Monthly Market Outlook – Aug2023

22nd September, 2023

U.S.

In early August, Fitch, the credit rating agency, downgraded the credit rating of the US government from AAA to AA+. Although this downgrade sparked intense debates in political and economic circles, it had minimal impact on the 10-year US Treasury yields. The yields barely rose following Fitch's announcement. However, later in the month, yields experienced an increase due to better-than-expected economic data and strong issuance.

Overall, the economic data in the US remained robust. Non-farm payrolls indicated a slightly cooling but still resilient job market in July, with gains of 187,000, slightly below the consensus expectation of 200,000. The unemployment rate decreased to 3.5%, while average hourly earnings showed stronger growth than anticipated at 4.4% year on year. Retail sales also exhibited positive growth, rising 0.7% month on month in July, surpassing the expected 0.4% increase.

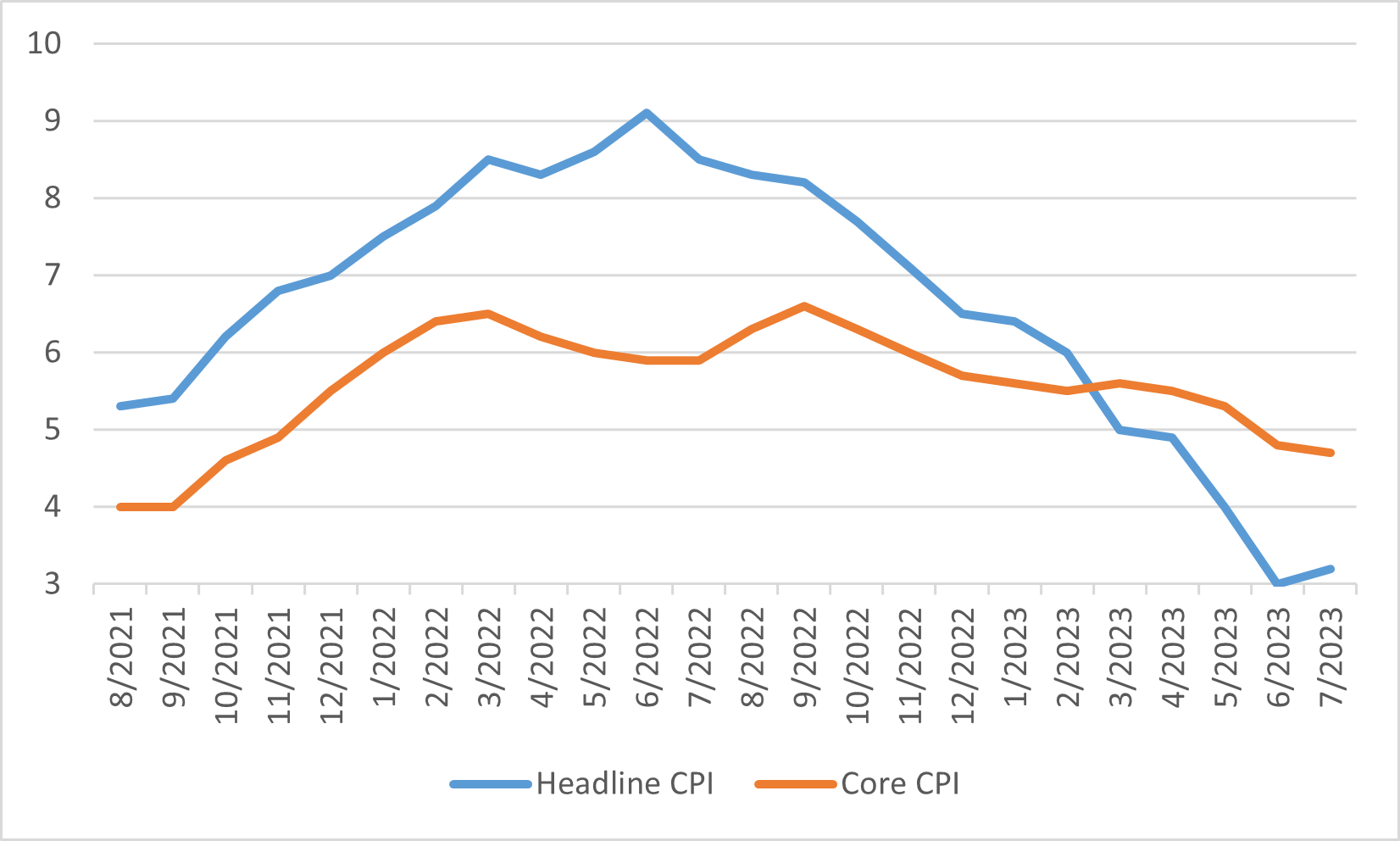

Regarding inflation, the headline CPI experienced a slight uptick in July, reaching 3.2% due to higher food and energy prices. However, core CPI decelerated slightly to 4.7% from 4.8% in June. The Federal Reserve's July meeting minutes revealed that most officials maintained concerns about inflation, thus keeping the possibility of additional rate hikes open. Jerome Powell's speech at the Jackson Hole symposium was well received by financial markets, signalling a positive response. Overall, the Federal Reserve's policy will remain dependent on incoming data, leaning towards tightening if deemed necessary.

Despite the relative strength of the US economy, the S&P 500 index experienced a 1.59% decline in August as yields rose. The higher rates and increased volatility supported the US dollar, and the index ended at 103.62 at the end of August.

US Headline and Core CPI

Japan

In August, the Japanese equity market demonstrated a nuanced trajectory, with the TOPIX registering a 0.4% increase within the local context. Conversely, the Nikkei 225 experienced a decline of -1.7%, serving as an indication of the vulnerability observed in large-cap growth stocks. The market initially adopted a risk-off stance, partly influenced by the downward trend observed in US stocks.

The policy adjustment implemented by the BOJ towards the end of July triggered a modest upswing in Japanese government bond yields. This, in turn, led to a sell-off of large-cap growth stocks. However, on a contrasting note, domestically-oriented stocks within the mid and small-cap segments demonstrated commendable performance, bolstered by encouraging indications of inbound tourism, notably from China.

