Monthly Market Outlook – Nov 2023

22nd December, 2023

U.S.

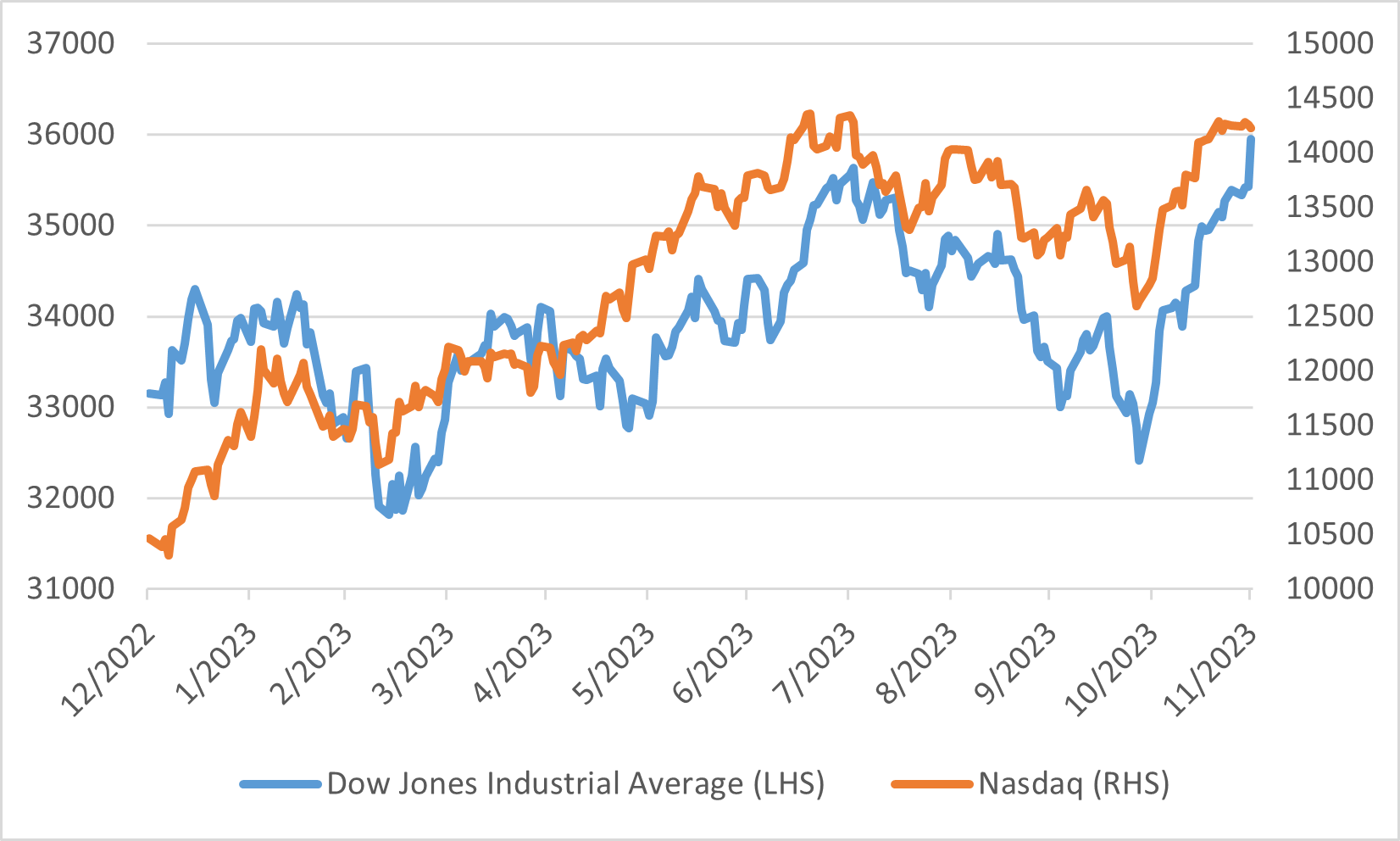

In November 2023, the US market experienced a pivotal shift, underscored by robust equity market performances, significant movements in bond yields, and critical changes in key economic indicators. This period marked the cessation of a three-month downturn in the stock market, culminating in the most robust monthly performance seen in over a year. Leading indices such as the Dow Jones Industrial Average, S&P 500, and Nasdaq concluded the month on a high note, with the Dow achieving a new pinnacle for the year. The month was also remarkable for the recovery of small-cap stocks. The Russell 2000 Index, a barometer for small-cap enterprises, rebounded from its October slump, recording a 9% upswing in November.

