Monthly Market Outlook – Sep 2023

20th October, 2023

U.S.

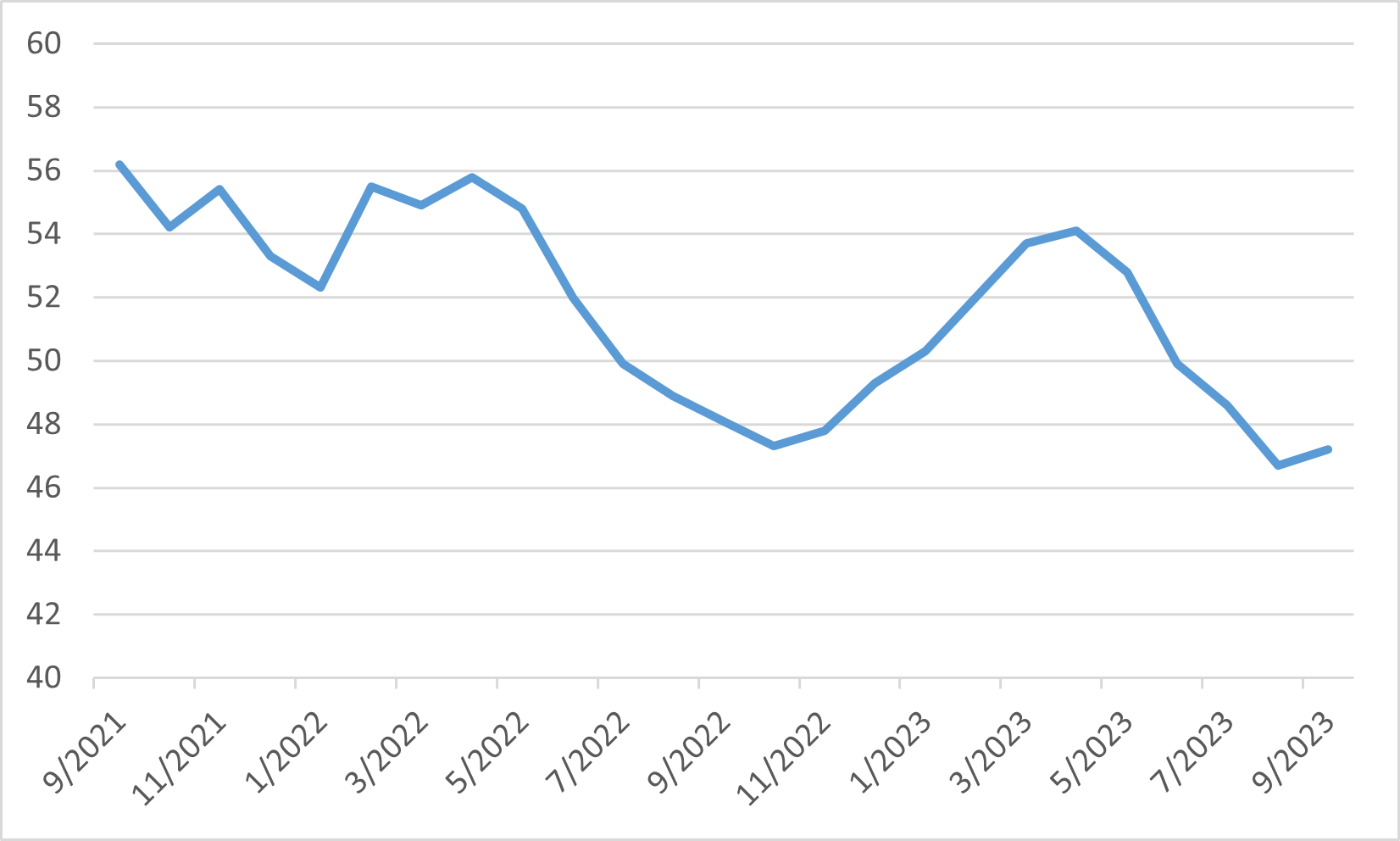

In September, stock prices experienced widespread declines across major indexes. The NASDAQ, S&P 500, and Dow Jones Industrial suffered notable decreases of 5.81%, 4.87%, and 3.50%, respectively. Concurrently, fixed-income markets faced pressure as the yield on the benchmark 10-year U.S. Treasury note surged to approximately 4.67%, reaching its highest level in 16 years before experiencing a slight decline towards the end of the month.