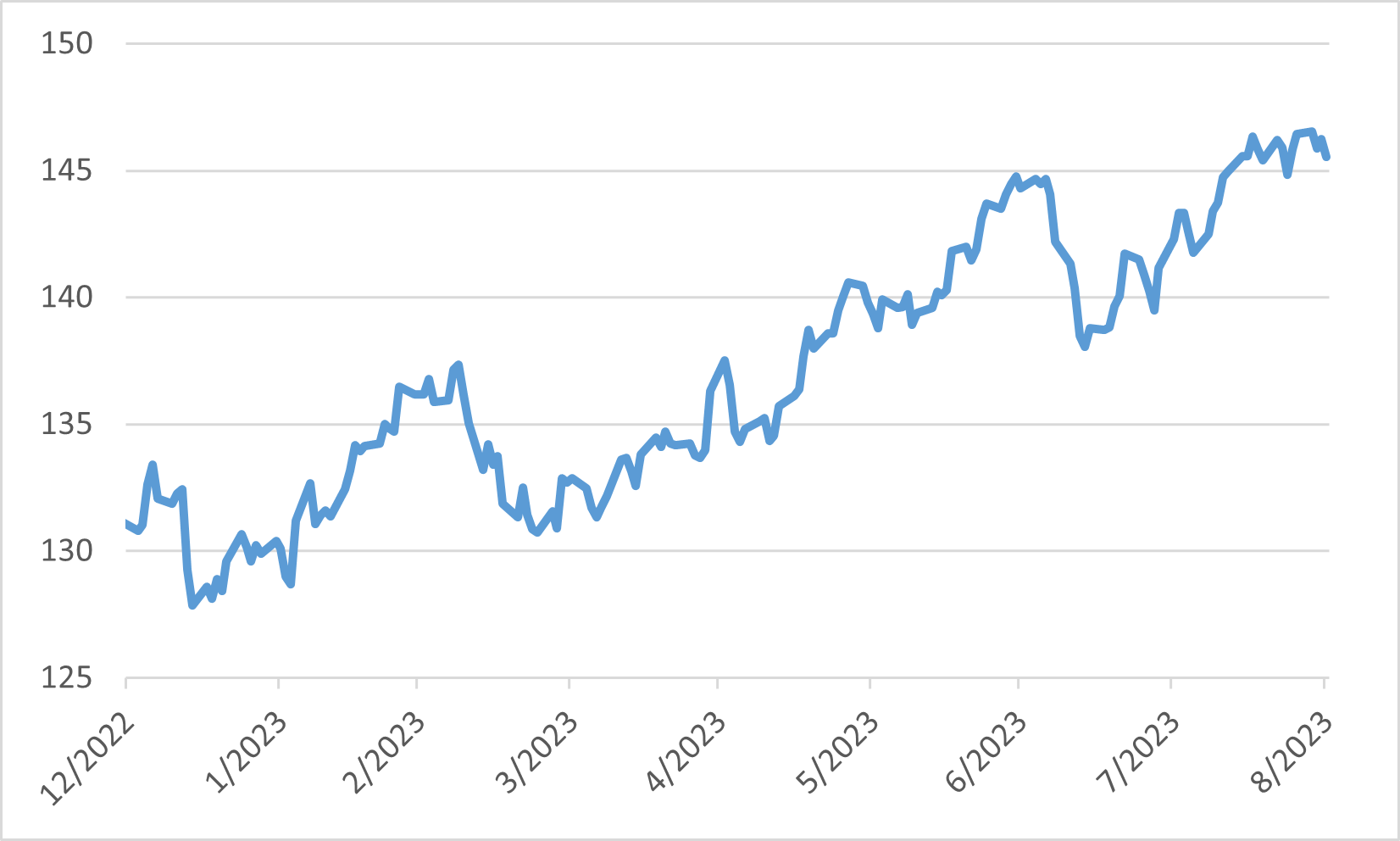

As the month progressed, the market sentiment displayed a more positive outlook, primarily attributed to the sustained strength of Japanese corporate earnings. Notably, numerous estimates were revised upwards, further contributing to the optimistic atmosphere. Nevertheless, market sentiment faced a degree of weakening due to prevailing political tensions, both domestically within Japan and in relation to China. The Japanese yen continued to exhibit weakness, maintaining relative stability at around the 146 level against the US dollar.

USD to JPY Exchange Rate

China

In China, the activity data revealed considerable weakness, falling short of expectations. Notably, the CPI recorded a negative growth rate of -0.3% in July, while the PPI continued its deflationary trend for the tenth consecutive month. Furthermore, retail sales experienced a significant deviation from anticipated growth, expanding by 2.5% instead of the expected 4.5%.

Chinese investment data further underscored the prevailing low business confidence, with private investment declining by 2.3% in July. Additionally, the official Manufacturing PMI indicated the fifth consecutive month of contraction, signalling enduring weakness in the sector. Among the various sectors, the property sector emerged as the weakest, as investors grappled with uncertainty regarding the extent of stimulus measures that Beijing would implement. The challenges faced by companies such as Country Garden and Evergrande served to highlight the vulnerability of the property sector in August.