In the bond market, the yield on the 10-year U.S. Treasury bond witnessed its most substantial monthly decrease since December 2008, dropping to 4.33% from a high of 5% in October. This decline was a component of a wider rally in the bond market, with the U.S. aggregate bond index achieving its largest monthly gain in over three and a half decades.

Turning to economic indicators, there was a marginal increase in the unemployment rate, rising to 3.9%, alongside a slight dip in the labour force participation rate. The figures for job creation fell short of expectations, signalling a potential easing in the labour market. Inflation metrics, as indicated by October's Consumer Price Index (CPI), remained stable compared to September, with core CPI rising less than anticipated. This pattern aligns with a narrative of disinflation, bringing inflation rates closer to the Federal Reserve's target.

Dow Jones and Nasdaq performance

Japan

In November 2023, the Japanese market experienced a significant shift, underpinned by a notable resurgence in equity performance and dynamic changes in economic indicators. The period was characterized by the TOPIX index's remarkable recovery, which recorded a total return of 5.38%. This resurgence was largely attributed to a transformation in investor sentiment, itself a response to evolving global market dynamics.

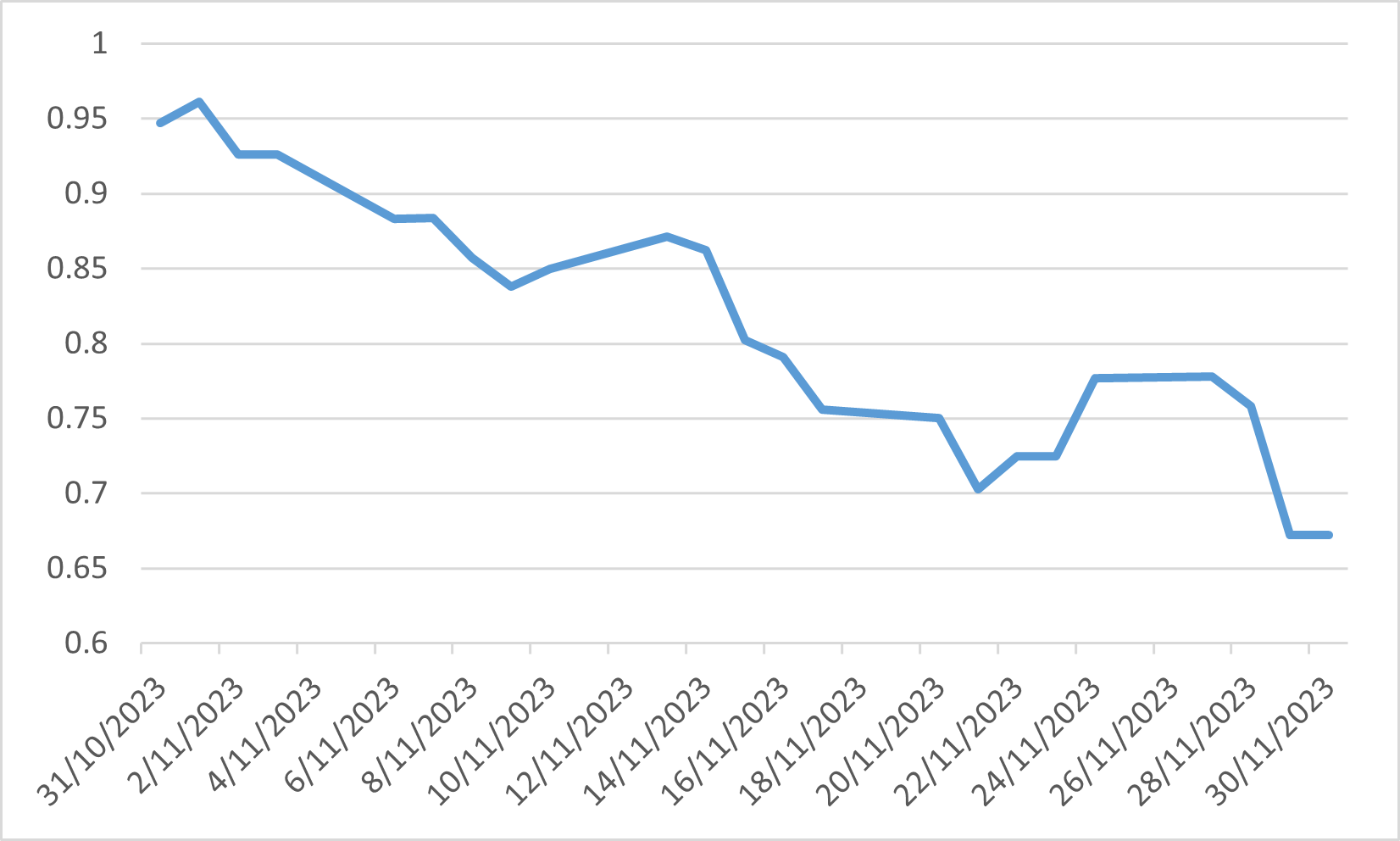