As expected, the Fed maintained the interest rate at 5.5% during its September meeting. However, they indicated their intention to raise rates once more in 2023 and implement fewer cuts next year. This stance reflects a "higher for longer" approach in response to inflation risks, despite a robust labour market.

Concerns regarding potential inflationary pressures weighed on market sentiment, driven by both rising oil prices and increasing demands for higher wages. In a broader context, the UAW initiated a limited strike against the three major U.S. automakers, which had the potential to become the largest work stoppage in the country in a quarter-century.

Towards the end of the month, the UAW strike, combined with the resumption of student loan payments following the end of a COVID-era moratorium, instilled fears that these factors could push the U.S. economy into a recession. Additionally, the possibility of a government shutdown loomed due to Congress' failure to pass a budget for the upcoming year. However, a last-minute agreement to fund the government through mid-November averted this potential headwind, at least temporarily.

10-year U.S. Treasury Yield

Japan

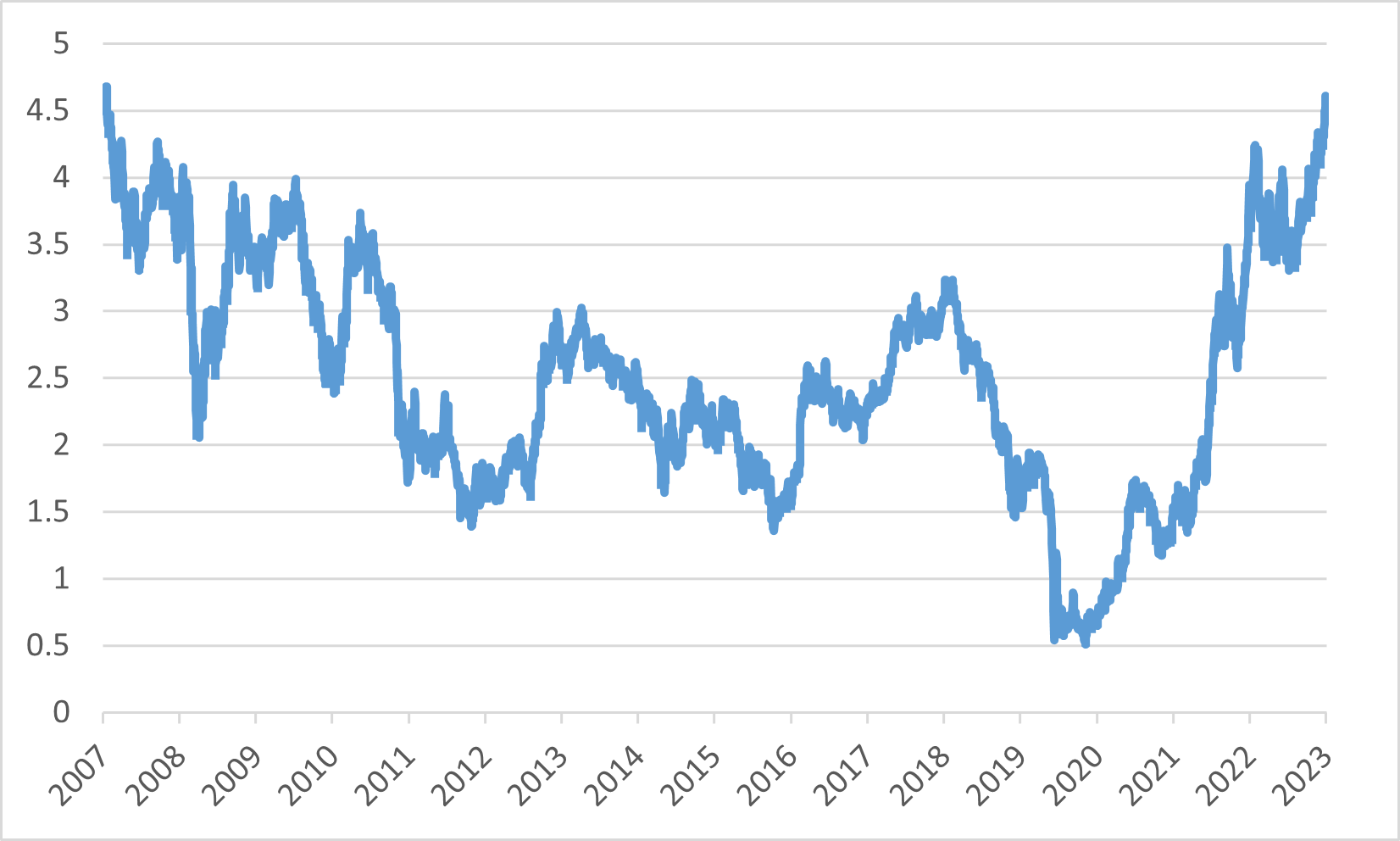

In September, Japanese equities outshone most of their developed market counterparts, with the MSCI Japan Index yielding a total return of 0.37% in local currency terms, thereby extending its robust performance since the start of the year. The depreciation of the yen, which proved advantageous for Japan’s exporters, was a significant factor. However, market sentiment was somewhat subdued due to indications from the Fed that it intends to maintain elevated interest rates for an extended period to tackle persistent inflation. In stark contrast, the BoJ adhered to market predictions by leaving its monetary policy unchanged, thereby quashing any anticipation of a hint towards an exit from negative interest rates. Nonetheless, steady inflation growth in Japan has led to predictions that the weighted median of inflation will soon reach the BoJ’s target of 2%, thereby intensifying market discussions about its ultra-accommodative monetary policy.

This divergence in monetary policy has seen the yen depreciate to its weakest level in over 11 months, standing at approximately JPY 149.7 against the USD, down from around 145.5 at the end of August. This has fuelled speculation that Japanese authorities may intervene in the foreign exchange market to bolster the yen, given their repeated assertions that they would react appropriately to swift currency fluctuations. However, Finance Minister Shunichi Suzuki refuted claims that the authorities have a specific USD/JPY level in mind that would necessitate intervention.

