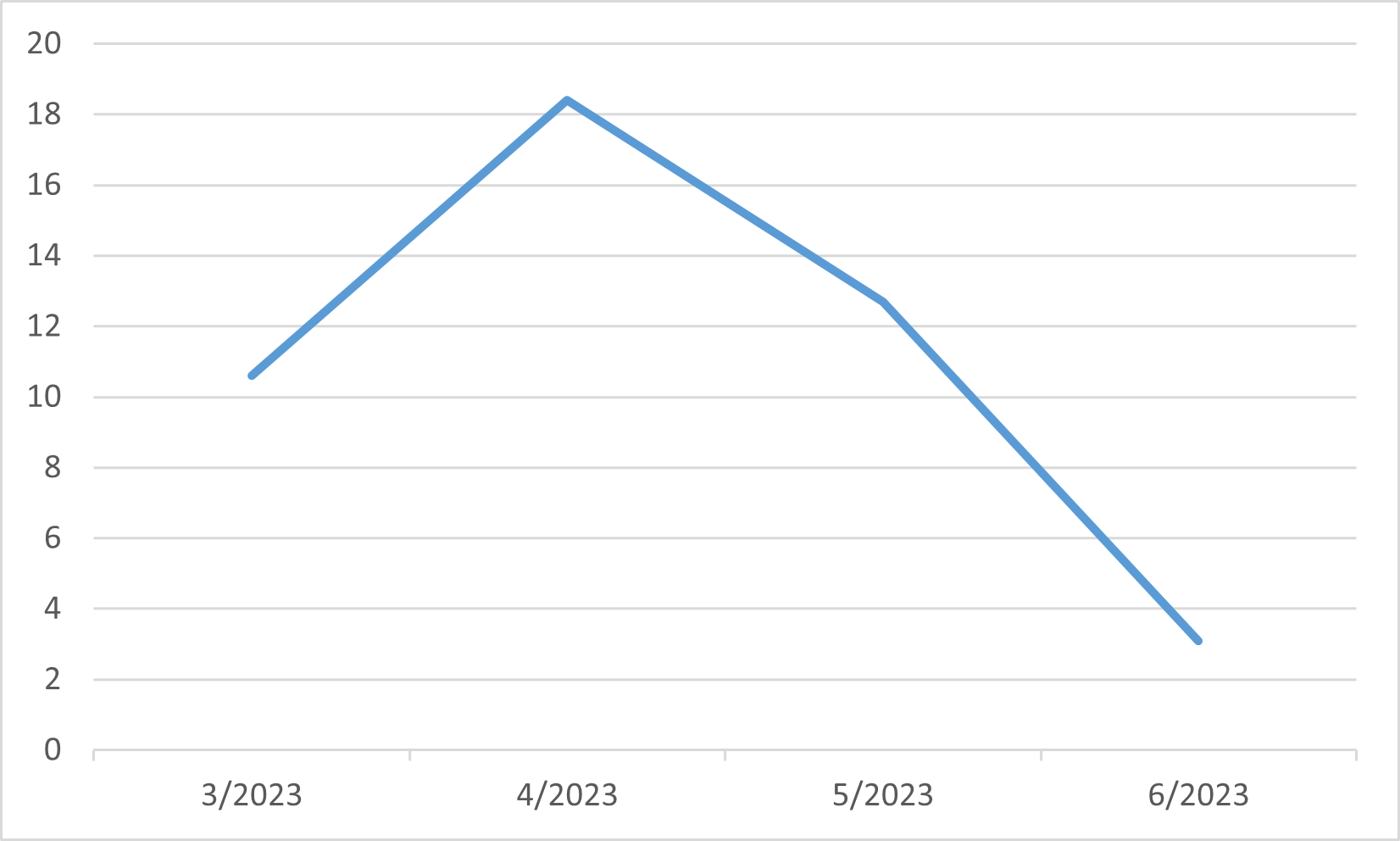

In stark contrast to the economic trajectory witnessed in the United States, China's consecutive economic expansion displayed deceleration during the second quarter. Notably, the growth registered a mere 0.8% quarter-on-quarter increase. This moderation can be attributed to the deceleration of investment activities alongside the persistent frailty in both consumer and business confidence. A conspicuous decline in June's retail sales figures, standing at 3.1% year-on-year, further underscores the impact of adverse wealth dynamics brought about by lacklustre stock market performance and the wavering real estate sector.

In the wake of this disheartening GDP data, the Chinese government and the State Council issued a comprehensive document outlining strategies aimed at buttressing the private sector. Noteworthy developments emerged during the Politburo meeting in late July, wherein subtle shifts in language surrounding the property market were observed. Notably, the phrase "housing is for living, not for speculation" was omitted, and instead, emphasis was placed on the responsiveness of housing policy to the dynamic shifts in supply and demand conditions. The response from financial markets to these developments has been marked by optimism, primarily stemming from the presumed intent to deploy more robust economic support measures. Hang Seng and CSI 300 Indexes gained 6.15% and 4.48% in July. However, it is pertinent to note that specific directives pertaining to stimulus initiatives or policy relaxation are still pending official announcement.