During the initial weeks of the month, the Japanese equity market's upward momentum was predominantly fuelled by large-cap growth stocks. This trend received further impetus from foreign investors, who demonstrated a renewed interest in Japanese equities. Concurrently, the yields on Japanese Government Bonds, specifically the 10-year bonds, witnessed a decline, mirroring global trends. This was particularly evident in the context of the diminishing expectations of further monetary tightening by the US Federal Reserve.

The Japanese yen's valuation experienced an appreciation against the US dollar, a development largely influenced by the shifting global monetary scenario. This currency appreciation had a nuanced impact on the Japanese equity market, particularly affecting sectors heavily reliant on exports.

In terms of macroeconomic health, Japan presented a mixed picture. The GDP data for the third quarter indicated a performance that fell short of expectations, with domestic demand, consumer spending, and capital expenditure showing signs of weakness. Despite these macroeconomic headwinds, the corporate sector in Japan exhibited a degree of resilience. The first half of the fiscal year was marked by robust earnings results, buoyed not only by the depreciation of the yen but also by the strong pricing power exhibited by Japanese corporations.

Japan 10 Yr government bond yield

China

China's macroeconomic landscape presented a juxtaposition of positive retail performance and continued struggles in the housing sector. The country reported a robust 7.6% yoy increase in retail sales for October, signalling consumer strength. However, the housing market remained a key constraint on broader economic growth, evidenced by ongoing year-on-year declines in new home sales.