USD to JPY Exchange Rate

China

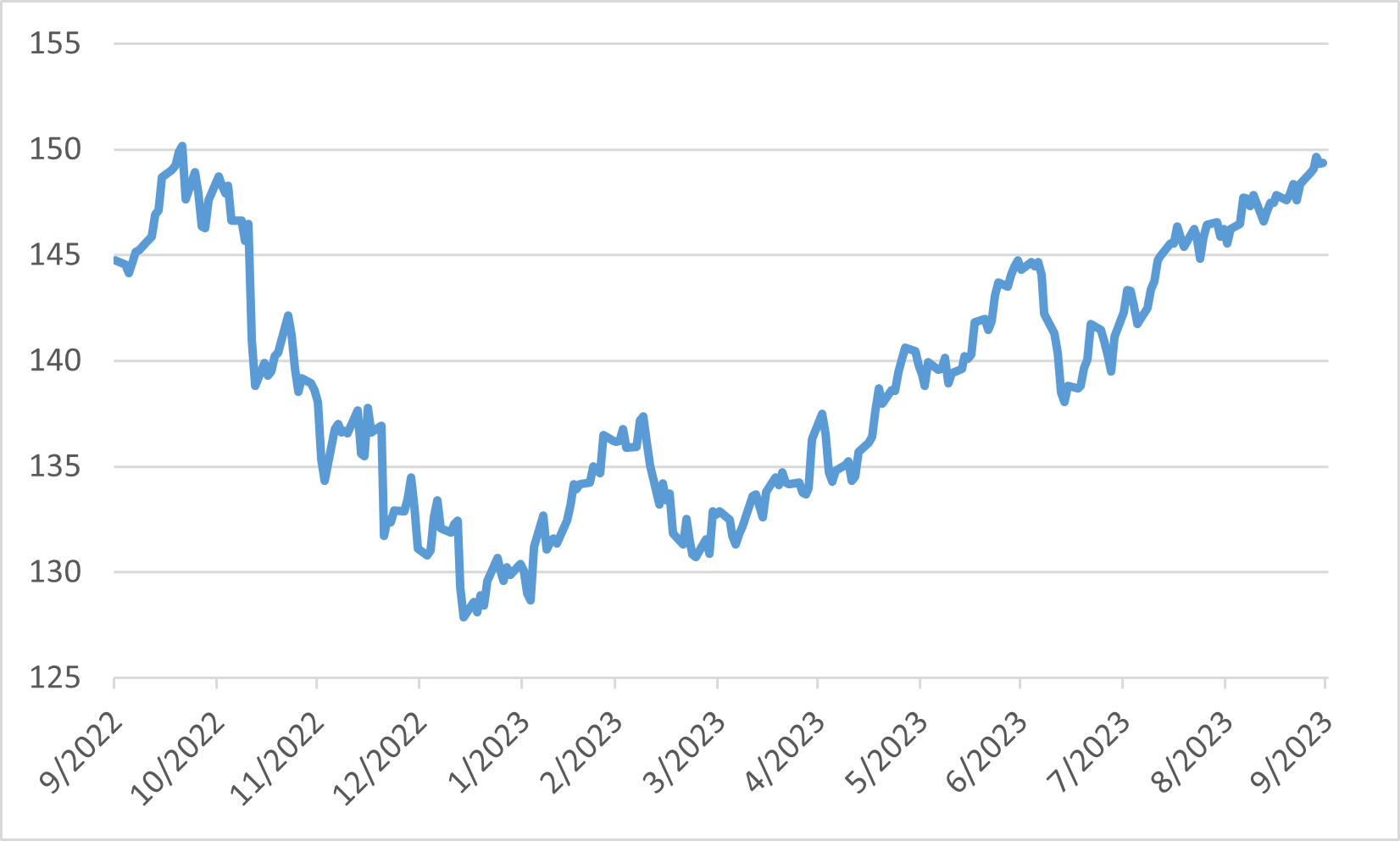

The data indicates that the Chinese economy experienced a period of stabilization, with economic activity showing signs of weakening following a brief rebound in the first quarter after the lockdown. In August, industrial production and retail sales exceeded expectations, registering growth compared to the previous year. Surprisingly, the unemployment rate also declined in August. However, fixed asset investment growth in August fell short of forecasts due to a more significant decline in real estate investment.

Regarding monetary policy, the PBoC implemented a 25 basis points reduction in its reserve ratio requirement for the second time this year to inject additional liquidity into the financial system. The central bank injected RMB 591 billion into the banking system, an increase from the maturing loans worth RMB 400 billion. Many analysts anticipate further policy easing in the second half of the year as Beijing aims to stimulate the economy, which has been affected by a persistent downturn in the property sector that began in 2021.

Concerns about the economic outlook led to continued capital outflows from China in August. Consequently, the onshore yuan reached a 16-year low against the U.S. dollar in September.

The Fed's hawkish signals impacted the market sentiment in China. Additionally, concerns surrounding the real estate sector further overshadowed Chinese markets, resulting in a 5.49% decline in the Hang Seng Index and a 2.01% drop in the CSI 300 index.