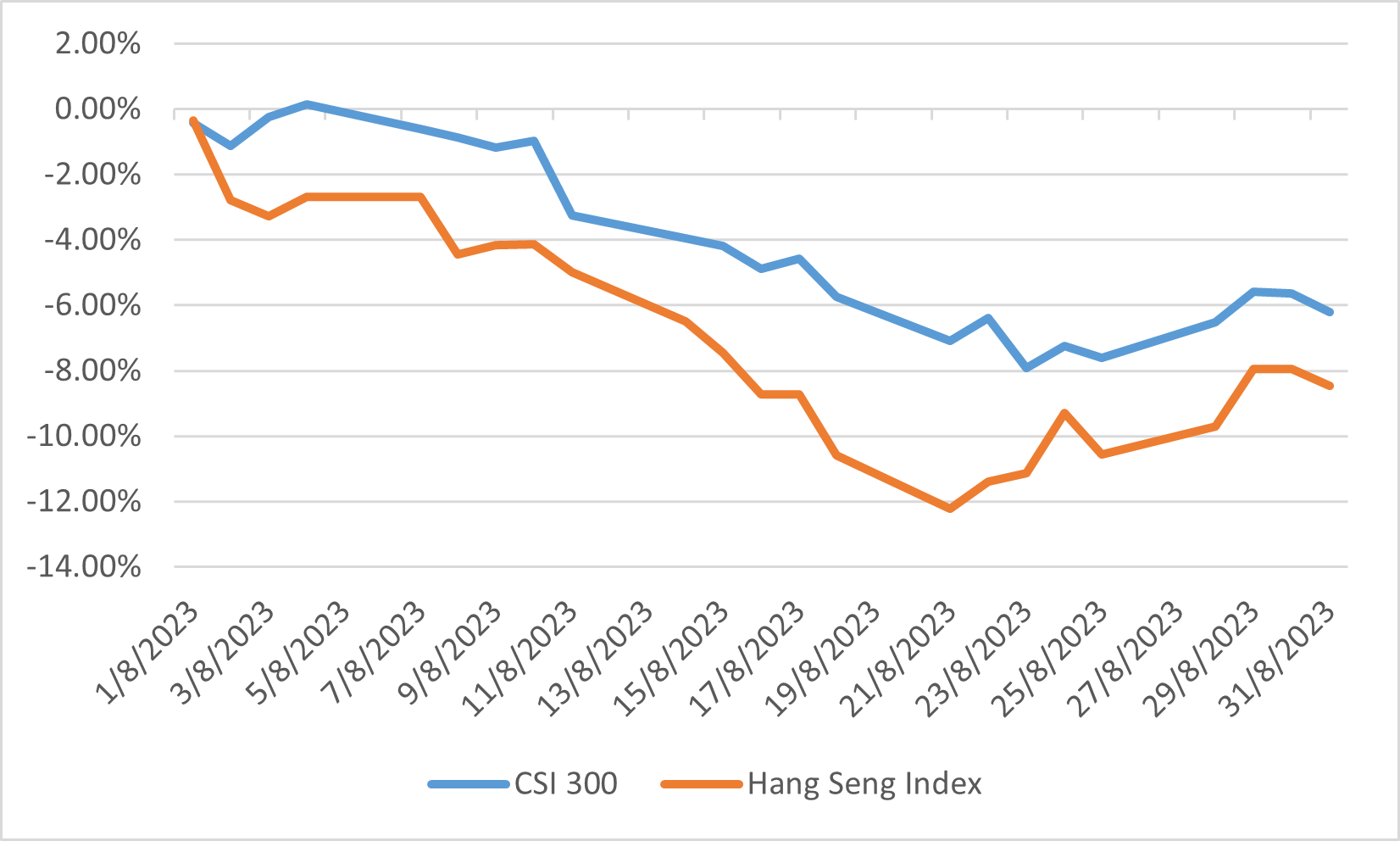

To address these challenges and mitigate deflationary risks, the PBoC implemented two interest rate cuts in August. However, credit demand has thus far remained subdued. Towards the end of the month, the government in Beijing introduced several initiatives aimed at bolstering confidence in the struggling stock market. These measures included reducing the stamp duty levied on share transactions and slowing down the pace of initial public offerings in Shanghai and Shenzhen. Despite these efforts, the Renminbi experienced a depreciation of 1.63% against the US dollar over the course of the month, while the CSI 300 and Hang Seng index witnessed a significant decline of 6.21% and 8.45%.

Index Performance in August

Europe

According to Eurostat's flash GDP estimate, the euro area experienced a modest QoQ growth of 0.3% in Q2 2023. Despite this relatively moderate pace, the labour markets in the euro area remained highly tight, with the unemployment rate reaching a record low of 6.4% in July. However, the economic outlook is clouded by uncertainty, as evidenced by the August composite PMI falling to 46.7, its lowest level since the Covid-19 pandemic struck in 2020.

In terms of inflation, the headline figure in the Eurozone defied expectations by remaining unchanged at 5.3% in August. However, there was a slight decrease in core inflation, which fell from 5.5% in July to 5.3% in August. Although there has been some improvement, inflation levels remain significantly above the ECB's target. Consequently, the market continues to factor in the possibility of further ECB rate increases before the year concludes.