China Retail Sales Value YoY (%)

Europe

Throughout the month of July, the Eurozone equities market exhibited notable gains, bolstered by a concurrent decrease in inflationary pressures and encouraging indicators of economic growth. CAC40 and DAX closed with 1.32% and 1.85% gain. A discernible trend was witnessed wherein the real estate, energy, and materials sectors emerged as frontrunners in terms of growth, while the consumer staples, information technology, and utilities sectors experienced comparatively subdued performance.

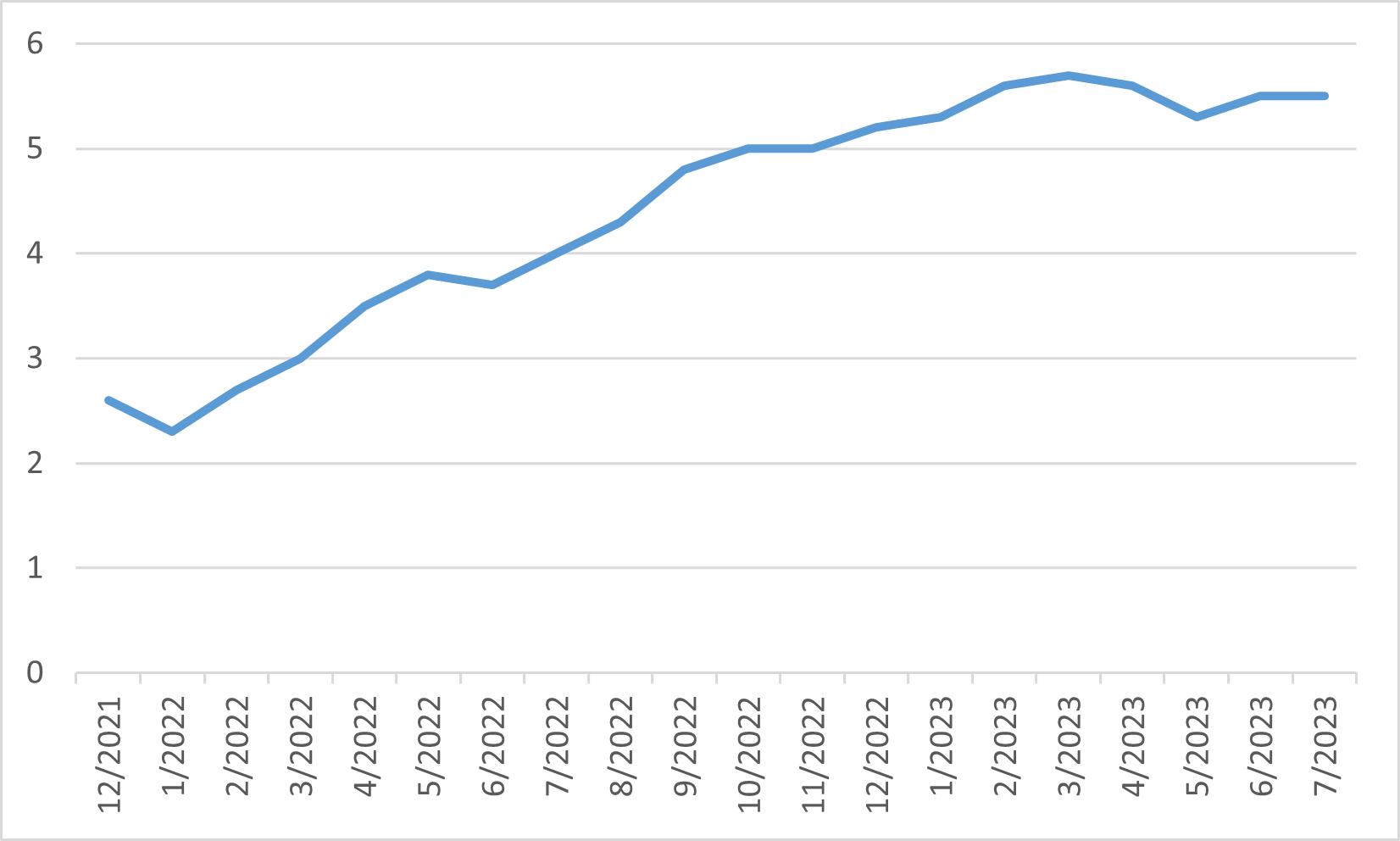

Against the backdrop of these market dynamics, a pivotal development took place as the ECB opted to raise its interest rates by a modest 25 basis points during the same month. For the month of July, the Eurozone witnessed a recalibration in its annual inflation metrics, as the figure was approximated at 5.3%, down from the preceding month's reading of 5.5%. It is worth highlighting, however, that a pertinent consideration is the enduring resilience of core inflation, which persists at the level of 5.5%.

Eurozone Core Inflation