Hang Seng and CSI 300 index performance

Europe

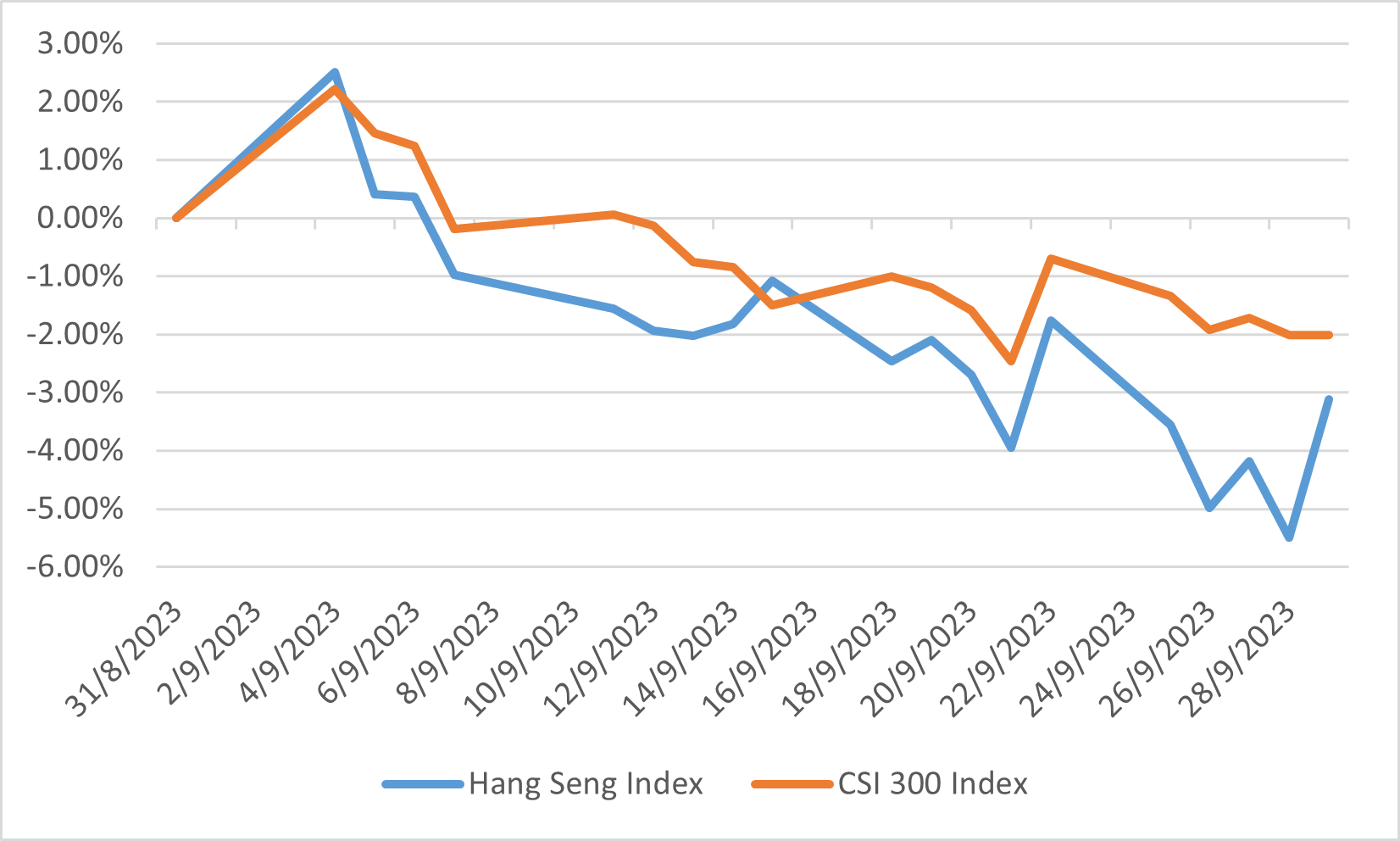

European equity markets concluded the month on a negative note as they faced challenges arising from a slowdown in eurozone GDP. However, the energy sector showcased strong performance, driven by the upward trajectory of oil prices, while investors showcased a preference for value stocks over growth stocks.

Regarding monetary policy, the ECB implemented an interest rate hike; however, it hinted at a potential pause in response to the weaker economic growth and cooling labour markets. Although there was a slight improvement in the composite PMI, it remained below the critical threshold of 50, indicating ongoing economic contraction. The easing of inflationary pressures likely contributed to a more stable interest rate environment.

Furthermore, the European Commission revised its growth forecasts due to a decline in industrial activity, sluggish trade, inflationary pressures, and rising borrowing costs. These factors highlight the challenges faced by the European economy in achieving sustained growth and stability.

Eurozone Composite PMI