During August, Eurozone shares experienced a decline. Only the energy and real estate sectors managed to register a positive return, while all other sectors saw a decrease. Notably, sectors most sensitive to the economic environment, such as consumer discretionary, recorded some of the sharpest declines.

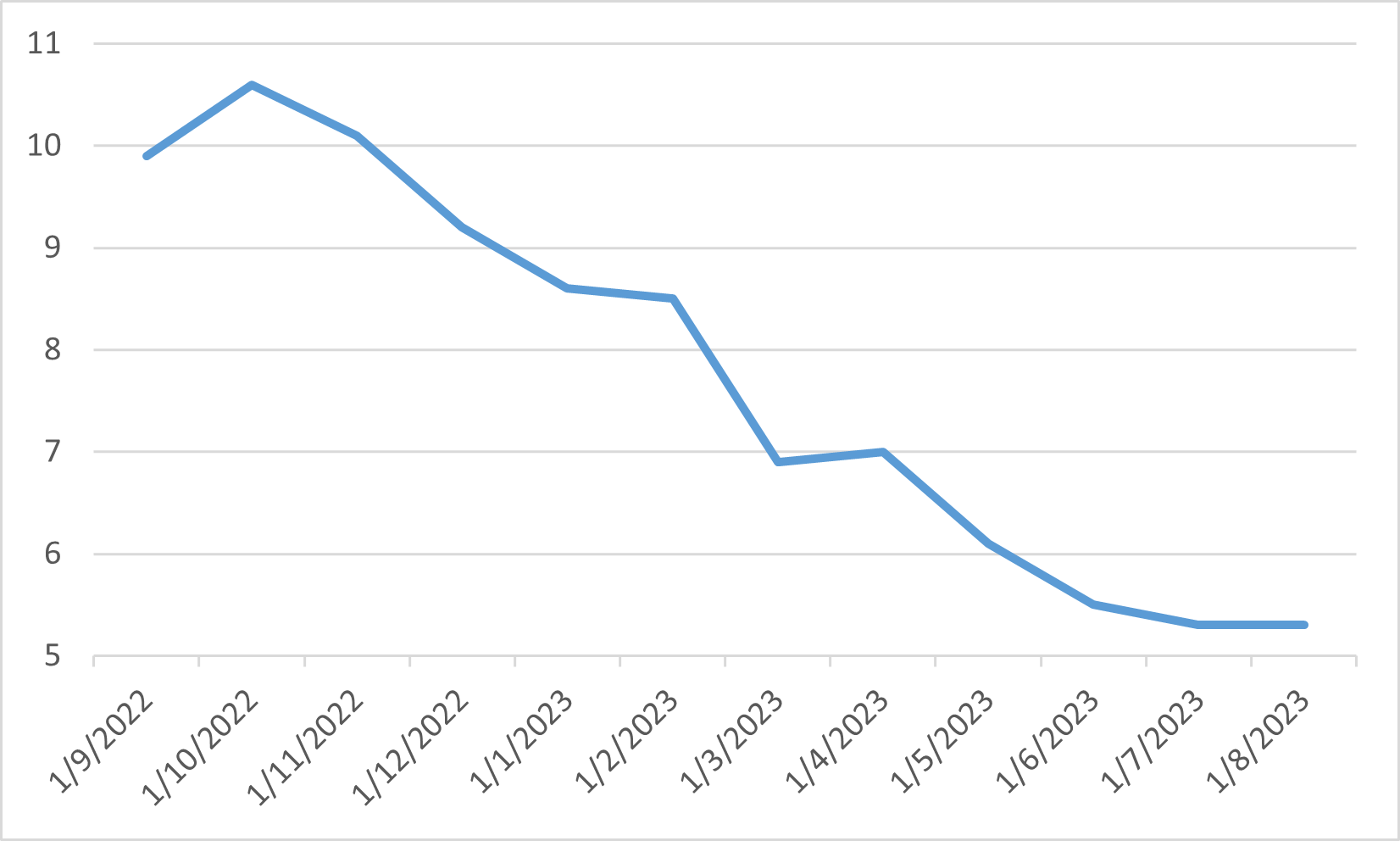

Euro area Headline Inflation