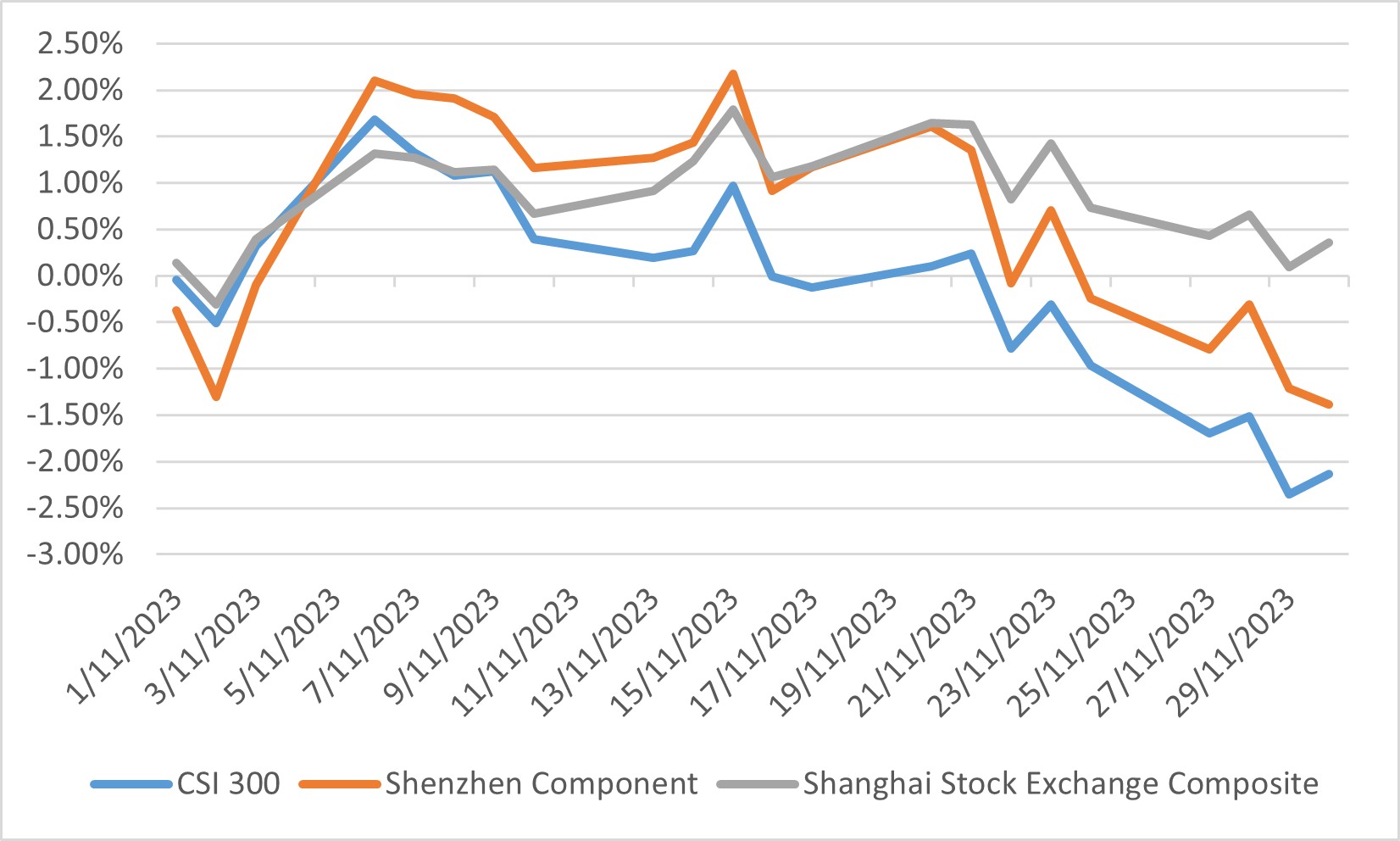

Chinese equities lagged behind regional counterparts, reflecting investor unease over China's slowing economic growth. This sentiment was evident in the downturns of the CSI300 and Shenzhen Component indices, which fell by 2.14% and 1.39% respectively and the Shanghai Stock Exchange Composite with only a slight gain of 0.36%. This cautious investor stance, driven by economic growth concerns, likely persisted into December, leading to a period marked by conservative trading activity.

The apprehension among investors was further fuelled by doubts regarding the adequacy of stimulus measures implemented by the Chinese government. Concerns were raised about whether these measures would effectively stimulate growth, especially given the ongoing crisis in the real estate sector. In response, the People’s Bank of China introduced additional liquidity into the banking system and contemplated further reductions in the required reserve ratio by year's end. Nevertheless, there is a growing consensus that more comprehensive fiscal stimulus might be necessary to bolster consumer confidence and counter deflationary pressures.

On the diplomatic front, the meeting between the Chinese and US presidents resulted in several agreements, particularly in the areas of energy transition and climate change. This development hinted at a possible de-escalation of tensions between the two economic superpowers.

China stock market indices performance in November

Europe

In November, Eurozone stocks experienced notable gains, buoyed by sharper-than-anticipated declines in inflation rates. Key indices such as the DAX, Euro STOXX 50, and FTSE 100 witnessed robust rallies, surging by 9.49%, 7.91%, and 1.8%, respectively. This upturn was catalysed by the Eurozone's annual inflation for November, which fell to 2.4%, a decrease from October's 2.9%. Similar to trends observed in the US, this reduction in inflation kindled optimism about a potential easing of price pressures and the prospect of impending interest rate cuts.

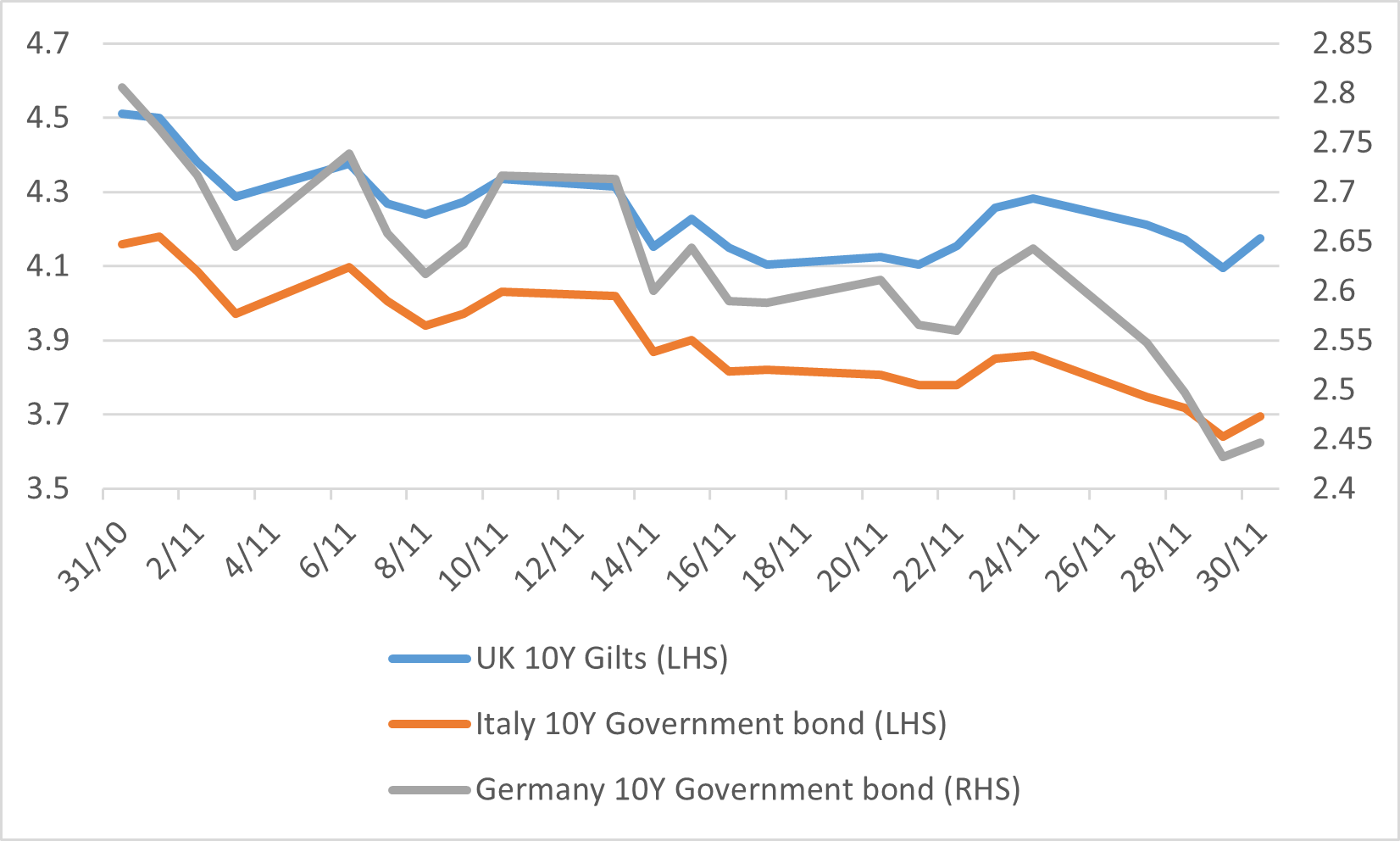

The bond market also responded positively, driven by investor expectations that central banks' interest rates had peaked and were poised for reductions. In Germany, the yield on the 10-year government bond declined to around 2.45%, while its Italian counterpart fell to approximately 4.23% and the yield on the 10-year gilt dipped to 4.17%.

Despite the market's enthusiastic response to the prospect of rate cuts, European Central Bank President Christine Lagarde offered a more tempered outlook. She indicated that Eurozone inflation is expected to revert to the 2% target, provided that interest rates are maintained at their current levels for a sufficient duration.

UK, Italy and Germany government bond yield